Still from the trailer for The China Syndrome (1979).

A Potential China Syndrome In Reverse

Forty two years ago, The China Syndrome terrified movie audiences with the prospect of a nuclear meltdown in the U.S. spreading to China; today, investors worry about a financial meltdown in China spreading elsewhere. The meltdown is the impending default of China's largest property developer, China Evergrande Group EGRNF, which has $313 billion in outstanding debt. ZeroHedge detailed potential for contagion in a post on Saturday ("This Is How Contagion From Evergrande's Default Will Spread To The Rest Of The World").

The Twitter thread below also sketches out how contagion could spread.

Previously, ZeroHedge had presented its nightmare scenario for the default, which would be an inverse of the 2008-2009 global financial crisis, this time without Chinese growth to quickly drag the world out of it. In the event that nightmare scenario comes to pass, here's a quick-and-dirty (and relatively cheap) way to hedge your portfolio on Monday.

Setting Initial Conditions

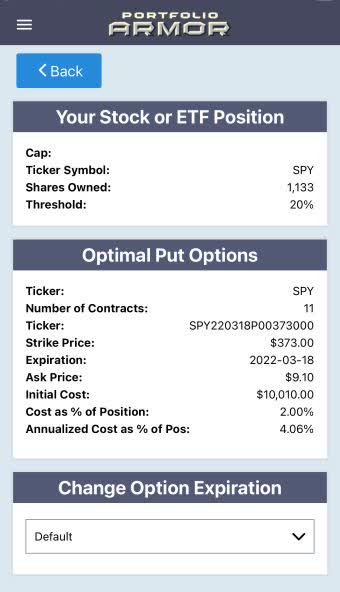

For the purposes of this example, we'll assume your portfolio is worth $500,000, and that it’s closely correlated with the SPDR S&P 500 Trust ETF SPY. We'll also assume you have enough diversification within it to protect against stock-specific risk, and that you can tolerate a decline of up to 20%. If you have a smaller risk tolerance, you can use the same approach entering a smaller decline threshold, Similarly, if you have a larger or smaller portfolio, you can adjust Step 1 below accordingly. If you have gold, bonds, or other asset classes in your portfolio, we'll address that at the end.

Hedging Stock Market Risk

Step 1

Divide the dollar value of your portfolio by the current price of SPY. For this example, we'll use numbers as of Friday's close, but obviously, you'll use current data when you do it. SPY closed at $441.40 on Friday. Dividing $500,000 by 441.4, gets you 1,133 shares (rounded up).

Step 2

Scan for the optimal, or least expensive, puts to protect against a >20% decline in your number of shares of SPY at the options expiration you want. We've used our default time frame to expiration below; if you think the Evergrande situation will resolve itself sooner, then you can find cheaper protection by picking a sooner expiration date.

This and the next screen capture are via the Portfolio Armor iPhone app.

As you can see above, the number of options contracts the algorithm presented was 11. Since each options contract covers 100 shares, what our algorithm does when you enter a number containing an odd lot like 1,133 is this: it slightly over-hedges the round lots (the 1,100 shares, in this case), so that your entire position, including those extra 33 shares, is protected against the drawdown you specified.

Note the cost here: $10,010, or 2% of portfolio value. The app calculated that conservatively, using the ask price of the puts (in practice, you can often buy options at some price between the bid and ask prices).

Step 3

Round up the number of SPY shares to the nearest 100 and repeat step 2.

Note that, in this case, it was cheaper to hedge 1,200 shares using the second hedge ($9,192 versus $10,010), so you would go with that.

Hedging Other Asset Classes

In our simplified example above, your portfolio was 100% stocks that were highly correlated with SPY. Let's say your portfolio includes a broader range of asset classes: 40% diversified stocks, 20% tech stocks, 30% bonds, and 10% gold. You could use the same approach as above using QQQ as the ticker for the tech stocks, TLT or LQD for the bonds (depending if they're Treasuries or corporates), and GLD for gold. So, in that case, you'd divide the dollar amount of your tech stocks by the current price of QQQ, etc.

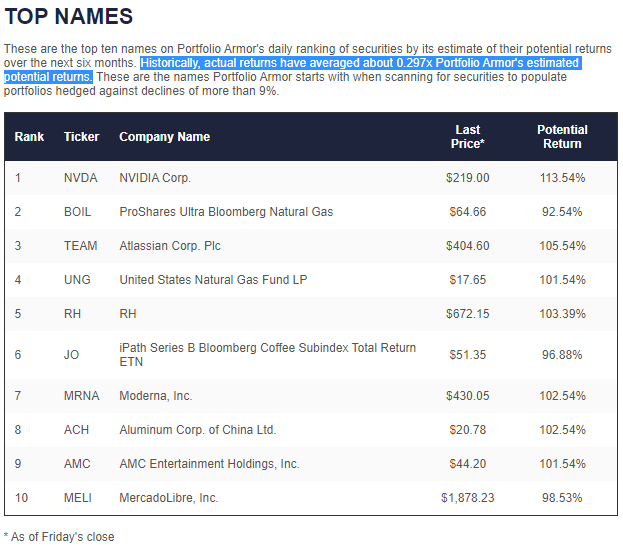

A Contrarian Bet On China

If you're the type to buy when others are selling, in a previous post we wrote about a contrarian bet on China, the Aluminum Corporation of China, ltd (ACH), which was our #8 name on Friday.

Screen capture via Portfolio Armor on 9/17/2021

It might be more prudent to buy and hedge in this case though.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.