The Pivot Issue

For two years, Wall Street pundits and asset gatherers have been screaming for the Fed to pivot to lower interest rates. Unsurprisingly, they make more money when asset prices are high. They were doing this even as the CPI was approaching double digits and when real inflation was approaching 20%. This week, Fed Chairman, Jerome Powell, changed his tune and delivered a dovish message. The CPI is trending down led by lower energy prices. Consumers continue to spend like crazy. A year ago, the soft-landing crowd sounded crazy. Now, it’s a real possibility.

This week, we’ll address the following topics:

- The Powell pivot. This week he delivered a different message. It’s different this time? Yes, it is.

- The CPI: Still too high, but it is coming down.

- Retail sales: up from a slow start and indicating a strong Christmas.

- Nvidia NVDA moving production out of Taiwan. Good move despite Taiwan having the best fab plants in the world.

- Barron’s calls for a higher neutral rate. We think they’re right. Don’t know what the neutral rate is? No worries. Explaining is what the 5 Things is here to do.

Ready for a new week featuring the long-awaited pivot? Let’s dive in:

1) Powell Changes His Tune:

For the last two years, DKI has been correctly critical of the asset gatherers who make more money when the Federal Reserve blows up asset bubbles with too-low interest rates. Even last year, with inflation raging these people screamed for the Fed to “pivot” to lower rates. DKI has spent the last two years saying inflation is too high, rates were too low, there will eventually be a pivot, but for now, Powell means it when he says “higher for longer”. This week, Powell gave a speech with a completely different tone. It’s clear that the Fed is done with interest rate hikes this cycle. Fed projections for the end of 2024 went from a net decrease of .25% in the fed funds rate to a .75% decrease.

I know I said “higher for longer” two weeks ago, but WAIT!

DKI Takeaway: Some are arguing that the Fed has overtightened and the US is now going to experience a massive recession. DKI suggests that a 5.3% fed funds rate is sensible and that it’s really the decade and a half of zero and near-zero interest rates that created the problem. I further suggest that regardless of what the Fed does, Congressional overspending is going to lead to massive future inflation. Their view and my view no longer matter. The “pivot” is here. The most significant part of Powell’s speech was he made it clear the Fed would consider reducing the fed funds rate even before the CPI came down to 2%. The Fed’s next move will be a rate decrease. Gold and Bitcoin have been rallying. DKI owns both.

2) November CPI in Line with Expectations – Cheers Investors:

The November CPI was up 3.1% vs last year and .1% from October. The Core CPI, which excludes food and energy, was up 4.0% vs last year and .3% from October. These were in line with expectations, and the market liked the results.

Looks flattish to me, but the market celebrated.

DKI Takeaway: There isn’t much in this report that’s a surprise. Inflation has come down partly due to rate hikes and partly due to comparisons against two years of big increases. The core CPI remains sticky as services and labor are still expensive and becoming more so. Housing remains high as mortgage rates decline. And energy is bailing out the Federal Reserve but potentially signaling a recession. As noted in this week’s first “Thing”, core CPI might be double the target, but the Fed pivot is here.

