Zinger Key Points

- TSMC, Samsung focus on advanced chip production at home, plan U.S. expansion amid challenges.

- TSMC sets 2025 for 2-nm chips in Taiwan; Samsung invests in Seoul project, eyeing cost-efficiency.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

Taiwan Semiconductor Manufacturing Co TSM and Samsung Electronics, leaders in the semiconductor industry, emphasize their latest chip production facilities in their home countries, Taiwan and South Korea, respectively, despite expanding their operations to the U.S., Japan, and other locations.

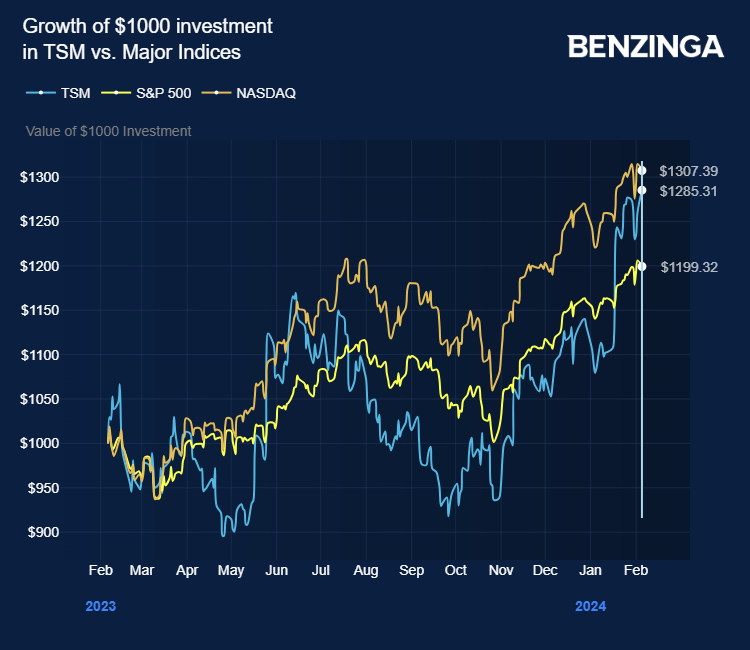

TSMC is a key contract chip supplier for leading companies. The stock is trading higher on Monday as it continues to ride on the artificial intelligence frenzy.

The key Nvidia Corp NVDA supplier announced plans to construct fabs for 2-nanometer chips in Taiwan’s Hsinchu and Kaohsiung cities, with mass production aimed for 2025.

Similarly, Samsung, also a critical Nvidia supplier, disclosed a significant investment in a semiconductor project near Seoul, focusing on advanced 2-nanometer chip technology, SCMP reports.

Both companies are navigating the complexities of establishing production bases in the U.S. amid efforts to bolster domestic chip manufacturing, facing challenges such as recruiting skilled workers and higher production costs compared to their home countries.

In January, TSMC clocked a fourth-quarter revenue of $19.62 billion, down by 1.5% year-on-year, beating the consensus of $19.45 billion. EPS of $1.44 beat the consensus of $1.37. TSMC looks to expand its global manufacturing footprint, signaling the industry’s prospects.

Taiwan Semiconductor eyes a second Japanese plant in Kumamoto, potentially investing $13.5 billion. TSMC’s expansion in Japan includes a $8.6 billion wafer factory and possibly a $20 billion 3nm chip plant.

The U.S. Chips and Science Act, offering substantial subsidies, aims to support these initiatives despite delays.

For instance, TSMC has adjusted its production timeline in Arizona to 2025 due to staffing and union issues, while Samsung has postponed its Texas fab’s mass production start to 2025.

These strategic decisions underscore the cost-efficiency and logistical advantages of maintaining cutting-edge manufacturing within Taiwan and South Korea despite global efforts to localize semiconductor production.

Price Action: TSM shares traded higher by 1.99% at $118.05 on the last check Monday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Sundry Photography on Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.