The Surprise Higher For Longer Issue

The Federal Reserve surprised the market by leaving the fed funds rate unchanged and indicating its not inclined to lower at the next meeting in March. The market was disappointed, but a better-than-expected manufacturing index with higher-than-expected pricing plus a seemingly hot labor market support the Fed’s decision. There was huge growth in jobs, but we have reservations on some of the seasonal adjustments and full-time vs part-time positions. DKI is also bullish on oil prices and online education. Read on to see why.

This week, we’ll address the following topics:

-

Jerome Powell and the Federal Reserve shocks the market by doing exactly what they said they’d do.

-

Manufacturing PMI shows further decline, but still better than expected. Prices up a lot.

-

The employment picture is again better than expected. Does this mean “higher for longer”?

-

Saudi Arabia stops oil capacity expansion. Ready for higher oil prices?

-

Coursera COUR beats both analyst estimates and its own terrible guidance.

Ready for a new week of higher interest rates? Let’s dive in:

-

The Fed Shocks the Market with Consistent Behavior:

The Federal Reserve completed its January meeting and decided to keep the fed funds rate unchanged. A couple of months ago, the market was pricing in a high probability of a rate cut at this meeting. DKI disagreed. By the time the meeting came, the market had shifted from pricing in a January cut to expecting one in March. While the language in the Fed press release was more dovish than before and excluded prior language about the possibility of future rate increases, Powell sent the market down during his press conference when he indicated a rate cut in March was unlikely.

That thumb turned down and hard. Should we have a market run by unelected academic bureaucrats who haven’t ever managed a business?

DKI Takeaway: The market has been expecting a total of 1.5% of rate cuts in 2024. DKI expects fewer interest rate reductions. There’s a huge quiet battle going on right now between the Federal Reserve which wants to get inflation under control and the combination of Congress and the Treasury which are engaging in massive spending and monetization which is inflationary. No one in Congress will cut spending in an election year (or a non-election year) so massive stimulus will continue making the Fed less likely to reduce rates than the market expects.

