Zinger Key Points

- AMD's February performance shows modest growth with Genoa's strong expansion leading the way, according to KeyBanc's John Vinh.

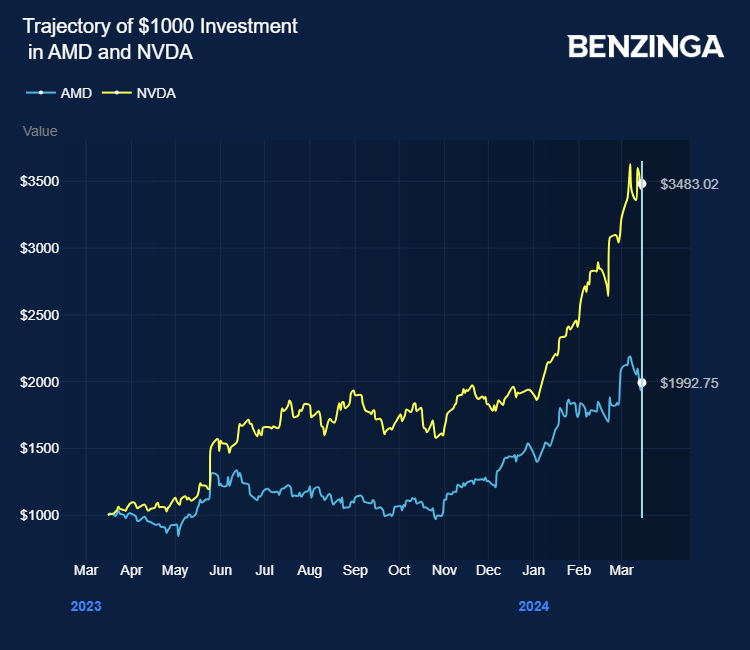

- Vinh notes a decline in server demand and China's cloud sector, with AMD's positive outlook contrasting stable or declining figures for NVDA

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

KeyBanc analyst John Vinh maintained an Overweight rating on Advanced Micro Devices, Inc AMD with a price target of $270.

The analyst said AMD grew modestly in February, as Genoa’s growth remained strong.

AMD processor instances were +1% month-on-month (M/M), +24% Y/Y, compared with January (+1% M/M,+35% Y/Y).

Genoa instance growth remained strong (+19% M/M), led by Amazon.Com Inc AMZN AWS, after growing +13% M/M in January. Rome was +1% M/M,+14% Y/Y.

AMD’s price target is $270, based on 30x Vinh’s 2025 EPS estimate of $9.05. AMD is trading at 21x Vinh’s 2025 EPS estimate and 38x the 2025 consensus EPS estimate compared to its peers, trading at an average consensus 2025E P/E multiple of 34x.

Vinh’s February results showed a continued decline in traditional server demand and China, as cloud instances saw a slight decrease of 1% M/M, a downturn from January’s 1% growth M/M.

This overall decline was marked by Alibaba Group Holding Limited’s BABA significant 11% reduction in M/M, underscoring the weakness in China’s cloud sector.

On a company basis, Nvidia Corp NVDA and Arm Holdings Plc ARM remained stable M/M, and Intel Corp INTC experienced a 1% decline M/M.

In contrast, Intel’s Sapphire Rapids instances slowed to 2% M/M growth following a significant 50% M/M surge in January.

Nvidia’s GPU growth remained stagnant M/M, mirroring its January performance, with U.S. cloud service providers (CSPs) allocating capital expenditure towards internal generative AI workloads.

ARM’s server growth was flat m/m versus a slight 1% M/M increase in January.

Based on the latest cloud tracker data, these findings suggest a moderately positive outlook for AMD and a neutral impact on ARM, Intel, and Nvidia.

Investors can gain exposure to AMD via AOT Growth And Innovation ETF AOTG and Invesco PHLX Semiconductor ETF SOXQ.

Price Action: AMD shares traded higher by 3.20% at $193.05 on the last check Friday.

Photo by cebbi from Pixabay

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.