Investors on Reddit, mainly on the forum that participated in a short squeeze in the shares of GameStop Corporation GME, are laying the finger of blame on Wall Street big shots for the plunge that affected several companies Friday.

What Happened: Multiple posts from Reddit users including on r/WallStreetBets bemoaned the unfairness of the situation where retail investors using social media were allegedly blamed for risky trading while institutional investors were the ones that were overleveraged.

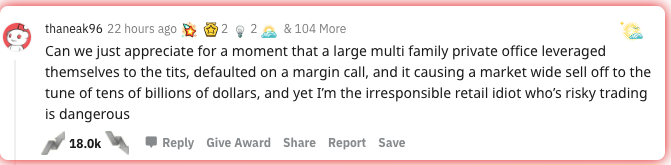

Screenshot: A post on Reddit forum r/WallStreetBets critical of Archegos.

Screenshot: A post on Reddit forum r/WallStreetBets critical of Archegos.

Shares of companies like Discovery Communications Inc DISCA, Baidu Inc BIDU, and Tencent Music Entertainment Group TME, and others plunged on Friday after several major investments banks including Goldman Sachs Group Inc GS forced the hedge fund Archegos Capital Management to liquidate holdings.

Also affected were companies such as ViacomCBS, trading under the name of CBS Corporation Common Stock VIAC, and several Chinese names.

See also: How to Buy GameStop (GME) Stock

Why It Matters: In January, when the buzz around the short squeeze was at some analysts such as Loop Capital’s Anthony Chukumba compared the actions of the Reddit investors to gambling.

Purpose Investment’s Chief Investment Officer Greg Taylor said the actions of the investors “blurs the line between gambling and investing.”

Some Reddit posters took exception to such thoughts on their style of trading.

Screenshot: A post on Reddit forum r/WallStreetBets.

Screenshot: A post on Reddit forum r/WallStreetBets.

Screenshot: A post on Reddit forum r/WallStreetBets

Screenshot: A post on Reddit forum r/WallStreetBets

In February, the GameStop short squeeze saga reached the Congress where, at a hearing, a key WallStreetBets investor Keith Patrick Gill who goes by the handle “Deep F---ing Value” told lawmakers, “in short, I like the stock.”

The lawmakers also heard from CEOs of Wall Street firms such as Robinhood, Citadel, and Melvin Capital who became ensnared in the short squeeze frenzy, one way or another.

See Also: How GameStop Bull Roaring Kitty Isn't All That Different From Warren Buffett

At the beginning of February, Rep. Stephen Lynch (D-Mass.) told CNBC that Reddit-fueled trading wasn’t fair or orderly and posed a “systemic risk.”

For news coverage in Italian or Spanish, check out Benzinga Italia and Benzinga España.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.