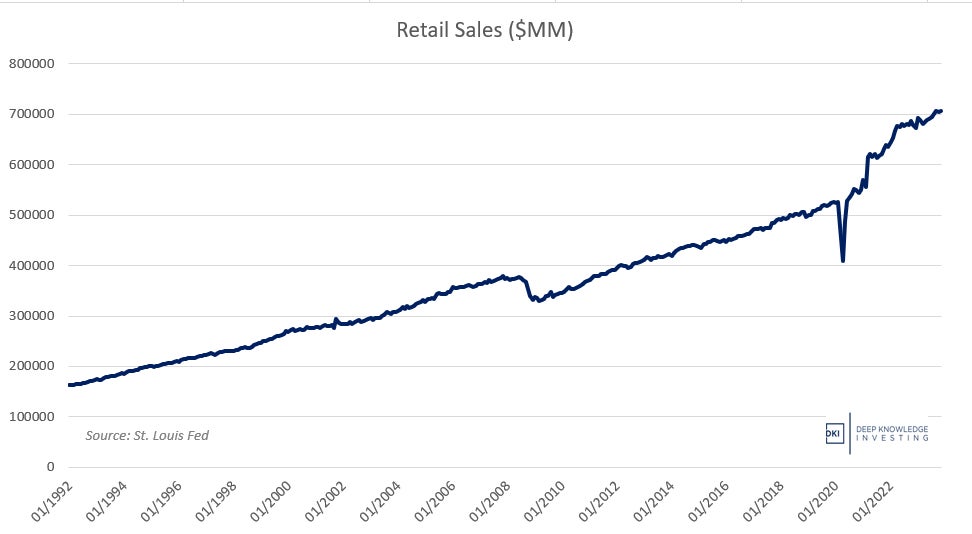

3) Retail Sales Grow – Defying Expectations:

Last month, weak retail sales indicated we could be heading for a Grinchy Christmas. As usual, the US consumer came to the rescue. November sales were up .3% from October crushing expectations for sales to be down 2%.

A lot of people thought that last bar would be negative.

If you’re in the no-recession soft-landing crowd, this is exhibit one.

DKI Takeaway: Inflation has hurt a lot of families. Feelings of insecurity and dissatisfaction with the economy are horrible right now. Despite that, unemployment is low, a lot of people have gotten raises, and the government is spending like the US will never have to pay its bills. That last point should scare you, but for the moment, people feel flush enough to continue spending. DKI also acknowledges that while we have previously pointed out that higher inflation is part of higher retail spending, the consumer continues to buy more goods and services.

4) Nvidia Moving Some Production to Vietnam:

Nvidia makes some of the best graphics chips in the world which are ideal for both crypto mining and AI applications. Taiwan has the best semiconductor manufacturing plants in the world led by Taiwan Semiconductor. The facilities and personnel there are so advanced that even though Taiwan Semi is building new plants in the US, the expectation is that even those plants will produce less advanced chips than the Taiwan-based facilities do. This week, Nvidia announced it is diversifying its supply chain and investing in production in Vietnam.

The Nvidia 3060Ti in my home computer is below 20% of capacity on high-definition video calls.

DKI Takeaway: China has a near-monopoly on rare earth minerals, the components required for green energy, and 90% of US pharmaceutical production. Taiwan makes the best chips in the world. China has made clear its intentions to take control of Taiwan, and Nvidia is smart to diversify their supply chain. Apple AAPL is moving more iPhone production to India as well. I’d like to see US pharma take this coming problem as seriously as the tech firms and start to move production back to Puerto Rico. For decades, many of us benefitted from price deflation by moving production to the lowest-cost producers. Going forward, securing a reliable supply chain, even if it’s a more expensive one, is going to be crucial.

5) Barron’s Gets it Right on the “Neutral” Rate:

The “neutral rate” is the fed funds rate that neither stimulates nor restricts the economy. It can’t be measured; only observed after the fact. The zero and near-zero rates we saw following the 2008 financial crisis were too stimulative and led to the inflation we’ve experienced the past two years. Many now claim the current 5.3% fed funds rate is too restrictive and about to cause a recession. Those claims can’t be proven now, and will only be evaluated by future economists and market participants. During the past two years, I have often been at odds with the legacy media on inflation and interest rates. DKI was early when we warned on high non-transitory inflation in November of 2021 and right when we spent two years saying “higher for longer”.

Barron’s is a great publication and Megan Cassella just penned the post of the year.

DKI Takeaway: This week, Barron’s Megan Cassella wrote an article titled “Higher Interest Rates Are Here to Stay. What It Means for the Economy”. In it, she nails DKI themes of a higher neutral rate, higher government spending and stimulus, higher costs due to reversing globalization (see “Thing” 4 above), and expectations of higher future inflation. She also warns that near-zero interest rates aren’t and shouldn’t be the status quo in the future. It’s a great article and I recommend reading the entire thing. DKI congratulates Megan and Barron’s on the thoughtful analysis.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.