Partying Like It's 1999

A point we made earlier this year (Partying Like It's 1929) is that the blockchain and crypto can be both a transformative technology and a bubble, like Internet stocks were in the late '90s:

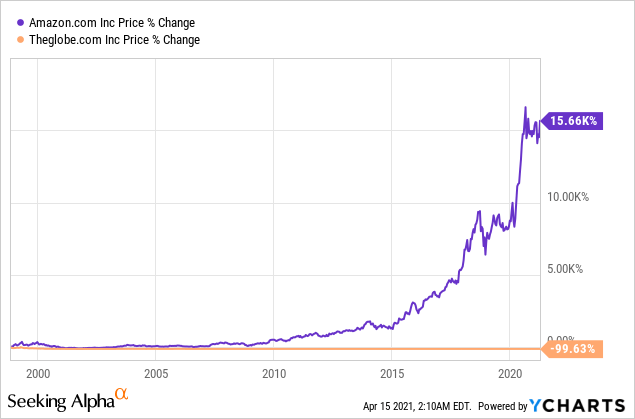

Something can be both transformative and a bubble. The Dot-com bubble of the late 1990s is an obvious example. When Theglobe.com, Inc. TGLO went public in 1998 and had the largest post-IPO price spike in history, that was a bubble. When Amazon.com, Inc. AMZN hit $400 per share in 1998, that was a bubble too. The Dot-com bubble nevertheless spawned transformative technologies and industries. Most of the Dot-com companies, such as Theglobe.com, ended up being essentially worthless. A few, such as Amazon, became trillion dollar+ oligopolies.

Crypto is obviously in a bubble now, as exemplified by the spike in the meme currency Dogecoin this year, apparently fueled by nothing more than joking Elon Musk tweets.

Bitcoin To $100k?

In that post, we included our friend Anatoly Karlin's prediction of Bitcoin peaking at $100k before crashing like Amazon didafter the dot-com bubble popped.

At the time, we gave two reasons why we felt Karlin was worth paying attention to: first, he was a long term Bitcoin bull, and second, his predictions about COVID-19 in early 2020 had proved accurate.

Bitcoin To $80k?

Last month, Karlin updated his Bitcoin peak prediction. He said he saw it peaking at around $80k in December, followed by a crash in February.

Bitcoin To $60k?

When we asked Karlin again earlier this month, he thought it might be plausible that Bitcoin crashes after it regains $60k.

Another smart observer and long term crypto/DeFi bull, Roko Mijic, suggested "the party was over" earlier this month as well.

Where Do You Think Bitcoin Is Headed?

Please take a moment to vote in the Twitter poll below. Afterwards, we'll look at a way to invest amid the current uncertainty.

Investing From The Viewpoint Of Calamity

We tend to think of investing "from the viewpoint of calamity," to re-borrow the expression Benjamin Graham borrowed from the philosopher Baruch Spinoza. Hence our focus on hedging. Here's what that looks like in practical terms.

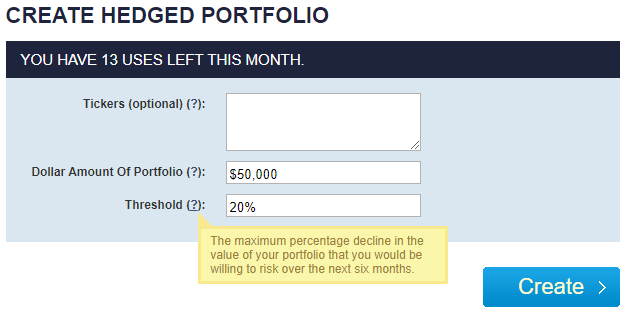

Let's say you have $50,000 in cash you want to invest, but you aren't willing to risk a drawdown of more than 20% over the next six months. You figure that if crypto crashes over the next few months, your stocks might drop a lot more than that. In that case, you could enter your risk tolerance and the dollar amount you were looking to invest in the tool pictured below.