-

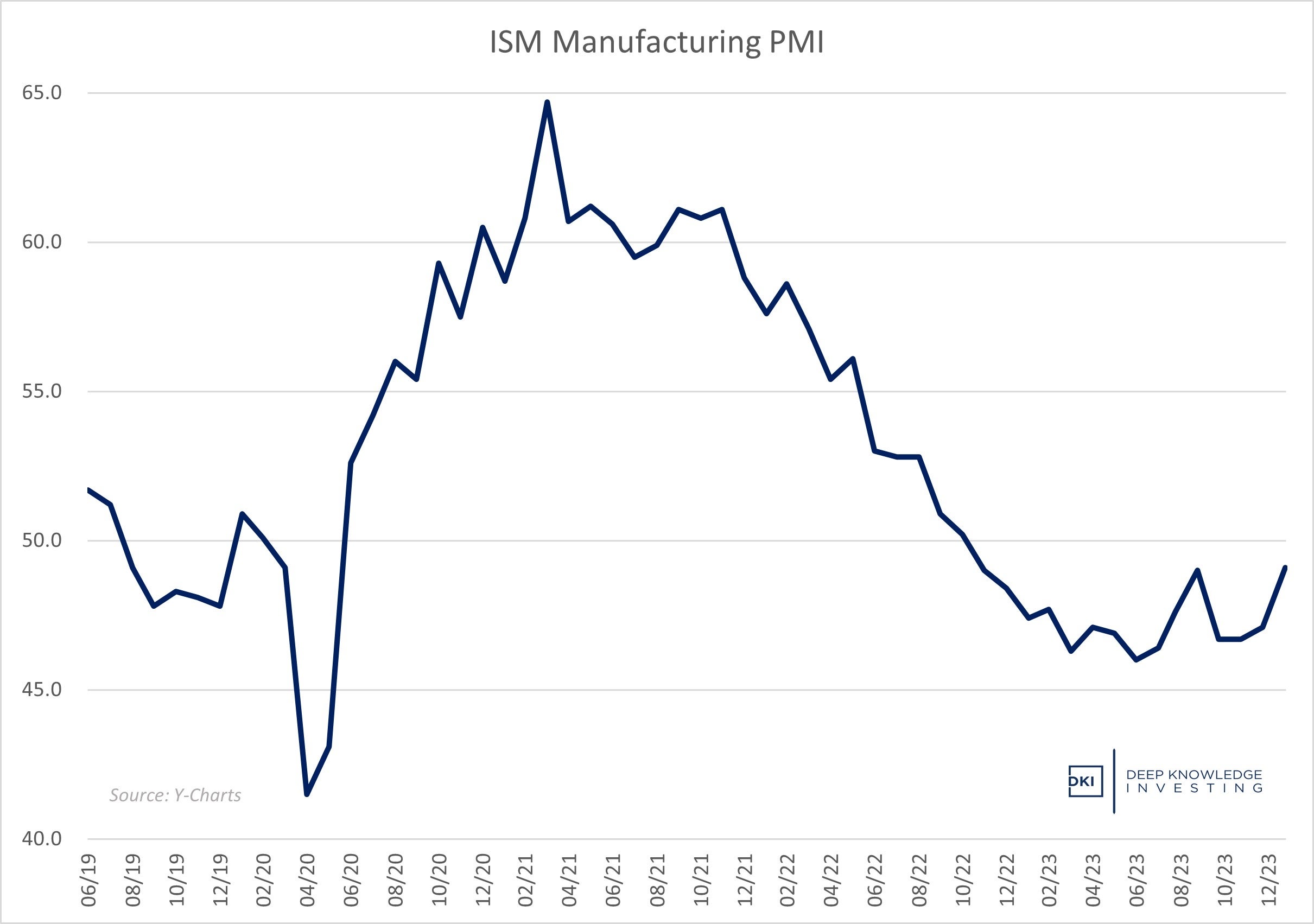

ISM PMI is Down and Better than Expected:

The Institute for Supply Management released the January Purchasing Managers Index which showed mixed results. The overall index was 49.1 where anything under 50 indicates a decline. However, the previous month was 47.1, and the estimate was for a PMI of 47.2. The new orders index of 52.5 was well above the estimate of 48.2 and indicates growth in new orders.

Manufacturing is still contracting, but there is improvement.

DKI Takeaway: DKI has been pointing out the weakness in manufacturing indexes from all over the country. This is the first (somewhat) positive result we’ve seen from producers in months. The negative is the manufacturing prices index was 52.9 vs 45.2 last month. So, we’re seeing a pickup in new orders, but at much higher prices. A stronger economy combined with higher prices will keep the Fed in the “higher for longer” camp.

-

The Employment Market Remains Red Hot – We Know What That Means:

