Zinger Key Points

- Credit Suisse shares are trading 5% higher premarket.

- The Swiss cabinet will conduct an extraordinary meeting on Thursday to address Credit Suisse.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

European banking stocks rallied Thursday as the Swiss National Bank pledged to lend Credit Suisse Group AG CS up to CHF 50 billion ($54 billion) through a covered loan facility and a short-term liquidity facility, alleviating fears of financial industry turmoil.

Credit Suisse shares are trading 5% higher premarket. The Swiss cabinet will conduct an extraordinary meeting on Thursday to address Credit Suisse, according to Swiss media.The Swiss Social Democratic Party is calling for individuals responsible at Credit Suisse to be held accountable.

Credit Suisse also announced a debt repurchasing operation, which is a cash tender offer to purchase up to 10 USD-denominated senior debt bonds for up to $2.5 billion.

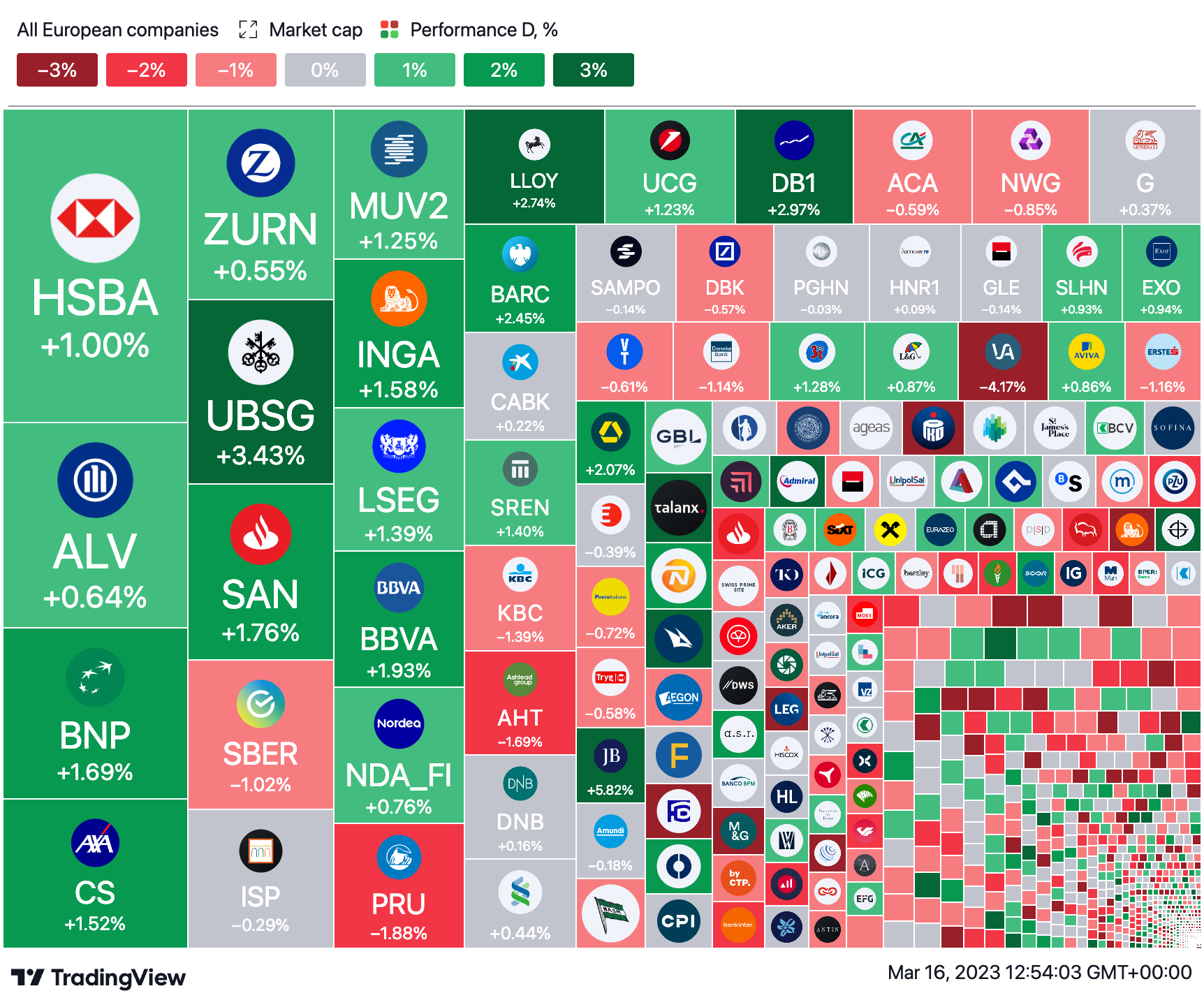

Other European financial institutions rallied in the European morning session, with UBS Group AG UBS, Lloyds Banking Group LYG, Barclays BLC and BBVA BBVA among the best performers.

European Banking stocks: Daily price performance on Mar 16, 2023 – Chart: TradingView

European Banking stocks: Daily price performance on Mar 16, 2023 – Chart: TradingView

Too Big To Fail? Larger Banks Outperform: Investors are flocking to banking stocks as regulators' pledge to provide liquidity backstops to troubled financial institutions supports the "too big to fail" narrative.

Large financial equities are outperforming small ones, as the woes of Silicon Valley Bank are causing a flight to quality within the industry.

Most trustworthy financial institutions are seeing a record influx of deposits as cash flows from failing banks. According to Bloomberg, Bank of America Corp BAC received more than $15 billion in deposits when SVB collapsed March 10.

Major financial institution shares tracked by the Financial Select Sector SPDR Fund ETF XLF have outpaced regional ones tracked by the SPDR S&P Regional Banking ETF KRE by 25% over the last month.

The XLF/KRE ratio, which measures the relative strength of large-cap against small-cap U.S. banks, is currently at an all-time high, surpassing levels reached before the Lehman collapse.

Financial Select Sector SPDR Fund ETF XLF vs SPDR S&P Regional Banking ETF KRE – Chart: TradingView

Financial Select Sector SPDR Fund ETF XLF vs SPDR S&P Regional Banking ETF KRE – Chart: TradingView

Photo via Shutterstock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.