EV stocks had another down week amid the broader market rout, triggered by macroeconomic uncertainties. EV leader Tesla, Inc.'s TSLA earnings report did little to salvage the somber market mood.

Here are the key events that happened in the EV space during the week:

Tesla Earnings Disappointment, White House Snub & More: Expectations were running high ahead of Tesla's fourth-quarter earnings report. Although the headline numbers were ahead of expectations, slowing margin growth, a warning regarding supply chain issues and the delay in new product launches beyond 2022, all served to spook investors, sending the stock sharply lower.

The post-earnings plunge led to over $100 billion being wiped out of Tesla's valuation.

Instead of car models, Tesla seems to be focusing on the humanoid robot it announced last year. CEO Elon Musk said on the earnings call that the robot, code-named Optimus, has the potential to be more significant than the company's vehicle business over time.

On a positive note, Cathie Wood's Ark Invest ended its Tesla selling streak and bought shares of the company for the first time in eight months.

Meanwhile, President Joe Biden once again snubbed Musk as the CEO was not among those invited to the "Build Back Better CEO Round Table" hosted by the White House this week. In a tweet, Biden commended General Motors Corporation GM and Ford Motor Co. F for "building more EVs at home than ever before."

GM Invests $7B Toward Accelerating EV Transition: GM said it plans to invest about $7 billion in Michigan to further its goal of becoming the EV leader in North America by 2025.

A portion of the investment will go into a new EV battery manufacturing plant the automaker is setting up along with its joint venture partner, LG Energy Solutions, and the remainder will be spent on converting the company's assembly plant in Orion Township for production of the Chevrolet Silverado EV and GMC Sierra EV.

In a separate development, a CNN report suggested that GM may be pulling the plug on its Chevy Bolt EV. Although GM executives did not explicitly state anything along those lines, the company has not manufactured a meaningful number of the model since August, the report said. It should be noted that GM has recalled almost all the Bolts that were manufactured, citing a fire hazard risk while recharging.

Related Link: Why This Analyst Thinks Tesla Is a $2,500 Stock And When It May Reach That Price Target

Lucid's European Foray Imminent: Lucid Group, Inc. LCID tweeted earlier this week a graphic that underlined its intent to expand into Europe.

The video has a caption running that the company is "going places" with the year 2022 mentioned. It also hinted at some European countries are potential destinations. Also during the week, a Twitter user shared an email sent by the company to potential European customers, asking them to convert preorders into reservations, which implies that deliveries could begin soon.

Baidu Plans Mass Production Of Robo Cars By 2023: Chinese search engine Baidu, Inc. BIDU said its intelligent EV division JIDU has raised about $400 million in Series A financing. The first Robocar concept car manufactured by the unit will be unveiled at the Beijing Auto Show in April. A mass-produced model is set to be launched in 2023.

Rivian Ramping Production: Rivian Automotive, Inc. RIVN, which undershot targets in 2021, is eyeing to ramp strongly and quickly. After production at its Normal, Illinois factory was stalled at the start of the year, Rivian is reportedly looking to ramp up production of its R1T pickup truck to 200 units per week.

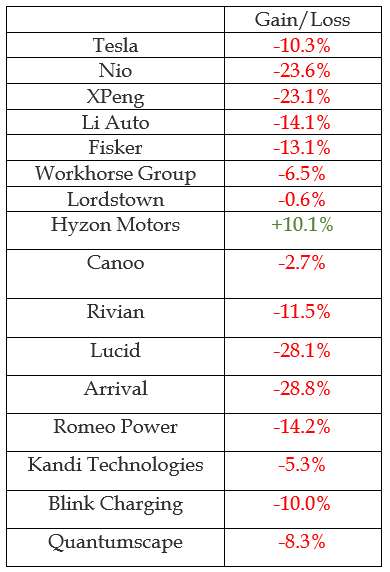

EV Stock Performances for The Week:

Related Link: Analyst Says Tesla's Q4 Is A 'Trophy Case' Quarter, Why He Thinks Momentum Building Into 2022

Photo: Courtesy of FirstEnergy Corp. on Flickr

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.