Source: Clive Maund 05/06/2024

Technical Analyst Clive Maund shares why he believes Giant Mining Corp. is an Immediate Speculative Buy.

If you are the kind of investor who likes to obtain maximum leverage on capital employed in an environment where risk is at tolerable levels, Giant Mining Corp. BFGFF is the stock for you.

In its former incarnation as Majuba Hill Copper, the only things giant about the company were the potential of its Majuba Hill resource, which continues, and the magnitude of losses suffered by shareholders. However, with the company to a large extent being reborn early this month involving a name change and a big 1 for 20 share rollback, a successful oversubscribed funding, and the prospect of a massive bull market in copper that has already started, there is considered to be a very good chance that the company and its stock will live up to the new name.

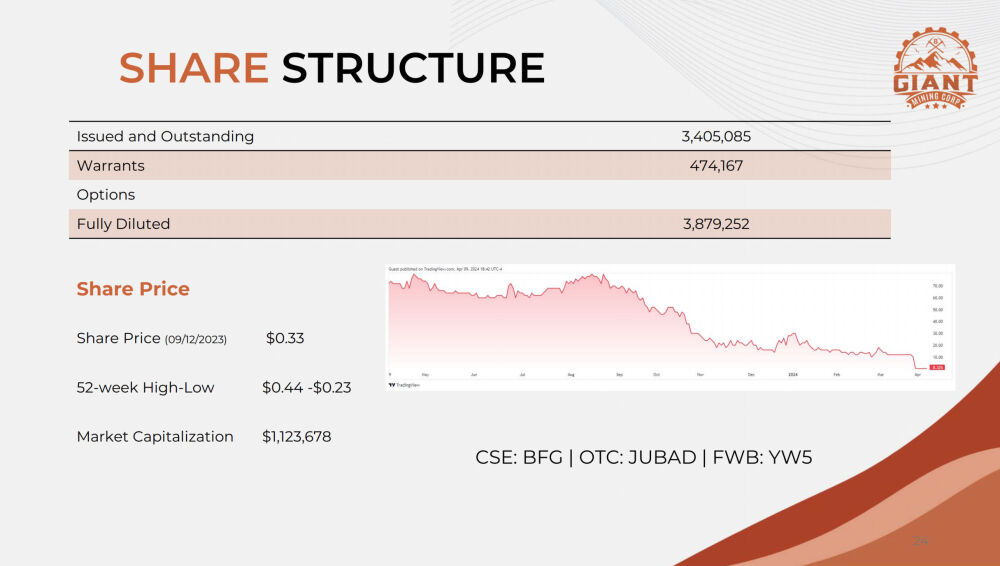

It is most important to note that there are two compelling factors that make the stock unusually attractive now. One is that it is at a historically extremely low price, as we will later see on its charts. The other is that, following the share rollback, there are only a tiny 3.4 million shares in issue, less than 2 million of which are in the float, so any tilt in the supply-demand balance will result in big gains in the stock.

Now, we will proceed to look at a range of slides from the company's latest investor deck, which help to tell the story.

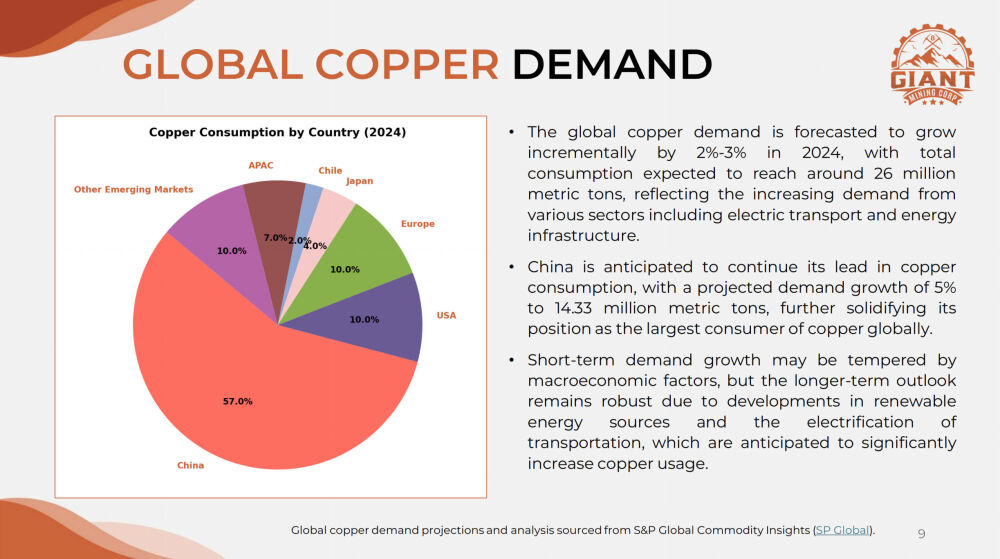

We will start first with a couple of slides about copper itself, which explain why it is such a central metal and why it will be in short supply in the future and thus rise significantly in price.

