Zinger Key Points

- Houthi Rebel attacks are forcing a growing number of shippers to halt Red Sea operations, Reuters reports.

- USO oil fund ETF gains 3.6%, Brent up 3.8% and Nymex WTI up 3.9%

- Markets are messy—but the right setups can still deliver triple-digit gains. Join Matt Maley live this Wednesday at 6 PM ET to see how he’s trading it.

Oil prices have found some respite from a six-week sell-off as BP PLC BP became the latest company to announce it was halting shipments through the Red Sea due to the “deteriorating security situation for shipping.”

The development comes amid increasing attacks on vessels in the Red Sea by Houthi militants in Yemen, according to Reuters.

On Monday, the price of the U.S. benchmark Nymex WTI contract rose 3.9% to $74.57 a barrel, but was still 22.5% lower than its peak in September. European benchmark Brent crude, rose by 3.8% to $79.47 a barrel, but remained nearly 20% lower than its September high mark.

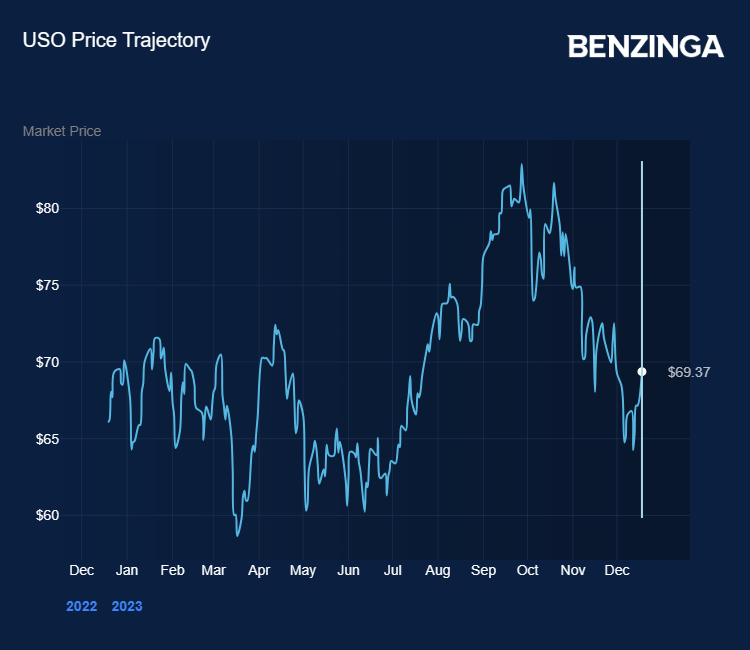

The United States Oil Fund USO, an exchange traded fund that tracks the price of light sweet crude, was up 3.6% in early trade, but still lags its 2023 peak by 19%.

American Depository Receipts in BP were trading 1.2% higher in midday trading on Monday. Among the US majors, Exxon Mobil XOM gained 1.5% to $102.47 and Chevron CVX added 0.7% to $150.50.

Also Read: Oil Prices Under Pressure As COP28 Climate Summit Agrees To Energy ‘Transition’

Avoiding Wild Waters In The Red Sea

In an emailed statement to Benzinga, BP said, “In our trading and shipping business, as in all BP businesses, the safety and security of our people and those working on our behalf is BP's priority.

“In light of the deteriorating security situation for shipping in the Red Sea, BP has decided to temporarily pause all transits through the Red Sea. We will keep this precautionary pause under ongoing review, subject to circumstances as they evolve in the region.”

BP is among a number of companies who have now suspended shipments through the area. Last week Moller Maersk and Hapag-Lloyd, the second- and third-biggest container shippers in the world, said they were halting shipments through the Red Sea. On Monday, Evergreen Line said it would suspend Israel import and exports services “due to rising risk and safety considerations.”

Key Shipping Route

The Red Sea is an important shipping route for goods and commodities moving to and from the Arabian Peninsula and East Africa, to Europe and the Eastern U.S.

Joining up with the Suez Canal, goods can be shipped though the Mediterranean Sea to Northern Europe and across the Atlantic to ports on the East Coast of the U.S.

In March 2021, Brent crude gained 8% over a couple of days when the Suez Canal was blocked for nearly a week by container ship Ever Given. Brent continued to rise into April as the build up in backlogs slowed down the rate of oil shipments into Europe.

The alternatives are crossing the Indian and Pacific Oceans to the U.S. West Coast or sailing around Africa. Either of which can add thousands of miles on to the journey and rack up significant extra shipping costs.

Warren Patterson, head of commodities strategy at ING, said: “Escalating shipping concerns in the Red Sea have added to the risk premium for oil. That said, the monthly report from IEA was quite soft as demand was downgraded mostly from Europe.”

Now Read: IEA Forecasts Slowdown In Oil Demand, Contrasts Positive Outlook By OPEC+

Image created using artificial intelligence with MidJourney.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.