Zinger Key Points

- Nvidia leads with a 92% share in data center GPUs, showcasing U.S. dominance in the generative AI market.

- Nvidia's CUDA platform is key to its success, used by over 4 million developers for AI and computing tasks.

- Wall Street veteran Chris Capre is going live April 9 at 6 PM ET to reveal a short-term strategy that just returned 195%—in the middle of a crashing market.

Nvidia Corp NVDA is a prime example of U.S. dominance in the generative artificial intelligence market.

From consumer applications to foundational technologies, cloud infrastructure, and semiconductors, U.S. firms lead, with Nvidia capturing a staggering 92% market share in data center GPUs.

This market leadership is underpinned by the widespread use of Nvidia’s CUDA development platform, which has been embraced by over 4 million developers worldwide for AI and parallel computing applications, Nikkei Asia reports.

Also Read: Nvidia Leads AI Chip Rivalry with New GPUs, While AMD and Intel Bet Big on AI PCs

The U.S. generative AI market, valued at $16.1 billion last year and projected to reach $65 billion by 2030, showcases the country’s expansive role in the field.

This growth is driven by significant investments from U.S. tech giants, including Meta Platforms Inc.’s META plan to integrate 350,000 Nvidia H100 GPU graphics cards into its infrastructure.

Furthermore, American companies command two-thirds of the global cloud infrastructure market, with Amazon.Com Inc AMZN, Microsoft Corp MSFT, and Alphabet Inc GOOG GOOGL Google at the forefront.

Recent reports indicated Nvidia expanding its operations by forming a new division to design custom chips for cloud computing providers and others, focusing on sophisticated AI processors.

Nvidia commands around 80% of the market for high-end AI chips.

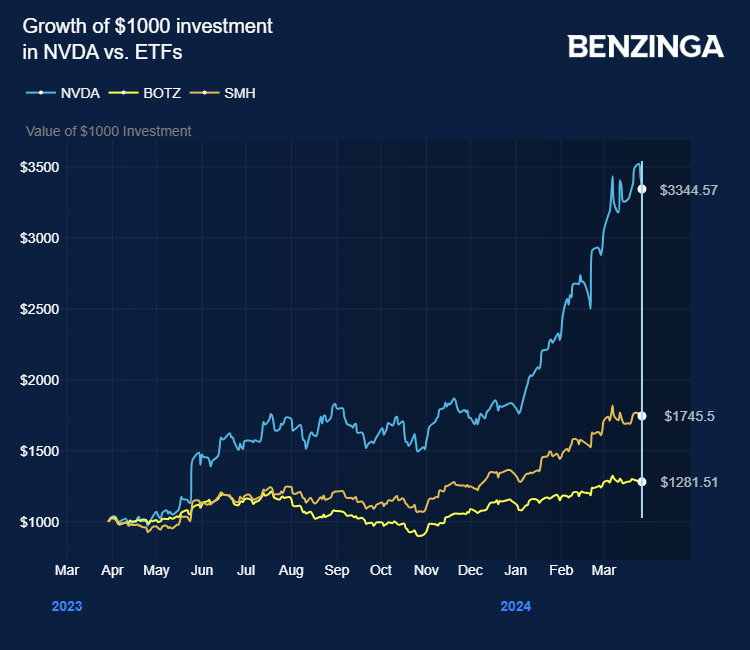

This dominance has been pivotal in boosting its market value by 40% to $1.73 trillion in 2024 after witnessing a more than threefold surge in 2023.

Nvidia previously acknowledged the lack of impact from the U.S. sanctions on China for AI technology.

Analysts had flagged Nvidia’s leading position in the accelerator market, valued at over $85 billion, with its dominance in the data center segment contributing the most to its revenue.

They expect sales from data centers to make up over 85% of Nvidia’s total revenue, marking a substantial rise from about 25% five years prior.

The stock surged 242% in the last 12 months. Investors can gain exposure to the stock via VanEck Semiconductor ETF SMH and Global X Robotics & Artificial Intelligence ETF BOTZ.

Price Actions: NVDA shares traded lower by 0.38% at $899.05 premarket on the last check Thursday.

Also Read: Nvidia’s Key Market China Wants To Beat US Embargo, Boosts Chipmaking Machinery Imports by 14%

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.