Shares of United Parcel Service Inc. UPS decreased by 18.31% in the past three months. Before we understand the importance of debt, let's look at how much debt United Parcel Service has.

United Parcel Service's Debt

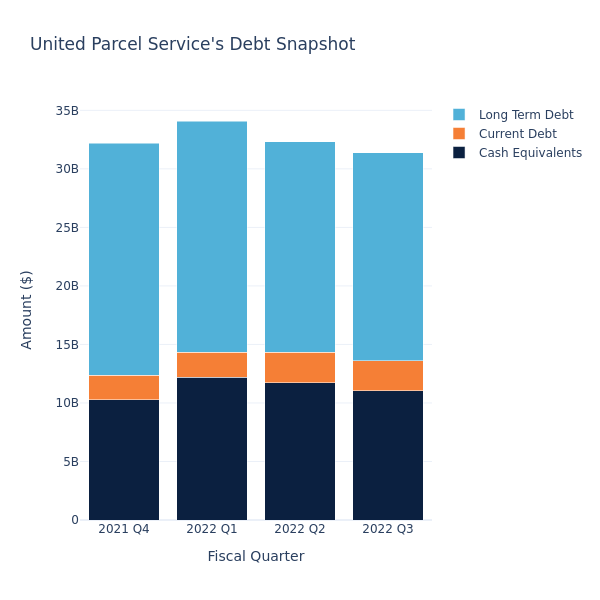

According to the United Parcel Service's most recent financial statement as reported on November 2, 2022, total debt is at $20.35 billion, with $17.77 billion in long-term debt and $2.58 billion in current debt. Adjusting for $11.04 billion in cash-equivalents, the company has a net debt of $9.30 billion.

Let's define some of the terms we used in the paragraph above. Current debt is the portion of a company's debt which is due within 1 year, while long-term debt is the portion due in more than 1 year. Cash equivalents includes cash and any liquid securities with maturity periods of 90 days or less. Total debt equals current debt plus long-term debt minus cash equivalents.

To understand the degree of financial leverage a company has, shareholders look at the debt ratio. Considering United Parcel Service's $69.54 billion in total assets, the debt-ratio is at 0.29. Generally speaking, a debt-ratio more than 1 means that a large portion of debt is funded by assets. As the debt-ratio increases, so the does the risk of defaulting on loans, if interest rates were to increase. Different industries have different thresholds of tolerance for debt-ratios. For example, a debt ratio of 40% might be higher for one industry, but normal for another.

Importance of Debt

Besides equity, debt is an important factor in the capital structure of a company, and contributes to its growth. Due to its lower financing cost compared to equity, it becomes an attractive option for executives trying to raise capital.

Interest-payment obligations can impact the cash-flow of the company. Equity owners can keep excess profit, generated from the debt capital, when companies use the debt capital for its business operations.

Looking for stocks with low debt-to-equity ratios? Check out Benzinga Pro, a market research platform which provides investors with near-instantaneous access to dozens of stock metrics - including debt-to-equity ratio. Click here to learn more.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.