The first slide shows who uses how much copper — China's consumption is astounding, with it gobbling up 57% of world supply this year.

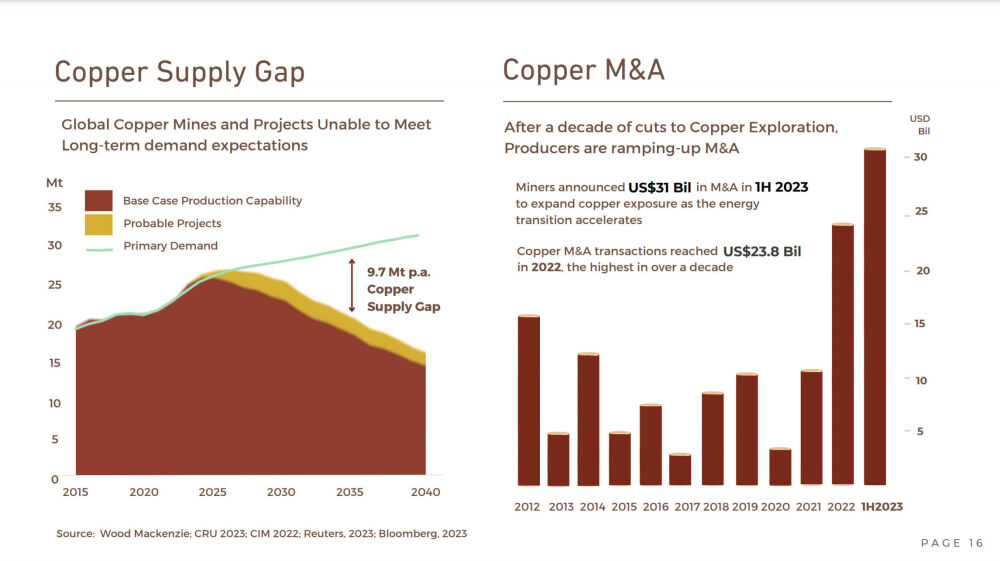

The next slide, which is not from the company's deck, shows the massive shortfall in copper supply that will start to impact as soon as next year and is set to get steadily worse, and it also shows the explosion in M&A (Merger and Acquisition) activity last year following a decade of cuts to copper exploration.

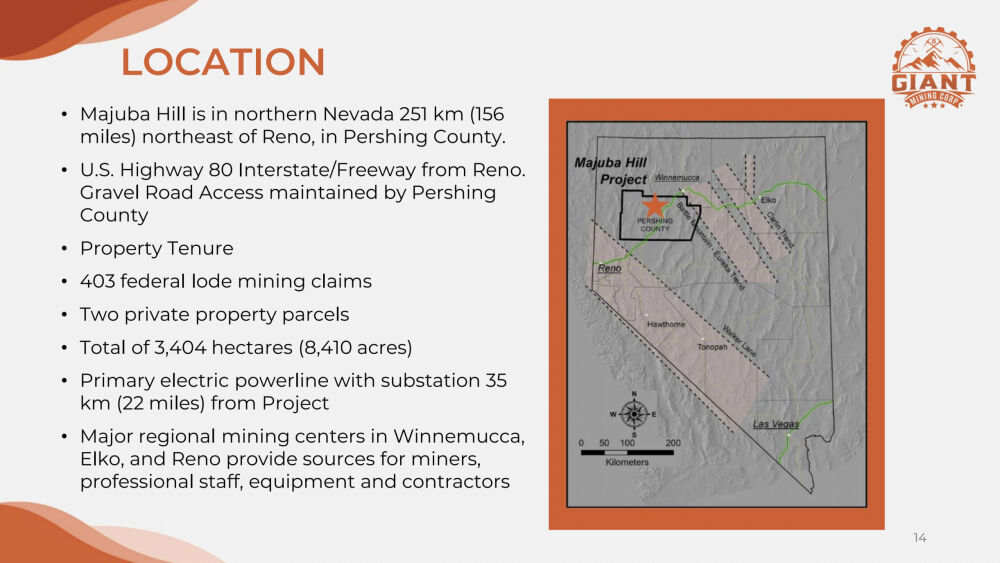

The following slide shows the location of the company's flagship property in northwest Nevada, situated between the famous Battle Mountain and Walker Lane trends, and also gives some details about it.

The next slide provides a view of what is presumably Majuba Hill, which furnishes the name of the company's property and formerly the name of the company itself.

If there are any hikers amongst you who might like to climb this hill, you are advised to do so before it gets carted away in 100-ton trucks.

