The death of U.S. federal cannabis reform isn't just hitting industry retail and cultivation operators. Sliding equity values have also taken down AdvisorShares Poseidon Dynamic Cannabis ETF PSDN, a Fund run by the affable Emily & Morgan Paxhia. According to a banner posted on the ETF webpage, the estimated final day of trading is August 25, 2023, with final distribution to shareholders expected to occur on or about September 1, 2023.

Sadly $PSDN has announced the closure of the fund with the estimated final day of trading to be in August 25th.

Sadly $PSDN has announced the closure of the fund with the estimated final day of trading to be in August 25th. pic.twitter.com/BmjS7OjhW8

— jungle.java (@junglejava1) August 11, 2023According to a Statement of Addition Information dated August 8, 2023, at the recommendation of AdvisorShares Investments, LLC, the investment adviser to the series of AdvisorShares Trust, the Trust’s Board of Trustees approved the liquidation of the Fund pursuant to the terms of a Plan of Liquidation. The last day of trading of Fund shares on the NYSE Arca, Inc. is expected to take place on August 25, 2023, with full Fund closure expected in September 1. Between the last day of trading and the Liquidation Date, shareholders will not be able to purchase or sell shares in the secondary market.

For investors already in the Fund at the time of closing, all is not lost. Following the Liquidation Date, the Fund will disburse a cash distribution to its remaining investors, corresponding to the net asset value of the shareholders' holdings as of the conclusion of business operations on the Liquidation Date. This sum will encompass any accumulated capital gains and dividends. Investors who retain their position in the Fund on the Liquidation Date will not encounter any transaction fees imposed by the Fund.

The cash distribution disbursed to shareholders during the liquidation process will be considered a form of payment in return for their shares.

Declining Equity Values Sink Poseidon Dynamic Cannabis ETF

With the seemingly never-ending delays on federal cannabis reform, U.S. cannabis equities have remained in prolonged bear market conditions. In turn, these conditions have torpedoed Poseidon's ability to generate a reasonable return, leading it to become a casualty of political intransience.

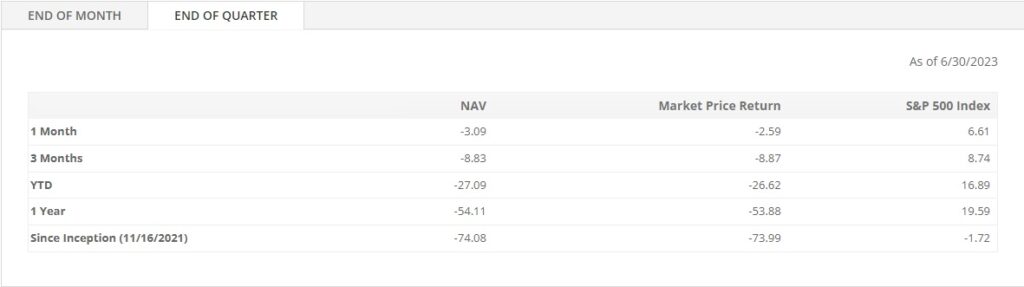

Since inception, has lost approximately 74% in value versus a 1.74% decline in the S&P 500.

And with a management fee of 0.80% relative to just $2,912,951.84 in remaining assets under management, the Fund is not generating much profit. Although the Fund never approached the size and popularity of AdvisorShares Pure US Cannabis ETF MSOS, the current management fee is likely insufficient to cover carrying costs. With U.S. reform looking tenuous in the near term going into an election year, pulling the plug might have been the prudent thing to do.

In the end, the cannabis industry equities have been undoubtedly hamstrung by Washington D.C.'s unwillingness to act. Whether we're talking about Chuck Schumer's failed CAOA gambit, or the failure to pass SAFE Banking after advancing from the House seven times, lack of progress has taken its toll. While most equities have simply slumped, Poseidon has become a verified casualty.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.