Newsletter Writer Captain Ewave shares a detailed analysis showing where they believe the gold market is headed.

Are gold and gold mining stocks on the verge of an explosive move higher? Based on our latest analysis, the answer appears to be a resounding yes. Let's dive into the technical setup and what it could mean for precious metals investors.

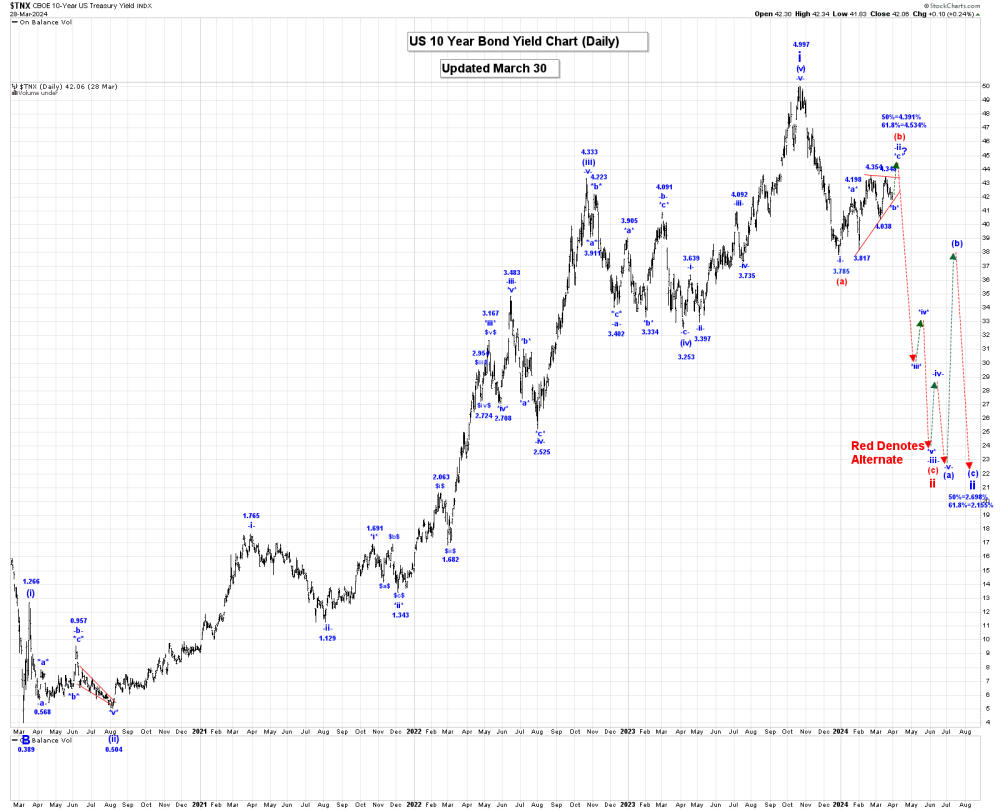

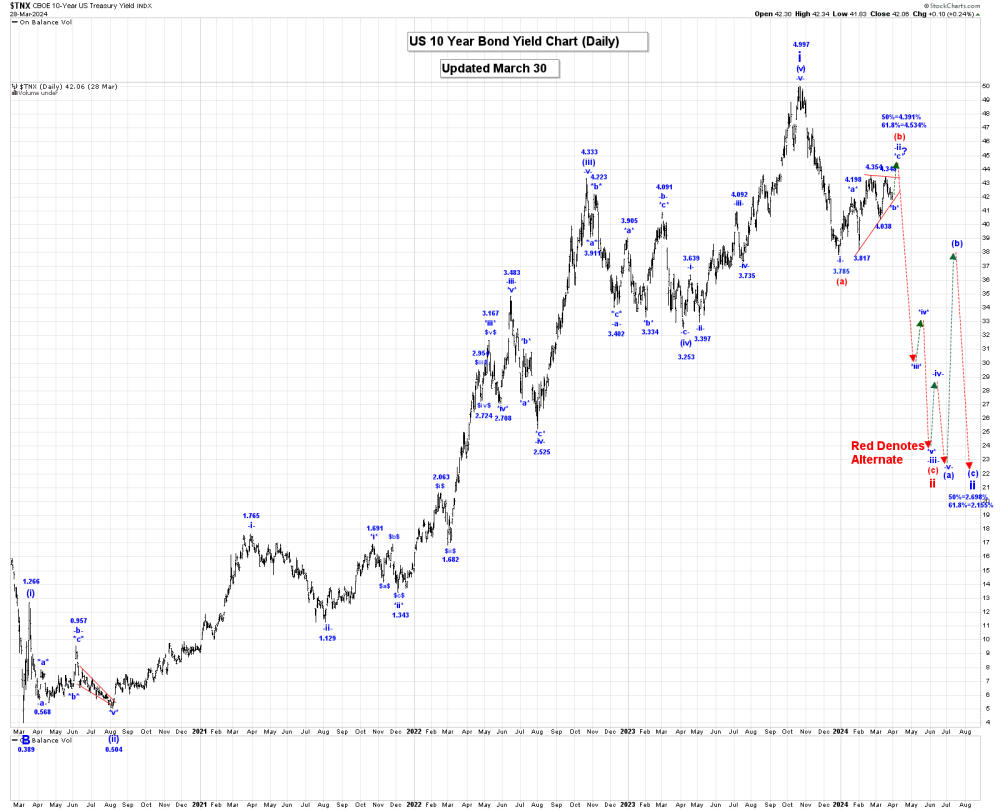

US 10-Year Bond Yield: Completing a Correction

Our analysis suggests the U.S. 10-year bond yield has finished the first wave of a new 5-wave impulsive sequence at the 5.021% high. We are now likely seeing a corrective wave ii pullback, with key retracement levels at 2.698% (50%) and 2.155% (61.8%).

Zooming in further, it seems wave ii is carving out a simple 3-wave pattern. Within that, wave -i- of (a) likely ended at 3.785%, and wave -ii- is still in progress, potentially tracing out a bullish triangle. Our retracement levels for all of wave -ii- are 4.391% (50%) and 4.534% (61.8%).

Notably, U.S. rates are not confirming the dollar's recent high - a bullish divergence for gold. We recommend staying short to ride the wave (a)/ii drop, with a stop above 5.050%.

Gold: Powerful Wave Pattern Unfolding

Gold's wave structure reveals the makings of a major thrust higher. It appears gold is advancing in wave .v., with wave ^i^ of i ending at $1997.20 and wave ^ii^ bottoming at $1931.80. This sets the stage for a powerful wave ^iii^ advance, with an initial target of $2234.50 (1.618 times wave ^i^).

Drilling down, wave ^iii^ is subdividing into five waves itself. Wave $i$ ended at $2151.20, and wave $ii$ pulled back to $1973.10. Now, wave $iii$ is extending, having already surpassed its first target of $2286.40 (2.618 times wave !i!). If the pattern continues, the next target for wave !iii! is $2473.10 (4.236 times wave !i!).

Stepping back, our current target for the entire wave -iii- is a towering $2531.10 (4.236 times wave -i-). Given the potent structure, we recommend being long gold and using puts as a risk management tool.

