Zinger Key Points

- Nickel continued to slump, causing industry-broad shutdowns, layoffs and capex reductions.

- The decline could continue in 2024, yet speculators should be mindful of short squeezes.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

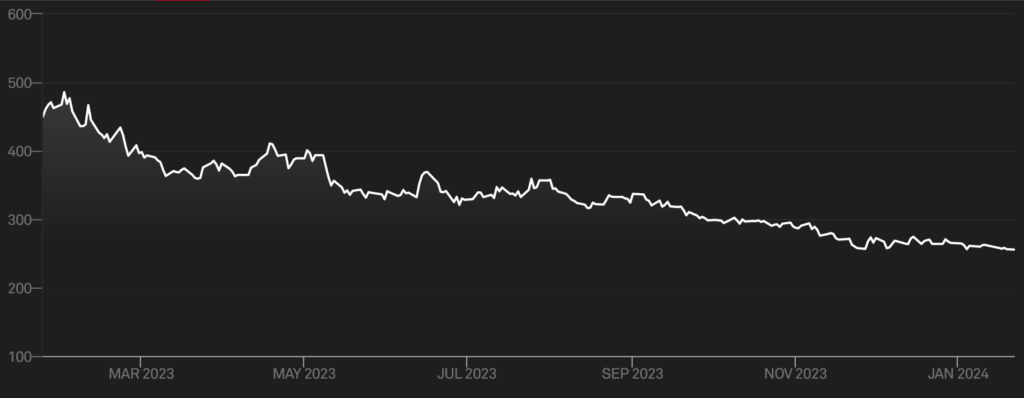

Nickel prices on the London Metal Exchange (LME) have continued their downward spiral, marking a more than 40% decline over the past year. This trend persists despite companies’ efforts to curtail production due to the steep price drop for the metal widely used in stainless steel and electric-vehicle batteries.

The ongoing slump reflects an influx of supply from Indonesia and sluggish demand. The Southeast Asian nation has solidified its dominance in global nickel supply thanks to efficient plants benefiting from affordable labor, cheap power, and abundant raw materials.

However, this double-whammy supply & demand effect is wreaking havoc in the nickel mining industry, causing production halts, layoffs and reduced capital expenditures.

Now read: Ivanhoe Mines Resuscitates A Century-Old Kipushi Mine To Start Zinc Production

The S&P GSCI Nickel Index, which provides a publicly available benchmark for investment performance in the nickel commodity market, shows the situation.

In the past year, the market experienced a gradual and persistent decline rather than a sudden crash due to unforeseen events. This steady downturn was occasionally punctuated by short-lived rallies that provided temporary relief.

S&P GSCI Nickel Index 2023-2024, Source: SP Global

Managing director of mining research consultancy Groundwork Plus, Peter Arden, offered some clarification for S&P Global.

“While all commodities go through these phases, nickel suffers somewhat more than other metals because when prices are good, you get a lot of recycling. Then the recycling falls off as prices decline,” he said.

Major producers took a defensive posture as early as September 2023, when Glencore (GLCNF) announced it would stop funding its 49%-owned Koniambo nickel mine in New Caledonia. After spending $9 billion, Glencore will freeze further funding by the end of February 2024 without a clear guideline on the output impact.

The latest casualty in this challenging environment is Wyloo Metals, which recently declared the shutdown of its nickel mines in Western Australia. This decision has a ripple effect through other parts of the mining ecosystem.

“The decision by Wyloo to suspend its operations means it will no longer be viable to continue operating parts of the Kambalda concentrator from mid-year,” BHP's Nickel West asset president Jessica Farrell stated for ABC News,

Other major nickel "victims" include First Quantum Minerals (FQVLF), which temporarily halted Ravensthorpe mine operations, and nickel miner Sherritt International (SHERF), which laid off 10% of its Canadian workforce amid a broader cost-cutting effort.

While an ongoing nickel market disbalance threatens to continue the current trend, those betting against the nickel market should be on alert. Per Bloomberg, short positions on the LME were in billions as early as October, yet short squeezes are not uncommon in this market, with prices spiking as much as 250% in less than a day.

Also read: Barrick Gold Denies First Quantum Rumors, Focuses On Developing Existing Tanzanian Projects

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.