Despite a slump in iPhone sales, consumers are showing a growing preference for models with higher storage capacities, according to a recent report. This trend is positively affecting the average sales price for Apple Inc. AAPL.

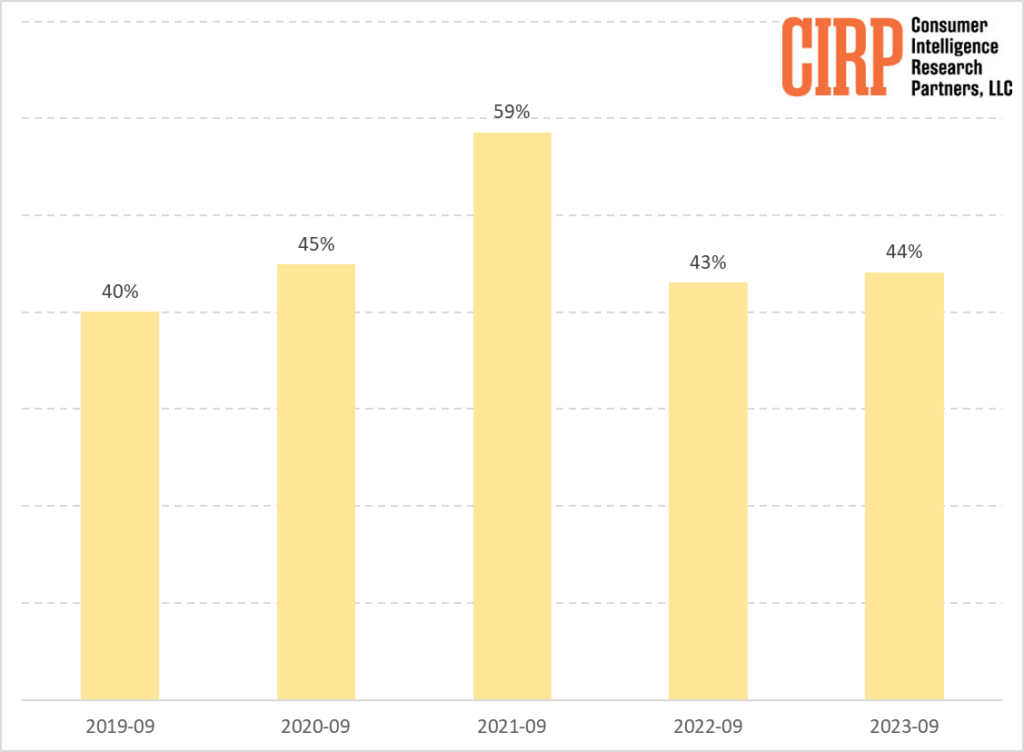

What Happened: The Consumer Intelligence Research Partners (CIRP) report revealed that around 44% of iPhone buyers in the third quarter of 2023 chose to upgrade from the base storage model.

This aligns with historical patterns and marks a recovery from the 2023 slump. The shift in consumer behavior towards higher storage models is notable despite the previous popularity of base models with lower storage capacities and prices.

The demand for more storage is primarily attributed to the increasing size of operating systems, app libraries, and media collections. The rise of iCloud storage and streaming media such as Apple Music had previously lessened the need for higher onboard storage. However, users now aim to “future-proof” their devices against evolving tech requirements, given the longer purchase contracts and extended usage periods.

Despite a 2% YoY reduction in iPhone revenue in 2023, analysts predict that weak iPhone sales over the holiday season will affect Apple’s Q1 2024. However, the ongoing trend of consumers opting for storage upgrades might help maintain Apple’s average sales price.

Why It Matters: KeyBanc Capital Markets analyst Brandon Nispel has expressed concerns about the impact of a challenging December quarter on Apple’s stock. However, the continued preference for higher storage models could offer a glimmer of hope.

Meanwhile, Apple’s iPhone production in India has reached a historic $13.5 billion, surpassing targets and potentially offsetting some of the sales decline.

However, the company is also facing a predicted sales decline in China despite the release of new iPhone models. The decline in sales in China, a key market for Apple, might further impact the company’s revenue in 2024.

Image Credits – Shutterstock

Engineered by Benzinga Neuro, Edited by Sudhanshu Singh

The GPT-4-based Benzinga Neuro content generation system exploits the extensive Benzinga Ecosystem, including native data, APIs, and more to create comprehensive and timely stories for you. Learn more.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.