Zinger Key Points

- TSMC's stock surges, reaching $575B market cap and surpassing Visa, fueled by AI demand and a Morgan Stanley upgrade.

- Nvidia's key supplier, TSMC, sees $42B market value boost amid AI frenzy, with plans for advanced 2-nanometer chips by 2025.

- Pelosi’s latest AI pick skyrocketed 169% in just one month. Click here to discover the next stock our government trade tracker is spotlighting—before it takes off.

Key contract chipmaker Taiwan Semiconductor Manufacturing Co TSM stock continues to pique investor curiosity thanks to the artificial intelligence frenzy.

The key Nvidia Corp NVDA supplier experienced a significant market value increase of approximately $42 billion.

In its first trading session following the Lunar New Year break, TSMC’s market capitalization reached a record $575 billion, making it the world’s 12th most valuable company, surpassing Visa Inc V. This surge followed Morgan Stanley’s decision to raise its price target for TSMC by about 9%, Bloomberg reports.

Also Read: TSMC Sets Sights on Japan for Next-Gen Chip Manufacturing, Boosting Global Tech Leadership

The company’s performance contributed to Taiwan’s benchmark index reaching an all-time high. Additionally, TSMC reported a 7.9% increase in January sales, signaling a potential uplift in the global demand for consumer electronics.

The Philadelphia Stock Exchange Semiconductor Index and Nvidia’s market capitalization, now around $1.82 trillion, have reached new heights.

Investors’ interest in AI-related stocks has been mainly influenced by Nvidia’s impact, especially after CEO Jensen Huang visited Taiwan, which heightened enthusiasm for the AI value chain and Nvidia’s suppliers.

Nvidia has emerged as a significant beneficiary of the recent AI surge sparked by growing enthusiasm for generative AI following OpenAI’s ChatGPT release in November 2022.

Morgan Stanley analysts project that shifting towards larger AI models will drive demand for advanced chips, favoring TSMC’s cutting-edge foundry services.

The transition to Nvidia’s B100 GPU is a critical short-term catalyst, influencing H100 lead times and the competitive landscape, CNBC reports.

TSMC is optimistic about a recovery in tech demand, with plans to increase capital spending in 2024.

It has focused on AI as a key growth driver, discussing supply constraints and potential solutions with Nvidia’s CEO last month.

TSMC is at the forefront of chip technology, currently producing 3-nanometer chips, with plans to initiate mass production of 2-nanometer chips by 2025.

It expects full-year 2024 revenue to grow in the low to mid-20% range in U.S. dollar terms versus the consensus of $84.01 billion as it expands its global manufacturing footprint.

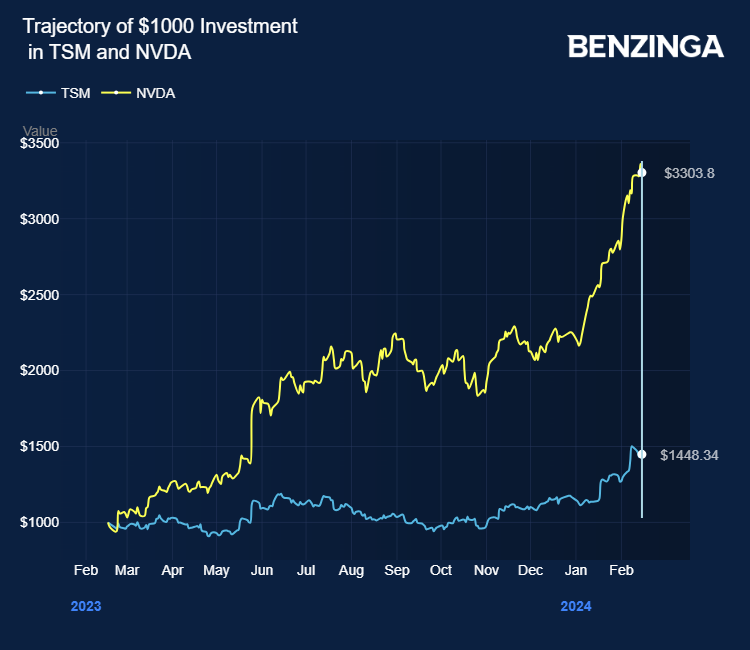

Taiwan Semiconductor stock gained over 42% last year, and Nvidia’s stock gained over 230%.

Price Action: TSM shares traded lower by 1.77% at $126.77 on the last check Friday.

Also Read: Taiwan Semi Announces Major Global Expansion and Capital Investment Plans for 2024 After Q4 Beat

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Wikimedia Commons

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.