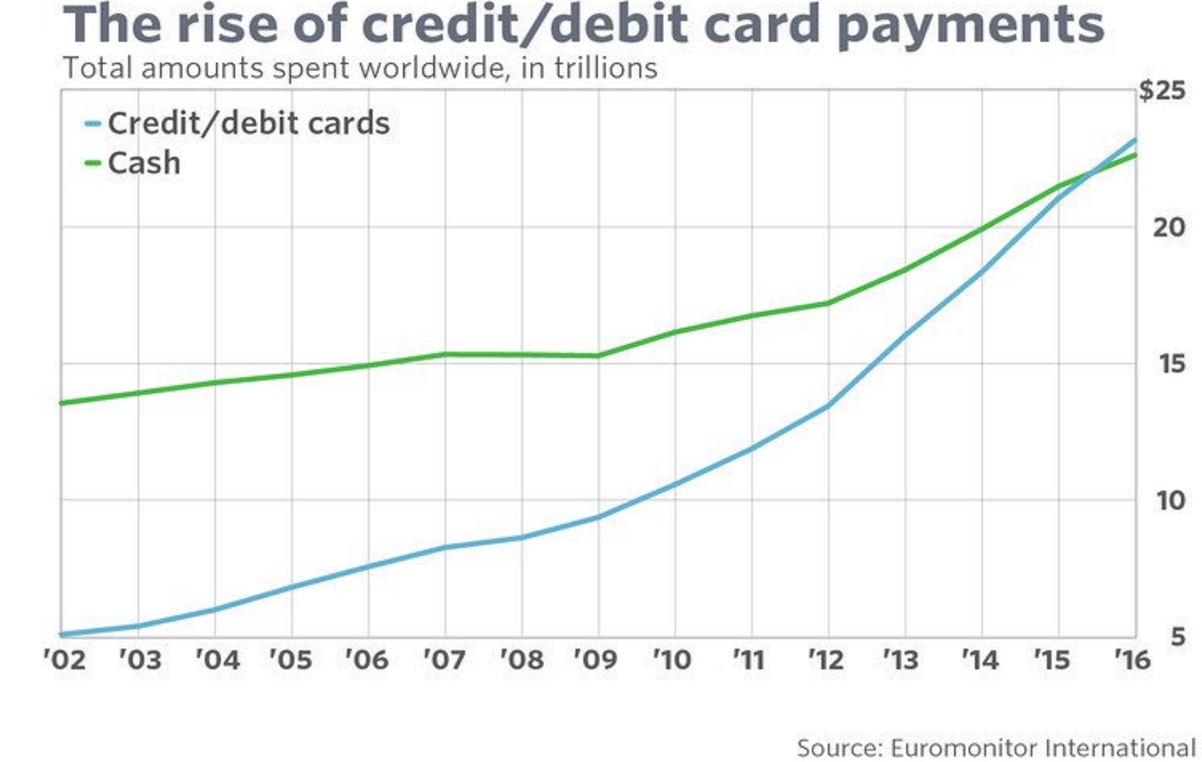

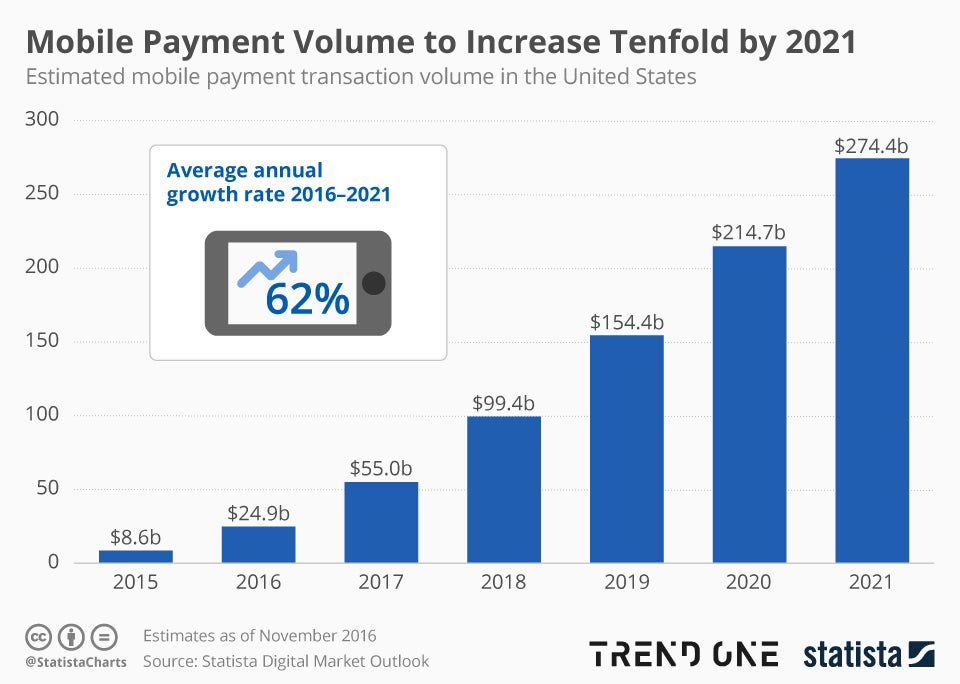

Mobile payment volume is expected to increase tenfold by 2021. While credit/debit card payments beat surpassed cash payments for the first time in history in 2016, the adoption of mobile payments has been slower than many have expected.

According to a report from Statista, 35 million Americans used their smartphone to make a payment at a physical store in 2016, amounting to $25 billion worth of transactions. Mobile payment transaction volume expected to hit $275 billion by 2021, amounting to a 62 percent annual growth rate.

Who Stands To Benefit?

Key players in the industry include:

- Global Payments Inc GPN: up 10.79 percent year-to-date.

- Moneygram International Inc MGI:up 9.57 percent year-to-date.

- Paypal Holdings Inc PYPL: up 5.4 percent year-to-date.

- Planet Payment Inc PLPM: up 4.17 percent year-to-date.

- Square Inc SQ: up 5.28 percent year-to-date.

- The Western Union Company WU: down 10.11 percent year-to-date.

Another Player

Ant Financial, a subsidiary of Alibaba Group Holding Ltd BABA Alipay, has made steps toward an acquisition of Moneygram for $880 million is bringing light to the industry. The deal is expected to "provide consumers in over 200 countries and territories with convenient and accessible financial services, which furthers Ant Financial’s mission to promote equal access to financial services globally," Ant Financial said in a statement.

Image Credit: By Mybloodtypeiscoffee (Own work) [CC BY-SA 4.0], via Wikimedia Commons

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.