In a recent interview with the Wall Street Journal, President-elect Donald Trump once again made reference to China’s negative impact on U.S. business due to its currency “dropping like a rock.”

“Our companies can’t compete with them now because our currency is too strong. And it’s killing us,” Trump said.

The recent comments certainly aren’t the first time Trump has called out China regarding its currency. Trump repeatedly bashed China for the way it handles its currency while out on the campaign trail.

Trump's History Of Calling Out China On Currency

“We can’t continue to allow China to rape our country,” Trump said while speaking about trade deficits last May. “It’s the greatest theft in the history of the world.”

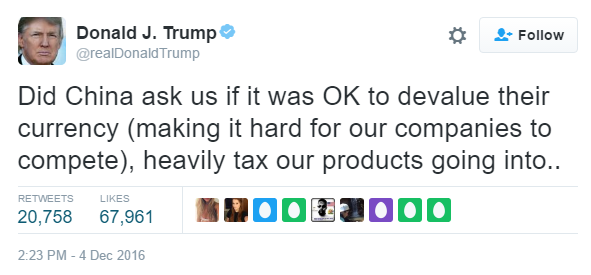

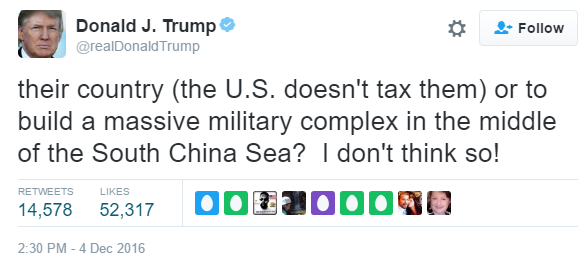

Early December, Trump once again brought up China and currency concerns, this time, via Twitter. "Did China ask us if it was OK to devalue their currency [...] I don't think so!" Trump tweeted.

But Is China Actually A Currency Manipulator?

Under the Obama administration, China has not been labeled a currency manipulator. To meet the current definition of a currency manipulator, a country must meet all three of the following requirements:

- Bilateral trade surplus versus the United States of at least $20 billion.

- Current accounts surplus of at least 3 percent of GDP.

- Official forex purchases of at least 2 percent of GDP.

Today, China only meets the first requirement.

However, as soon as Trump takes office, he could change or eliminate the current test all together.

The What Ifs

If Trump officially labels China a currency manipulator, it will be the first time the United States has done so since 1994. In terms of immediate economic impact, the label doesn’t officially change much. The declaration would begin a one-year clock in which the United States and China can negotiate bilaterally to attempt to resolve the issue. But even at the end of one year, there is no required penalty for being a currency manipulator.

Trump could choose take matters into his own hands with the backing of the Republican Congress. Trump proposed a 45 percent import tariff on Chinese goods during the campaign season as a punishment for what he saw as unfair trade practices. It’s unclear whether Trump intends to follow through with the extremely high tariff or whether he was simply using the proposal to create leverage during potential negotiations with China.

If Trump takes measures to enact the proposed tariff or even officially declares China a manipulator, it’s likely that the Chinese government will respond. China has threatened to impose its own tariffs on U.S. goods. China’s government-backed Global Times newspaper specifically suggested tariffs on Apple Inc AAPL iPhones and Boeing Co BA jets.

What About A Trade War?

Of course, a trade war between the United States and China would likely be bad news for the U.S. dollar. Trumps latest remarks sent the PowerShares DB US Dollar Index Bullish UUP down 0.9 percent on Tuesday, while the SPDR Gold Trust (ETF) GLD jumped higher by 1.4 percent.

Stock investors in both the United States and China seem nervous about the possibility of a trade war. Shortly after the remarks, the SPDR S&P 500 ETT Trust SPY was down 0.2 percent, while the iShares FTSE/Xinhua China 25 Index (ETF) FXI was also down 0.5 percent.

Image Credit: Derived from "Trump unveils child-care policy influenced by Ivanka Trump" By Michael Vadon - Own work, CC BY-SA 4.0, via Wikimedia Commons

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.