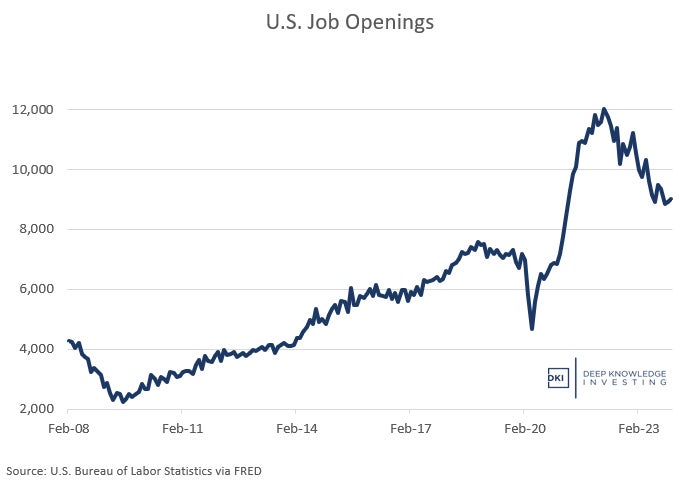

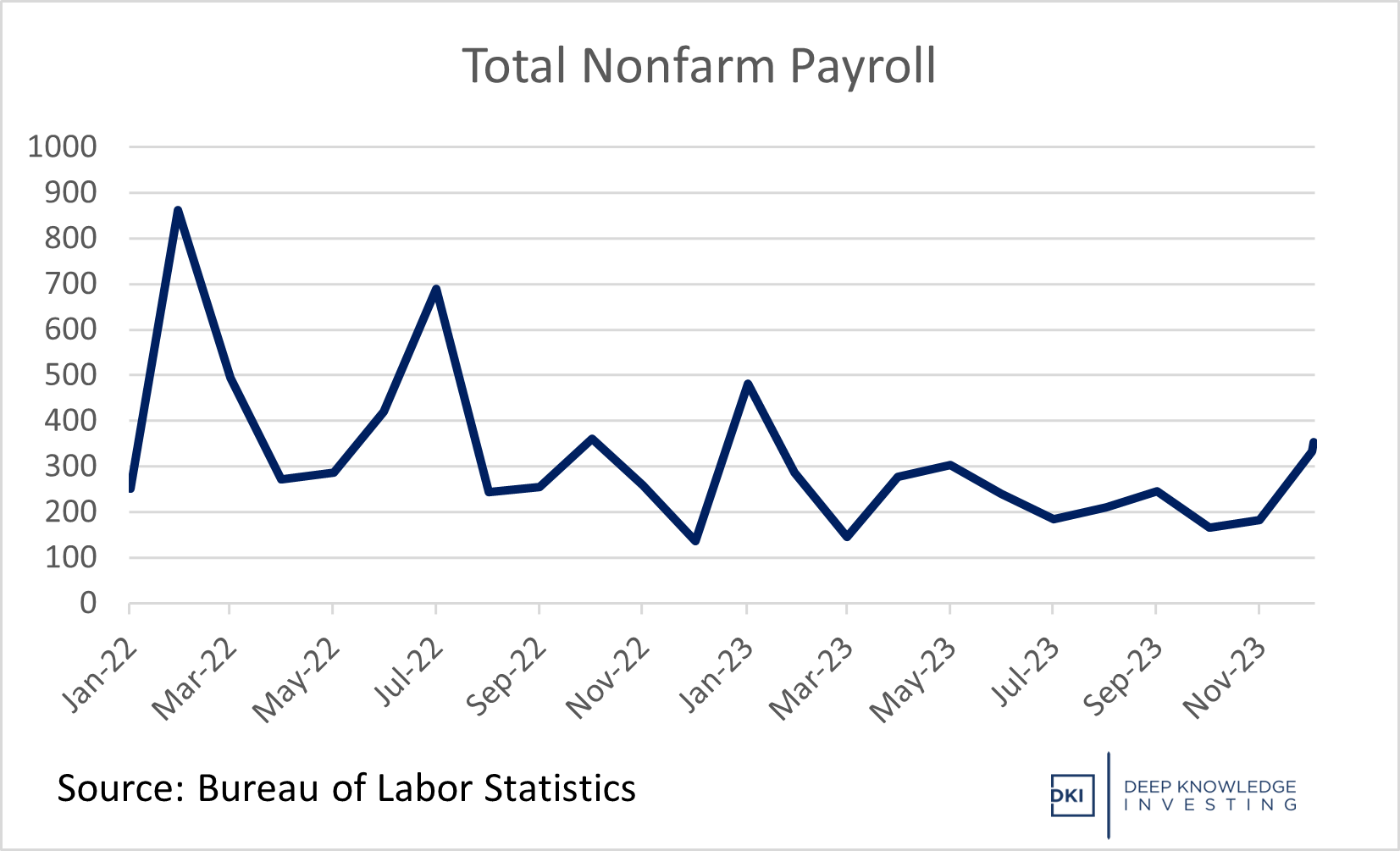

This week, we got two interesting pieces of data on the employment market. Job openings reversed a recent decline and moved back above 9MM. On Friday, we got the jobs report showing a huge 353k jobs added in January. This was far above expectations of 185k new jobs. The Federal Reserve has been trying to cool the employment market to stop a wage/price spiral where higher prices cause employees to seek higher wages which then leads to higher prices. The bond market responded by sending yields on the 10-year Treasury back above 4%.

Back above 9MM. It’s a big number even though some of these jobs aren’t real.

More than 300k jobs added in a month is big.

DKI Takeaway: The job market looks great on the surface. Underneath, it’s not as strong as it seems. Many/all of the jobs being added are people who no longer can find full-time work taking on multiple part-time positions. Many of the jobs being listed aren’t real. There are widespread reports of companies listing jobs to provide the illusion of growth, or to placate overworked employees who need help. However, when people apply, they may find that the company is making no effort to fill the position. Still, the Federal Reserve looks at these numbers, and wants to see a weaker job market. Absent that, it’s best to believe Chairman Powell when he says the Fed isn’t expecting to cut rates next month.

