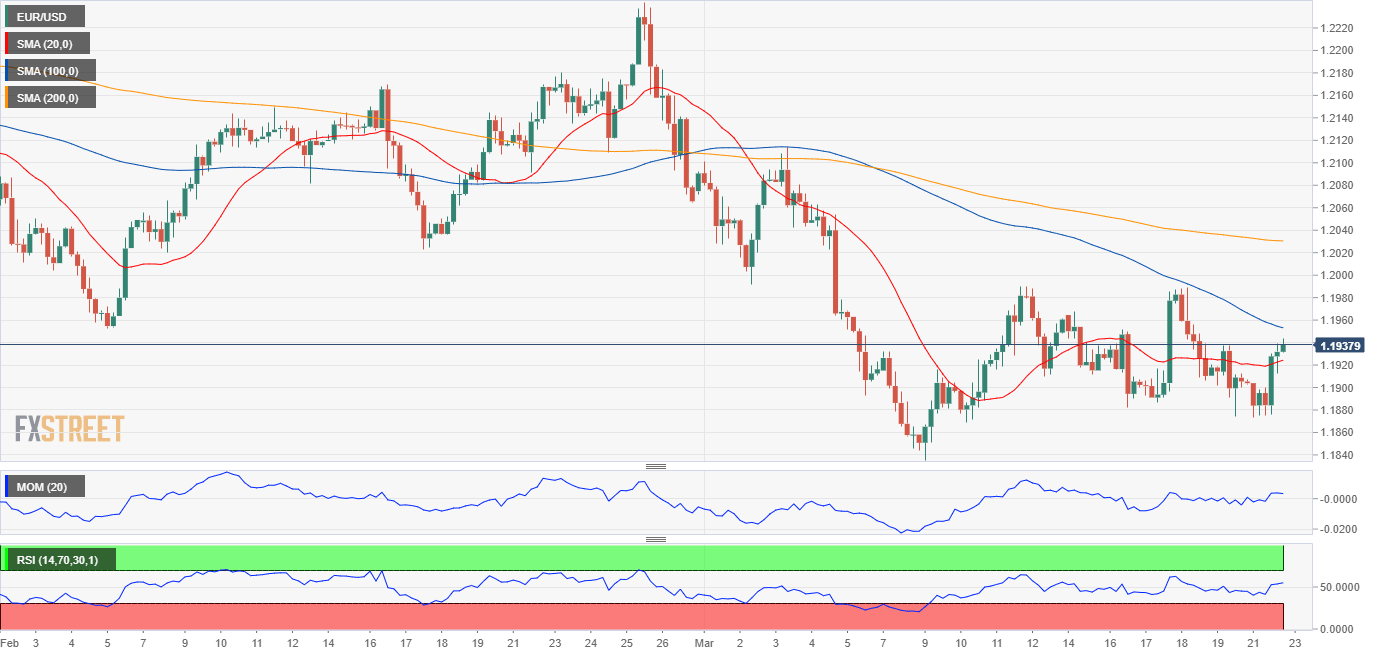

EUR/USD Current Price: 1.1937

- Turmoil in Turkey spurred risk-off at the beginning of the day.

- Eyes turn on US Federal Reserve chief Jerome Powell testimony on Tuesday.

- EUR/USD advances within familiar levels, still below the 1.1970 resistance.

The EUR/USD pair advanced and closed the day with modest gains in the 1.1940 region after posting an intraday low of 1.1871 at the beginning of the day. Risk aversion took over financial markets during Asian trading hours due to Turkey´s turmoil after President Erdogan fired the central bank chief, leading to a sharp depreciation of the currency against the greenback, which in turn appreciated across the board. The American currency extended its decline during the US afternoon, as US Treasury yields eased, with that on the 10-year note bottoming at 1.66% and settling nearby.

On the data front, the EU published the January Current Account, which posted a seasonally adjusted surplus of €30 billion, missing the market’s expectations. The US released the February Chicago Fed National Activity Index, which unexpectedly fell to -1.09 vs 0.21 expected, and Existing Home Sales for the same month, which plunged by 6.6%, more than doubling the expected -3%. On Wednesday, the US will publish minor figures, but Federal Reserve’s head, Jerome Powell, will testify on the quarterly CARES Act report before the House Financial Services Committee. Treasury Secretary Janet Yellen will testify alongside.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair remains within familiar levels, trading near a daily high of 1.1946. The short-term picture shows that the bearish potential eased, although further gains are not yet clear. In the 4-hour chart, the pair is above a flat 20 SMA but below a bearish 100 SMA, which stands below the 50% retracement of the November/January rally. Technical indicators advanced above their midlines but lack momentum enough. Bulls would have better chances on a break above the mentioned Fibonacci resistance.

Support levels: 1.1920 1.1885 1.1840

Resistance levels: 1.1970 1.2010 1.2050

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.