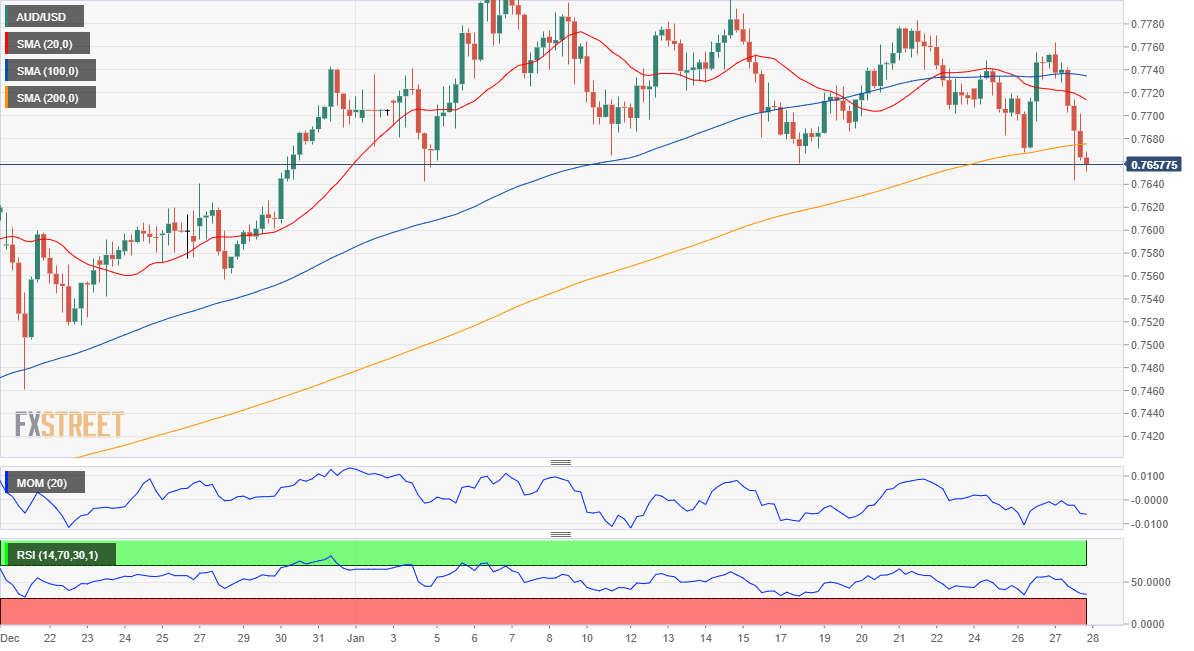

AUD/USD Current Price: 0.7655

- Australian data came in mixed, but inflation picked modestly up in Q4 2020.

- Risk aversion and plummeting equities pushed AUD/USD lower in the US session.

- AUD/USD is at risk of accelerating south on a break below 0.7640.

The Australian dollar enjoyed some demand at the beginning of the day, rising against the greenback to 0.7763, following the release of mixed Australian data. The Q4 Consumer Price Index came in at 0.9%YoY, better than the 0.7% expected, while the RBA Trimmed Mean CPI for the same period printed at 1.2%. However, NAB’s Business Confidence contracted to 4 in December, while Business Conditions in the same period improved to 14.

The AUD/USD pair plunged to 0.7643 on the back of risk-aversion, later bouncing towards the 0.7700 region ahead of the Fed, from where it resumed its decline. This Thursday, Australia will publish minor figures, the Q4 Import Price Index.

AUD/USD Short-Term Technical Outlook

Now trading at daily lows, the AUD/USD pair is at risk of falling further, as commodity-linked currencies take a hit from plummeting equities. In the 4-hour chart, the pair has fallen below the 20 and 100 SMAs, now hovering around a bullish 200 SMA. Technical indicators head firmly lower near oversold readings, favoring additional declines ahead. The pair will likely accelerate its decline on a break below 0.7640, the immediate support level.

Support levels: 0.7640 0.7605 0.7570

Resistance levels: 0.7770 0.7815 0.7850

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.