-

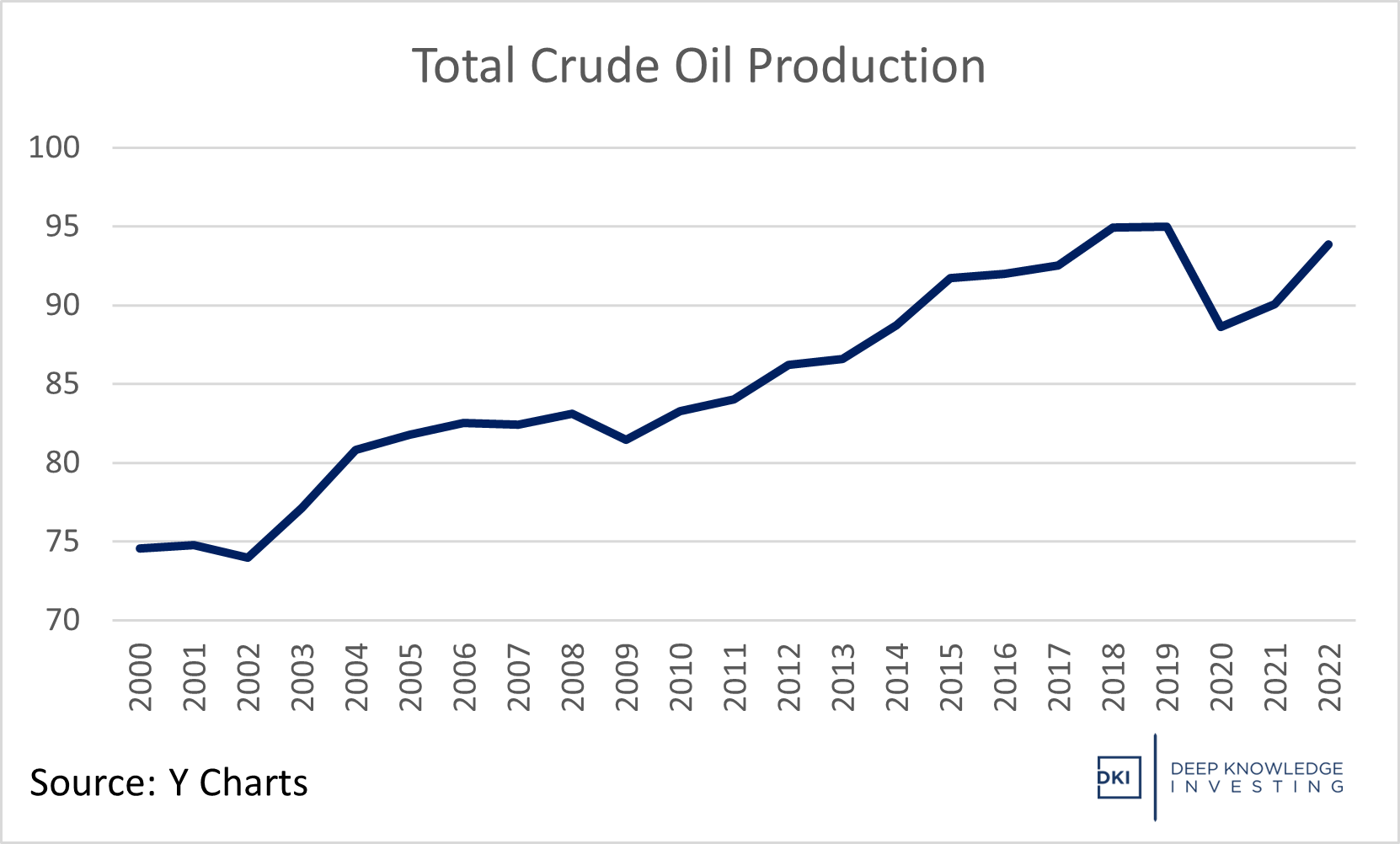

Saudi Arabia Stops Oil Capacity Expansion:

Saudi Arabia had been working on expanding its maximum sustainable capacity from 12MM barrels a day to 13MM. The Saudis changed their minds and told Aramco to stop work on the expansion. This will keep capacity at 12MM barrels a day.

Is 1MM barrels a day significant? Yes, it is.

DKI Takeaway: Worldwide oil production is almost 100MM barrels a day. On the surface, the Saudis not expanding production wouldn’t seem significant. However, despite the desires of environmentalists, billions of people around the world want a higher material quality of living and that means more demand for energy. Nothing is going to stop that demand. While the oil market is large, pricing typically gets determined by the price of the marginal (last) barrel. This means that growing demand combined with limitations on future supply are likely to lead to higher prices.

