Zinger Key Points

- Mastercard to hike "assessment" fee to 0.14%, adding $259.1M in fees post-$30B Visa settlement.

- Merchants brace for cost impact as Mastercard raises fees, despite recent swipe fee cap agreement.

- Join Chris Capre on Sunday at 1 PM ET to learn the short-term trading strategy built for chaotic, tariff-driven markets—and how to spot fast-moving setups in real time.

Mastercard Inc MA looks to raise specific credit card fees starting April 15, a move that comes shortly after announcing a $30 billion settlement with Visa Inc V over swipe fees aimed at providing financial relief to retailers.

The network “assessment” fee will increase to 0.14% from 0.13%, which translates to an additional $259.1 million in fees based on last year’s transactions exceeding $2 trillion, as the Merchants Payments Coalition reported.

This coalition, advocating for lower payment fees, disclosed the fee hike, emphasizing that such costs ultimately burden retailers through banks, Bloomberg Law reports.

Also Read: Visa, Mastercard’s $30B Settlement: Analyst Sees ‘More Record Credit Card APRs In The Short Term’

Assessment fees, levied on banks for each transaction made with Mastercard or Visa, differ from swipe or interchange fees paid to the card-issuing bank.

The recent five-year agreement to cap swipe fees aimed to help save retailers around $30 billion and mitigate longstanding litigation. Analysts expected the deal to relieve Visa & Mastercard of regulatory pressure and contain further reductions in interchange fees.

Despite this, many merchants intend to pursue trials against Visa and Mastercard, alleging collusion on credit card fees and seeking further monetary compensation.

Doug Kantor from the merchant coalition criticized the move, highlighting that merchants inevitably bear the cost of such fee increases. Visa and Mastercard have historically adjusted their fees biannually, with merchants often left in the dark until affected by the changes. The coalition noted repeated fee increases by Visa and Mastercard since 2011.

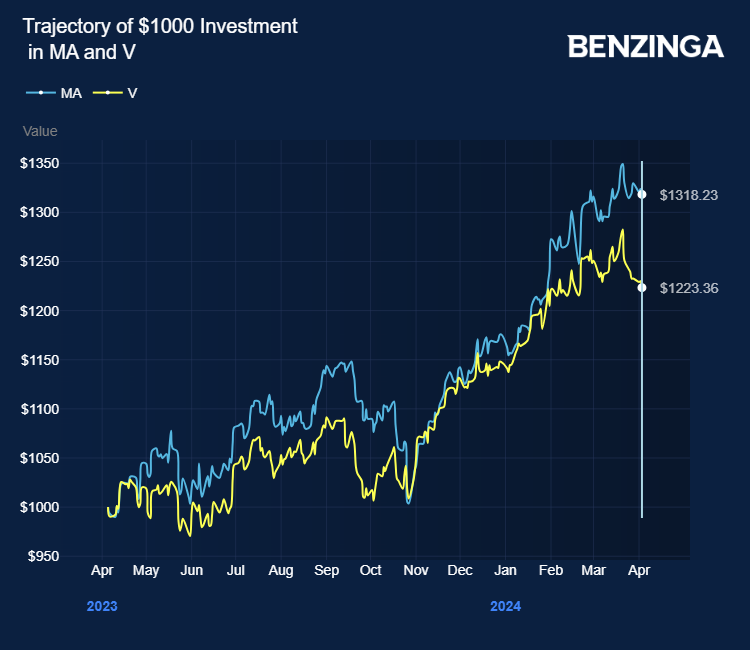

The Mastercard stock gained over 31% in the last 12 months. Investors can gain exposure to the stock via IShares U.S. Financial Services ETF IYG and SPDR Select Sector Fund – Financial XLF.

Price Actions: MA shares closed lower by 0.42% to $477.42 on Wednesday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Wikimedia Commons

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.