U.S. restaurants continue to flourish in 2024 after impressive performances in the last two years. Restaurant sales were not impacted much despite severe inflationary pressure. The momentum is likely to continue for the rest of 2024.

Strong Restaurant Sales in March

The Department of Commerce reported that sales at U.S. bars and restaurants (adjusted for seasonal variation and holiday sales but not for price changes) came in at $93.7 billion in March, up 0.4% from February. Year over year, spending on restaurants and bars rose 6.5% in February.

The restaurant space is the primary driver of growth for overall retail sales. Steady consumer spending continued in the first three months of 2024 despite worries that the economy may enter a recession in the near term. Although higher interest rates concerned customers, they did not cut down on spending at restaurants and bars.

The Zacks-defined Retail – Restaurant Industry is currently in the top 41% of the Zacks Industry Rank. Since it is ranked in the top half of Zacks Ranked Industries, we expect the consulting services industry to outperform the market over the next three to six months.

Innovative Measures

The restaurant industry is gradually witnessing improving sales. The improvement can be attributed to the enhancement in fundamentals such as modifications in business processes, staffing, floor plans and technology.

Restaurant operators' focus on digital innovation, sales-building initiatives, and cost-saving efforts have been acting as major catalysts. With the growing influence of the Internet, digital innovation has become the need of the hour. Big restaurant chains are constantly partnering with delivery channels and digital platforms to drive incremental sales.

The restaurant industry is consistently gaining from the spike in off-premise sales, which primarily include delivery, takeout, drive-thru, catering, meal kits and off-site options, such as kiosks and food trucks, owing to the coronavirus pandemic. Per NRA, more than 60% of restaurant foods are consumed off-premise.

By 2025, off-premise is likely to account for approximately 80% of the industry's growth. The idea of providing off-premise offerings along with a connected curbside service is steadily garnering positive customer feedback.

Our Top Picks

We have narrowed our search to five restaurant stocks that have strong growth potential for 2024. These stocks have seen positive earnings estimate revision in the last 60 days. Each of our picks carries a Zacks Rank # 2 (Buy).

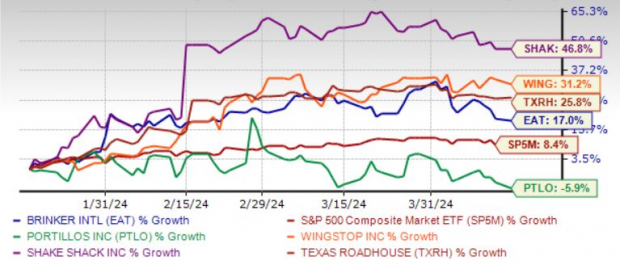

The chart below shows the price perfroamnce of our five picks in the past three months.

Image Source: Zacks Investment Research

Brinker International Inc. EAT primarily owns, operates, develops and franchises various restaurants under Chili's Grill & Bar (Chili's) and Maggiano's Little Italy (Maggiano's) brands. In the last reported quarter, EAT registered benefits from effective marketing and pricing strategies.

EAT also reported sequential improvements in guest traffic, surpassing industry benchmarks. Also, focus on menu adjustments bodes well. EAT intends to focus on balancing value offerings with margin expansion and adaptability to changing consumer preferences to drive growth.

Brinker International has an expected revenue and earnings growth rate of 4.9% and 31.1%, respectively, for the current year (ending June 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last seven days.

Shake Shack Inc. SHAK has been benefiting from various digital initiatives, strong same-shack sales and unit expansion efforts. SHAK's digital retention continues to be strong. It has also been making investments in digitization in an effort to sustain its digital guest enhancement strategies in the near term.

Shake Shack has an expected revenue and earnings growth rate of 14.5% and 91.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 51.1% over the last 60 days.

Texas Roadhouse Inc. TXRH is a full-service, casual dining restaurant chain offering assorted seasoned and aged steaks hand-cut daily on the premises and cooked to order over open gas-fired grills. TXRH operates restaurants under the Texas Roadhouse and Aspen Creek names.

TXRH offers its guests a selection of ribs, fish, seafood, chicken, pork chops, pulled pork and vegetable plates, an assortment of hamburgers, salads and sandwiches. TXRH also provides supervisory and administrative services for other licensed and franchise restaurants.

Texas Roadhouse has an expected revenue and earnings growth rate of 13.9% and 26.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.4% over the last seven days.

Portillo's Inc. PTLO owns and operates fast casual restaurants in the United States. PTLO offers Chicago-style hot dogs and sausages, Italian beef sandwiches, char-grilled burgers, chopped salads, crinkle-cut French fries, homemade chocolate cakes, and chocolate cake shakes. PTLO offers its products through its website, application, and certain third-party platforms.

Portillo's has an expected revenue and earnings growth rate of 12.3% and 10.8%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 5.1% over the last 60 days.

Wingstop Inc. WING franchises and operates restaurants. WING's operating segment consists of the Franchise and Company segments. WING offers classic wings, boneless wings, and tenders that are cooked-to-order, and hand-sauced-and-tossed in various flavors.

Wingstop has an expected revenue and earnings growth rate of 20.1% and 21%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the last seven days.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.