Zinger Key Points

- Nvidia's custom AI chip unit challenges Broadcom and Marvell, shaking up the silicon market.

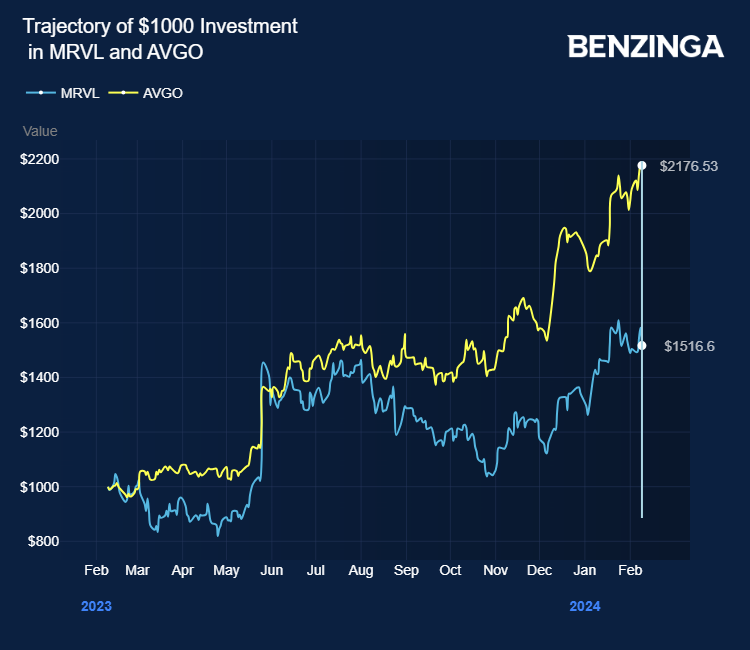

- Broadcom and Marvell stocks dip as Nvidia dominates with 80% of the AI chip market.

Nvidia Corp’s NVDA strategic expansion into custom AI chip design presents a formidable challenge to Broadcom Inc AVGO and Marvell Technology, Inc MRVL, significant players in the custom silicon market.

By establishing a new business unit to craft specialized chips for cloud computing and advanced artificial intelligence (AI) applications, Nvidia is leveraging its dominant position in the high-end AI chip market to enter a rapidly growing sector.

This move is particularly significant given Nvidia’s existing control over approximately 80% of the high-end AI chip market, a dominance that has contributed to a 40% increase in its market value this year alone, reaching $1.73 trillion, Reuters reports. Broadcom and Marvell stocks are trading lower following the report.

The decision by Nvidia to focus on custom chip design is in response to a noticeable trend among tech giants, such as OpenAI, Microsoft Corp MSFT, Alphabet Inc GOOG GOOGL, and Meta Platforms Inc META, towards developing in-house chips tailored to their specific needs.

These companies, traditionally reliant on Nvidia’s generalized H100 and A100 chips, seek more energy-efficient and cost-effective computing solutions.

This strategic pivot could significantly impact Broadcom and Marvell’s position in the custom silicon design market for data centers, a market valued at roughly $30 billion in 2023 and expected to continue its rapid growth.

Industry analysts have highlighted the potential for Nvidia’s move to eat into the sales of Broadcom and Marvell, with the custom silicon business of Broadcom alone touching $10 billion.

In December, Broadcom reported fourth quarter EPS of $11.06, exceeding analyst expectations of $10.98. The company reported quarterly sales of $9.29 billion, missing the Street’s estimate of $9.41 billion. Wall Street analysts boosted their price targets on the stock after the results.

Analysts have vouched for Broadcom’s dominance as a tech infrastructure leader with strong AI, cloud, and software positions. The stock gained 110% last year.

In November, Marvell reported third-quarter adjusted EPS of $0.41, beating the analyst consensus estimate of $0.40. Revenue clocked in at $1.419 billion, beating the Street’s $1.4 billion estimate, representing a year-over-year decrease of 8%. The stock gained 51% last year.

Price Actions: AVGO shares traded lower by 0.15% at $1,272.82 on the last check Tuesday. MRVL shares traded lower by 2.75% at $69.07.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.