-

Coursera Beats Estimates and Issues Strong Guidance:

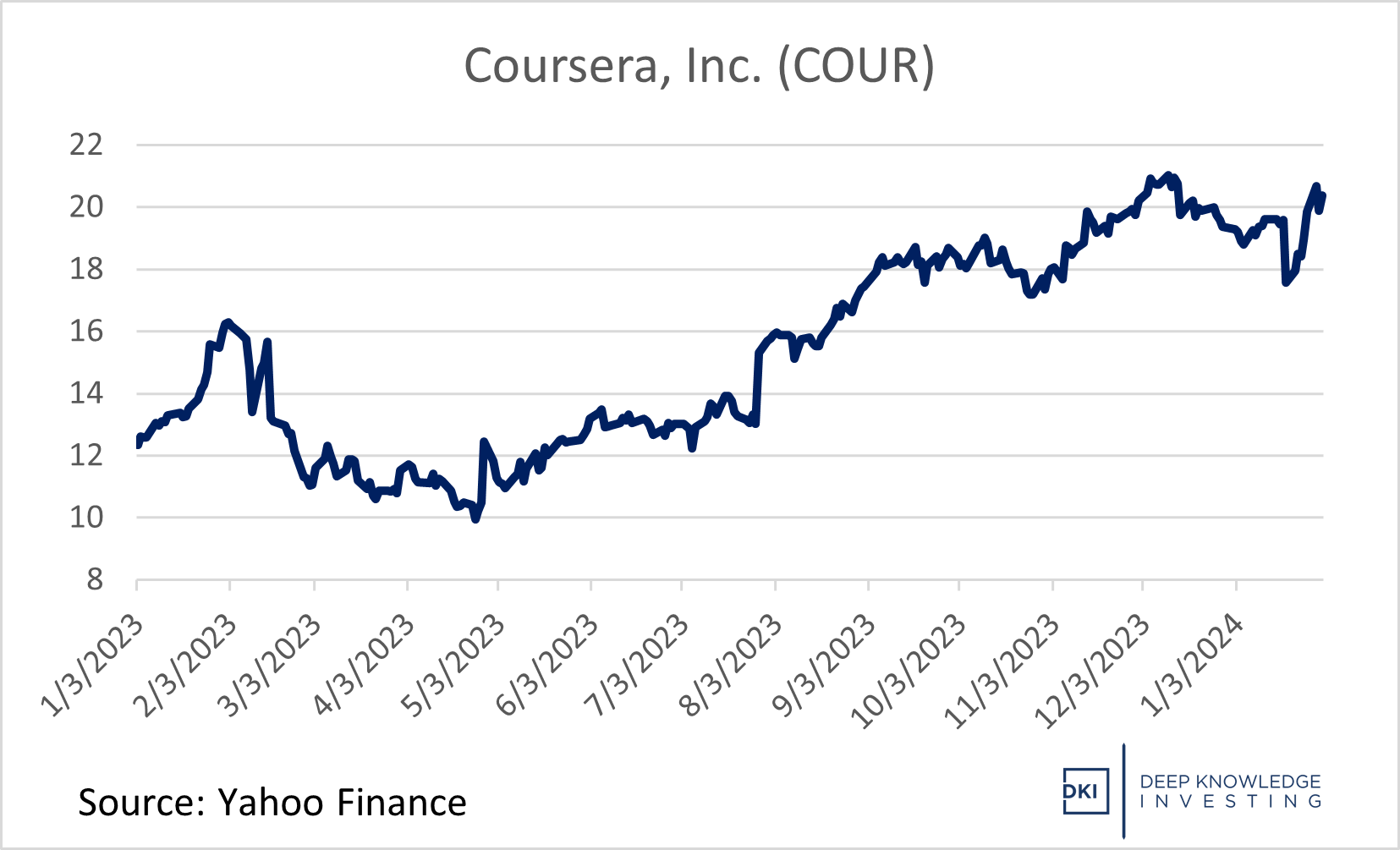

A year ago, Coursera offered terrible guidance for 2023 that caused the stock to fall below $10. When I called the company to ask for more detail, they responded by saying they were just being conservative. This week, the company delivered 4Q revenue growth of 19% which beat analyst expectations of 15% growth. For the year, $COUR management had given guidance for a revenue increase of 14%. Actual results were up 21% for 2023.

The stock has more than doubled off the lows.

DKI Takeaway: In the last year, tutoring site, Chegg CHGG has seen its stock get cut in half due partly to competition from AI and partly due to its bad reputation among educators. Direct competitor 2U TWOU has seen its stock get obliterated from almost $13 to below $1 in the last year because its business model relies on selling online education at on-campus prices. Coursera has continued to deliver high-end university credentials and company-approved career development at deeply discounted prices. As a result of having a better business model, revenue growth has ranged from 21% to 59% over the past six years. The registered learner base of 142MM people is the largest dedicated learning platform in the world.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.