Zinger Key Points

- JPMorgan's AI tool slashes corporate customers' manual work by 90%, now eyes charging for service.

- In 2023, JPMorgan forecast $1.5 billion in AI-driven business value.

- Markets are swinging wildly, but for Matt Maley, it's just another opportunity to trade. His clear, simple trade alerts have helped members lock in gains as high as 100% and 450%. Now, you can get his next trade signal—completely free.

Editor’s note: This story has been corrected to fix a headline that referred to a report from November 2023 and to make the timeline of the story clearer.

JPMorgan Chase & Co JPM has significantly reduced manual labor for its corporate customers by up to 90% through its artificial intelligence-powered cashflow management tool, Cash Flow Intelligence.

Tony Wimmer, head of data and analytics at JPMorgan’s wholesale payments unit, said around 2,500 clients are utilizing the toot at no charge, according to a March 4 Bloomberg report.

The bank is now contemplating introducing fees for this highly sought-after service, Bloomberg reports.

This initiative is part of JPMorgan’s broader strategy to enhance productivity and cut costs by integrating artificial intelligence into its operations.

CEO Jamie Dimon has even suggested that AI could lead to shorter workweeks, while the bank said in 2023 that it expected to generate $1.5 billion in business value from AI that year.

The Cash Flow Intelligence tool simplifies cash flow analysis and forecasting for corporate treasuries, a task Wimmer describes as complex and judgment-intensive.

Despite the automation’s efficiency in processing and visualizing payment flows, final liquidity management decisions still require human intervention.

Wimmer’s team, consisting of 250-300 data scientists and engineers, focuses on leveraging the massive daily payment flows JPMorgan oversees to develop and refine client solutions, emphasizing the ongoing importance of the human element in financial decision-making.

Morgan Stanley MS, Goldman Sachs Group, Inc GS, and Citigroup, Inc C have also tapped AI for various banking operations.

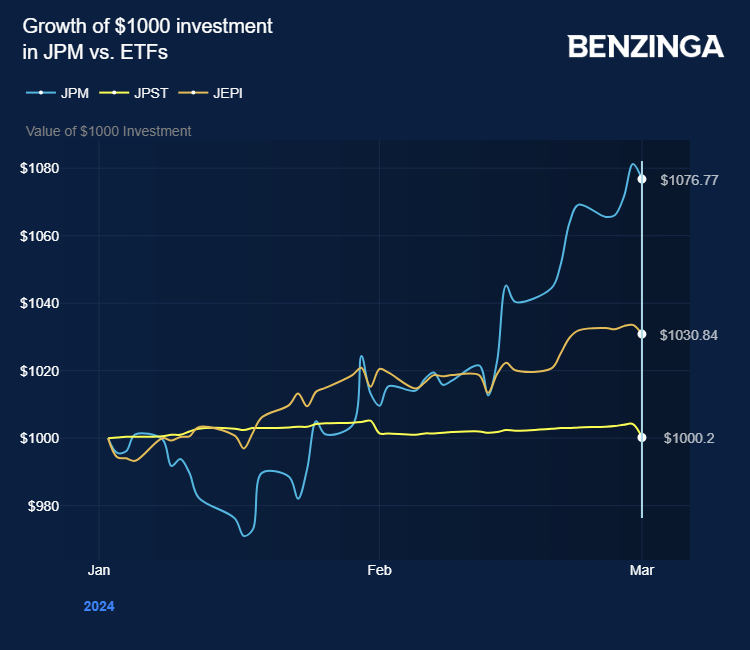

Investors can gain exposure to JPMorgan via JPMorgan Ultra-Short Income ETF JPST and JPMorgan Equity Premium Income ETF JEPI.

Price Action: JPM shares traded higher by 1.16% at $187.44 on the last check Monday.

Also Read: Great News for Nvidia? Amazon, Google, Microsoft Spending Big On AI and Cloud

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Shutterstock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.