This and the subsequent screen captures are via the Portfolio Armor website.

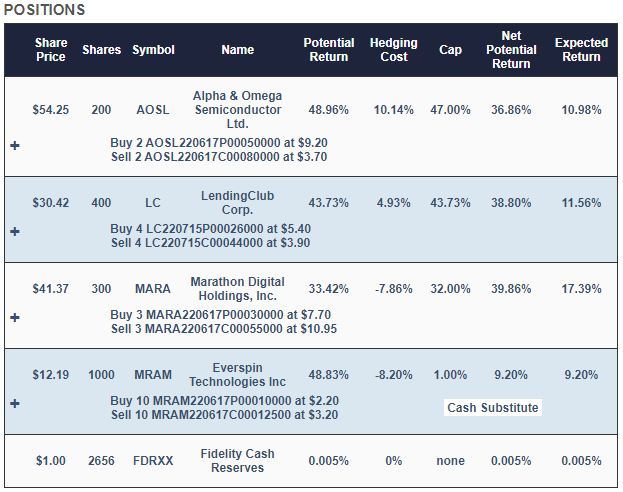

This is the portfolio it would have presented to you.

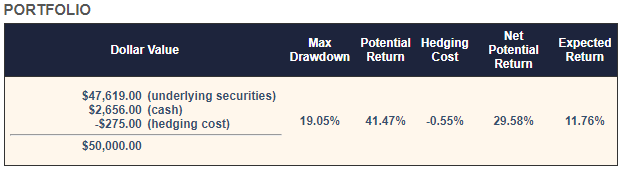

With that portfolio, your maximum drawdown over the next six months--that is, if every underlying security went to zero--would be a decline of 19% (the Max Drawdown). Your best case scenario would be a gain of about 30% (the Net Potential Return), and a more likely scenario (the Expected Return) would be about 12% over the next six months.

Why Those Names?

Alpha & Omega Semiconductor, Ltd. AOSL, Lending Club Corp. LC, and the Bitcoin miner Marathon Digital Holdings, Inc. MARA were the ones that had the highest potential returns, net of hedging costs, when hedging against a >20% decline, and had share prices low enough that they could fit in a $50,000 portfolio. Tesla, Inc. TSLA, for example was a top name of ours on Thursday but with a share price over $1,000, you couldn't fit a round lot of it in a $50k portfolio. Our system started with roughly equal dollar amounts of each, and then rounded them down to round lots, to reduce hedging costs. It swept up most of the leftover cash from the rounding-down process into a tightly collared position in Everspin Technologies Inc. MRAM to further reduce hedging cost.

Why Those Hedges?

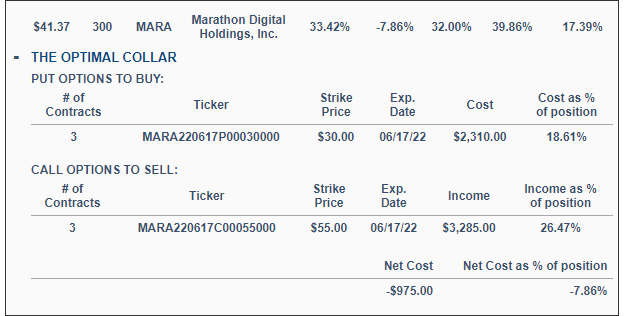

On our website, if you click the plus signs in the portfolio above, the positions expand to give you a better look at the hedges. For example, this is what the MARA position looked like expanded.

As you can see, MARA was hedged with an optimal collar, as were the other positions in this portfolio. Our system estimates returns both ways to determine which type of hedge is best. We elaborated on that process in a previous post: When To Hedge With Puts Versus Collars.

What Happens Now

We'll check back in a few months and see how this portfolio is doing. If the market keeps going up, this portfolio should do well. If crypto crashes, taking the market with it within the next six months, we know ahead of time that the downside risk of this portfolio will be strictly limited. Heads you win, tails you don't lose too much.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.