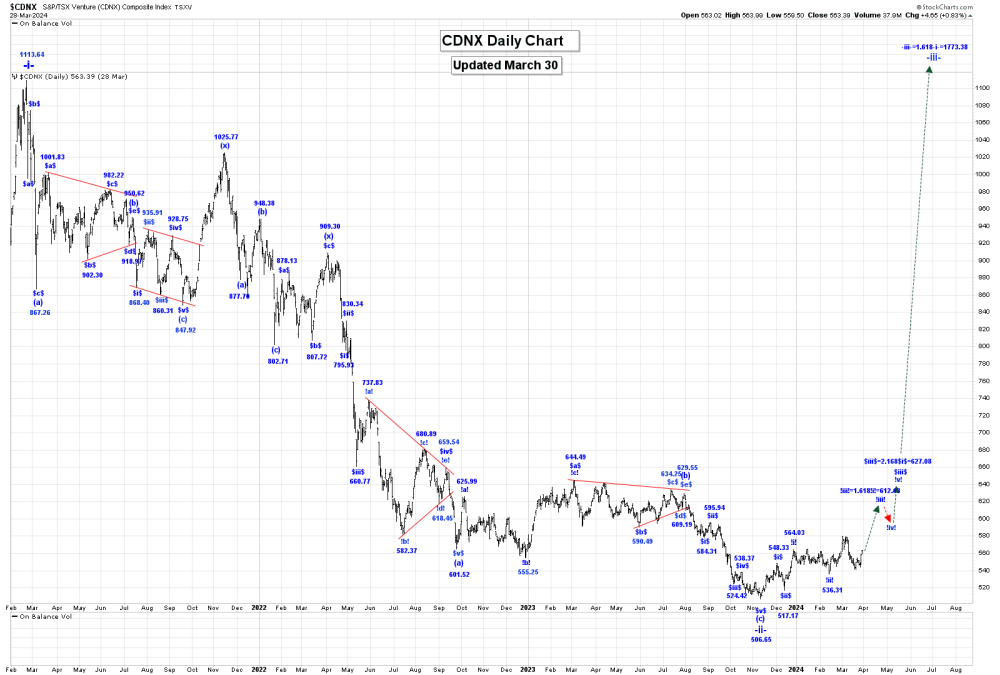

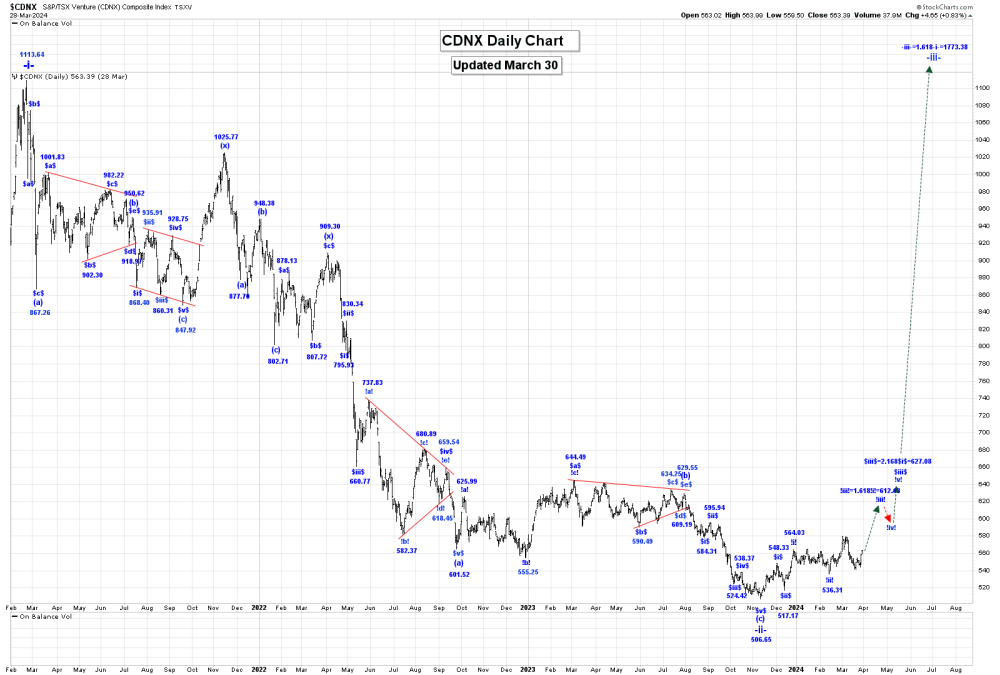

CDNX: Juniors Breaking Out

After a long triple three wave -ii- correction that ended at 506.65, the CDNX junior mining index has turned sharply higher in wave -iii-. The initial target for this move is $1773.38 (1.618 times wave -i-).

Within wave -iii-, wave (i) is underway, with wave $i$ ending at $548.33 and wave $ii$ bottoming at $517.17. The heart of the advance should be wave $iii, pointing to $627.08 (2.618 times wave $i$).

On the intraday chart, the price surged impulsively from $536.31 to $579.67, then pulled back correctively to $541.20, retracing just over 78.6% of the initial up-move. This is a bullish sign, suggesting the corrective dip is ending and a powerful wave !iii! advance is due next.

With a key daily reversal in the books, we recommend going long with the GDXJ to ride this major wave higher. Hold for the long term to maximize gains.

GDX: Gold Majors Joining the Party

The larger-cap GDX gold mining ETF GDX also sports a powerful wave pattern. It appears the bullish wave B triangle ended at $25.67, launching wave C higher. We're now advancing in wave $i$ of -i- of (i) of i - an intricate nested pattern with huge potential.

Wave $i$ will likely peak near major resistance around 33.00, potentially coinciding with the top of gold's wave !iii!. From there, expect a wave $ii$ pullback to retrace 50-61.8% of wave $i$, presenting an ideal buy opportunity.

The intraday chart reveals a potential bullish triangle nearing completion. If so, expect an imminent upside breakout. Remarkably, the Gold Indices/Gold ratio is approaching record lows even as gold notches new all-time highs. This unsustainable divergence points to an explosive mean reversion higher for gold stocks — a rally of "biblical scale" as gold stocks catch up and overshoot gold's performance.

Takeaway:Get Ready for a Golden Ride

In summary, our analysis suggests gold and gold stocks are on the cusp of a major wave higher as powerful impulsive patterns unfold. We recommend long positions in physical gold, the GDX and GDXJ ETFs, and select junior miners.

Use pullbacks as opportunities to add, keep stops disciplined to protect capital, and hold for the long haul to reap the full rewards of this epic bull market in precious metals. The golden ride of a lifetime is just getting started — make sure you have a seat on the rocket!

Important Disclosures: