Werner reported first-quarter net income of $6.3 million compared to $35.2 million in the same period of 2023. When adjusted for items expected to not recur or items considered not part of normal operating activities (acquisition-related expenses, costs from an insurance claim that has been appealed, changes to earnouts and changes in the value of equity investments) the company reported earnings per share of 14 cents. The adjusted result was 13 below the consensus estimate and 46 cents lower year over year (y/y).

A decline in used equipment values pushed gains on sales 80% lower y/y to just 4 cents per share (an 18-cent headwind compared to the year-ago quarter). Unit sales of tractors were down 18% y/y but trailers sold increased 78%. Werner lowered its outlook for gains on equipment sales to a range of $10 million to $20 million from the prior range of $10 million to $30 million.

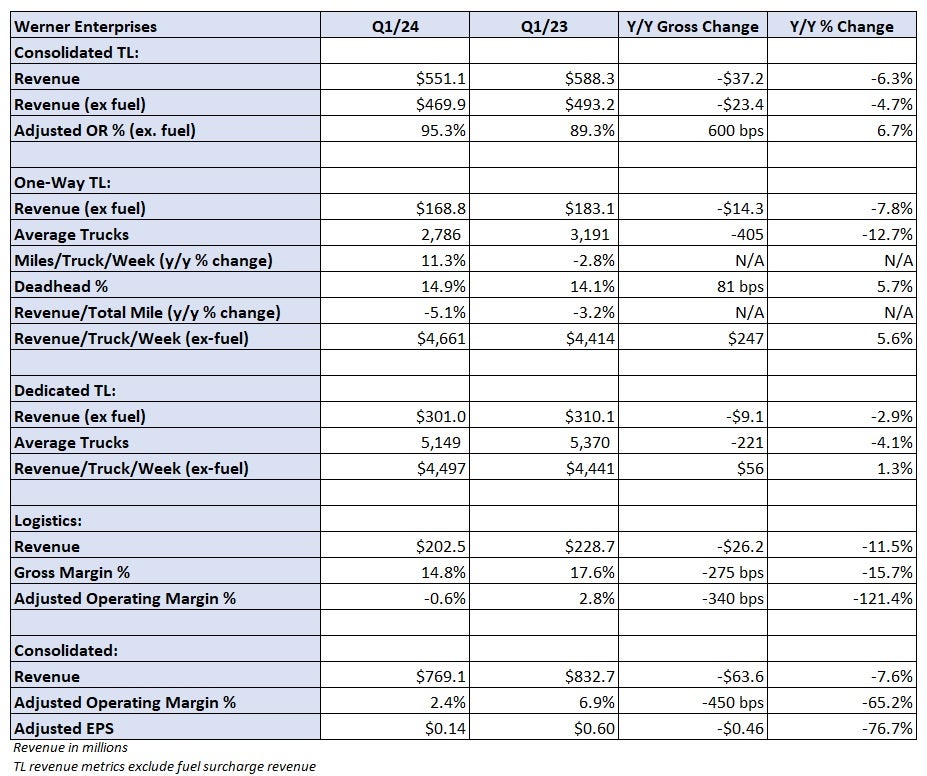

Table: Werner's key performance indicators

Total revenue from truckload services declined 6% y/y to $551 million. Dedicated revenue declined 3% y/y as trucks in service fell 4%, which was partially offset by a 1% increase in revenue per truck per week. The company reiterated full-year 2024 guidance of flat to up 3% y/y for revenue per truck per week.

The total TL truck count was down 2% y/y in the first quarter, prompting a guidance change from down 3% to flat y/y in 2024 to down between 6% and 3% y/y. The company has meaningfully lowered its one-way truck count and is seeing some headwinds to unit counts within dedicated accounts. However, it said all the discount retail customers it serves in a dedicated configuration have increased their truck counts with Werner this year.

The TL segment reported a 95.3% adjusted operating ratio (96.2% unadjusted), which was 600 basis points worse y/y and 280 bps worse than the fourth quarter. Adjusted operating income was down 58% y/y, with lower gains on sale accounting for nearly half of the decline.

The company has identified another $40 million in consolidated cost savings for 2024, $12 million of which has already been achieved. For all of 2023 and 2024, the company projects total savings of $80 million to $90 million, 60% of which it views as "structural and sustainable."

Werner's logistics unit recorded a $2.3 million operating loss in the quarter ($1.2 million on an adjusted basis). Revenue was down 12% y/y to $203 million with gross margin falling 280 bps to 14.8%. Brokerage operating margins are expected to improve later in the year given the cost savings initiatives.

Shares of WERN moved 2.3% lower in after-hours trading Tuesday.

The post Werner Enterprises says end of downcycle getting closer appeared first on FreightWaves.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.