AUD/USD Current Price: 0.7587

- The RBA kept the cash rate on hold, extended its QE program.

- Australia will publish the Commonwealth Bank Services PMI for January, expected at 55.8.

- AUD/USD trades at its lowest for the year, could extend the slide in the near-term.

The AUD/USD pair surged to 0.7661 early Asia, following the Reserve Bank of Australia’s decision to leave the cash rate on hold at 0.1%. However, the positive tone was short-lived as investors went deeper into the announcement. Australian policymakers have decided to extend the QE program, as the current pace of bond-buying at A$ 5billion per week will continue once the initial deadline expires in April. Also, the central bank repeated that inflation remains weak, as well as business credit growth. The pair fell to 0.7563, its lowest for this 2021.

Early on Wednesday, Australia will publish the Commonwealth Bank Services PMI for January, expected at 55.8. Later into the session, the country will release December Building Permits, while RBA’s Governor Philip Lowe is scheduled to speak.

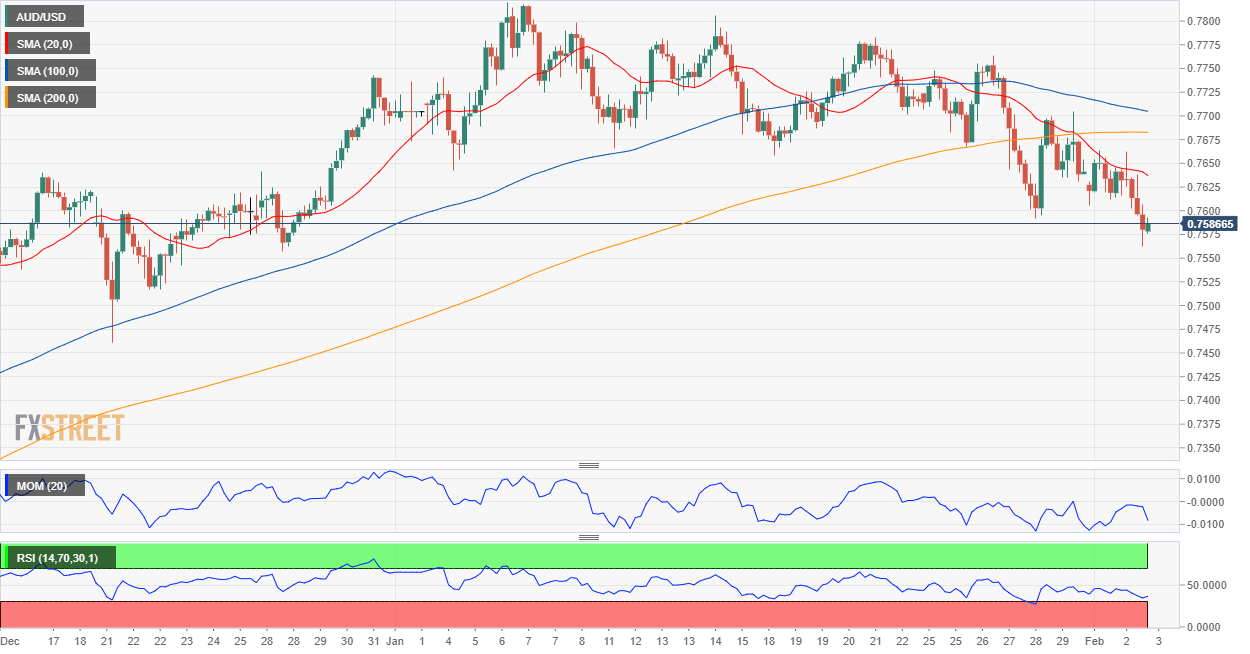

AUD/USD Short-Term Technical Outlook

The AUD/USD pair trades sub-0.7600 and could extend its decline this Wednesday, as the bounce from fresh yearly lows was quite shy. The 4-hour chart shows that the pair keeps developing below a bearish 20 SMA, while technical indicators head south whiting negative levels, favoring another leg lower in the upcoming sessions.

Support levels: 0.7560 0.7520 0.7475

Resistance levels: 0.7605 0.7645 0.7680

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.