Gold prices have been on a tear lately, hitting a slew of record highs in the past two months. Gold prices climbed more than 20% since October. The yellow metal increased 4% last week and notched a third successive weekly gain.

U.S. gold futures gained 1.7% to $2,347.30 per ounce in the last trading session despite a solid uptick in nonfarm payrolls in March. So, what's behind gold prices shattering record highs? China's move to unremittingly add gold holdings, the Federal Reserve's dovish stance, and sticky inflation are helping gold prices scale northward.

The People's Bank of China purchased gold for the 17th consecutive month in March and extended its precious metal buying spree. China's gold reserves soared to 72.74 million ounces last month.

China increased its gold reserves since the bullion metal is considered usually a safe-haven asset that provides financial security amid uncertainty in the global markets. After all, Chinese legislators have noticed how the Western governments confiscated Russia's reserves following their invasion of Ukraine.

What's more, trade conflicts with the United States and geopolitical upheavals around Taiwan would compel China to keep acquiring gold. China, at present, has the wherewithal to buy the yellow metal as the manufacturing side of its economy expanded in March for the first time in six months.

Several countries, along with China, are also buying gold to partly replace the dollar, a process better known as de-dollarization. This is because gold not only acts as a security but also increases investment value.

In the United States, most of the market participants are expecting the Fed to start trimming interest rates in the latter half of 2024. Traders are now pricing in a more than 50% chance that the central bank will cut interest rates in June. Fed Chair Jerome Powell also assured investors about interest rate cuts and wasn't taken aback by the current rise in the PCE index.

Needless to say, a lower interest rate environment makes fixed-income investments less enticing. Since these instruments can't provide higher yields, money will flow out of them, and flow into gold. On the other hand, a rise in the key inflation gauge for the time being acts as a boon for the yellow metal. This is because gold acts as a hedge against inflation.

Hence, as gold shimmers, gold mining stocks have a fair chance to gain. These stocks have been bearing an uptick in production expenses due to higher labor costs. But with gold prices rallying, the miners are well-poised to join in.

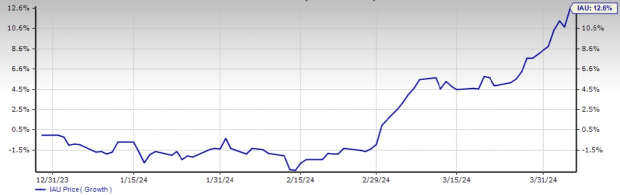

The iShares Gold Trust IAU, by the way, has gained 12.6% so far this year. This calls for astute investors to keep a tab on gold mining stocks such as Aris Mining Corporation ARMN, Equinox Gold EQX, Idaho Strategic Resources IDR and Triple Flag Precious Metals Corp. TFPM. These stocks have a Zacks Rank#3 (Hold).

Image Source: Zacks Investment Research

Aris Mining is a gold producer primarily in the United States. The company's expected earnings growth rate for the current year is 65.8%. Its estimated earnings growth rate for next year is 87.3%.

Equinox Gold is involved in exploring and developing gold deposits. Its main projects include the Mesquite gold mine in California. The company's expected earnings growth rate for the current year is 71.4%. Its estimated earnings growth rate for next year is 350%.

Idaho Strategic Resources predominantly produces gold at the Golden Chest Mine. The company's expected earnings growth rate for the current and next quarter are 500% and 133.3%, respectively. Its estimated earnings growth rate for the current year is 200%.

Triple Flag Precious Metals is a gold-focused streaming and royalty company that provides financial solutions to the mining industry worldwide including the United States. The company's expected earnings growth rate for the current year is 21.2%. Its estimated earnings growth rate for next year is 32.5%.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.