Zinger Key Points

- AMD's MI300 Data Center GPU sparks investor interest, amplifying rivalry with Nvidia.

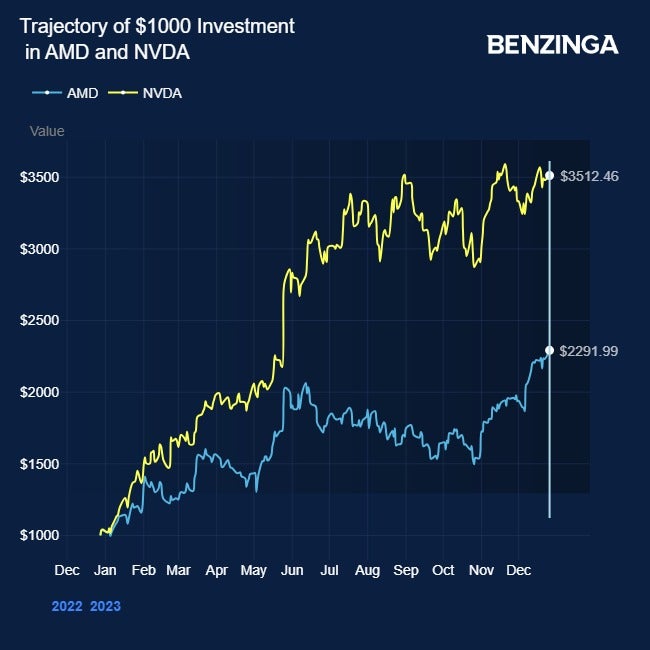

- Nvidia's closest AI chip competitor, AMD, gained 17% last month, indicating successful AI offerings.

- The ‘Trade of the Day’ is now live. Get a high-probability setup with clear entry and exit points right here.

Advanced Micro Devices, Inc AMD stock continues piquing investor attention with its artificial intelligence offering MI300 Data Center GPU, intensifying rivalry with Nvidia Corp NVDA.

Nvidia's closes AI chip rival AMD gained 17% last month, which reflects the success of its AI offering. Nvidia has gained slightly over 2%.

After Nvidia, analysts see AMD as the next leading player in the accelerator market.

Analysts see AMD securing 5% - 10% of the expanding market, likely to reach between $150 billion - $400 billion by FY27E.

In a recent client note, Deutsche Bank analysts highlighted AMD's strong positioning in leveraging the rapidly growing AI Total Addressable Market (TAM). They emphasized the company's accumulating customer partnerships and the launch of products showcasing remarkable performance metrics, CNBC reports.

In late 2023, a flurry of announcements by Nvidia, AMD, and Intel Corp INTC set the stage for a significant showdown in the realm of generative AI data center processors akin to a wild west shootout.

Nvidia, the early entrant, revealed advancements with the NeMo framework and H200 GPUs, boasting a substantial 4.2x performance boost in Tensor Core usage for Llama 2 models, Forbes reports.

AMD stepped in, showcasing the MI300X GPU and MI300A APU on their Instinct Platform, projecting notable performance gains of 40% more compute units and increased memory capacity.

The MI300X's capability to run Llama 2 70B on a single accelerator showed potential advantages in reducing the required number of GPUs for specific workloads.

Intel brought its 5th Gen Xeon AI accelerated CPU into the fray, promising impressive deep learning training and AI inference performance improvements.

They emphasized performance enhancements within the same power envelope as the previous generation, targeting a substantial reduction in total cost of ownership (TCO) for customers.

Nvidia focused on leveraging its installed base and software ecosystem for sustained differentiation, while AMD aimed to compete on technical capabilities, pricing, and availability.

Intel targeted TCO savings for its existing customer base. The three giants targeted inference market dominance while addressing memory capacity, power efficiency, and processor performance.

As the market gears up for 2024, these players prepare for an explosive year in the AI data center processor domain, anticipating continuous evolution and fierce competition.

Price Action: AMD shares traded higher by 0.74% at $144.48 on the last check Wednesday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Wikimedia Commons

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.