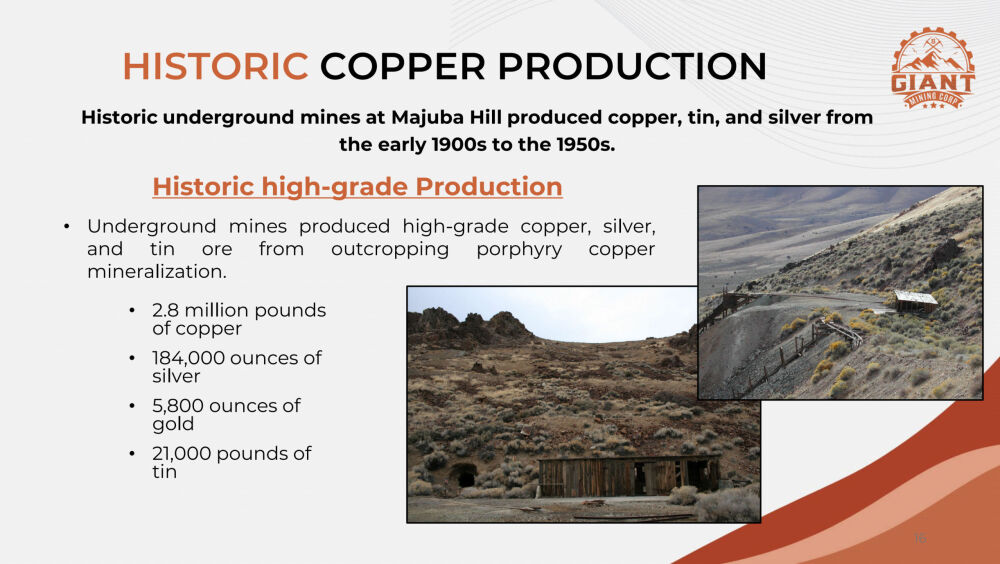

The following slide gives some insight into the history of Majuba Hill, where there were some high-grade underground mines.

This is not just of academic interest because it clearly shows the potential of the area when subjected to more modern and efficient mining techniques.

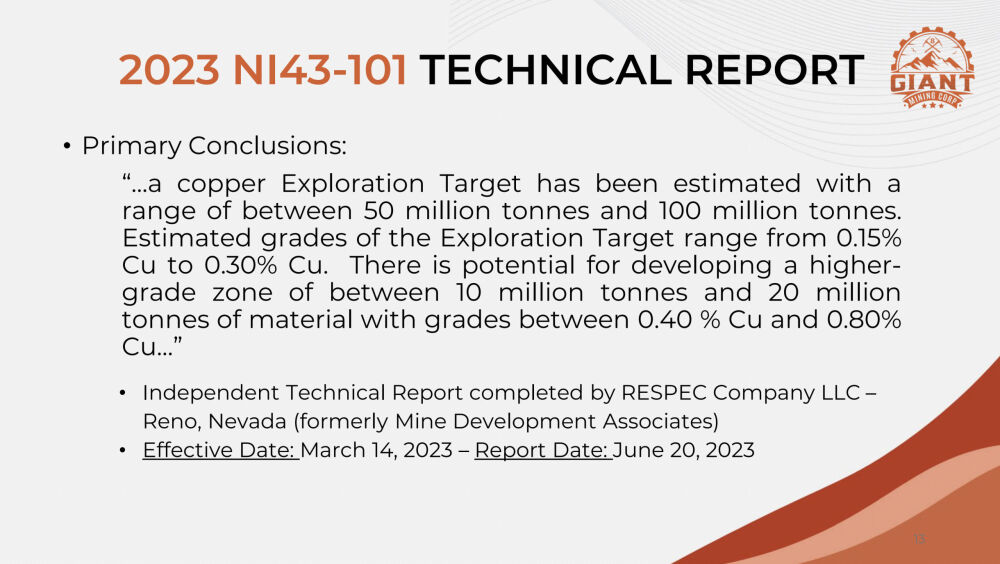

The company's plans for the property are not the product of "a pipe dream" or wishful thinking.

The following side showing the 2023 NI43 — 101 assessment demonstrates that there is economically viable copper in that hill — and that's at today's prices.

The last slide shows the extraordinarily low number of shares in issue following the consolidation at 3.4 million, which obviously creates the potential for big gains if there is an influx of demand.

Now we will proceed to look at the stock charts for Giant Mining, on which we see that it appears to be in the process of reversing to the upside from an extremely low level against the background of a constellation of vastly improving fundamentals both for the company and for the metal it is exploring for, which is copper, as discussed above.

We'll start by looking at long-term charts to gain an overall understanding of the history of the stock and then zoom in on stages.

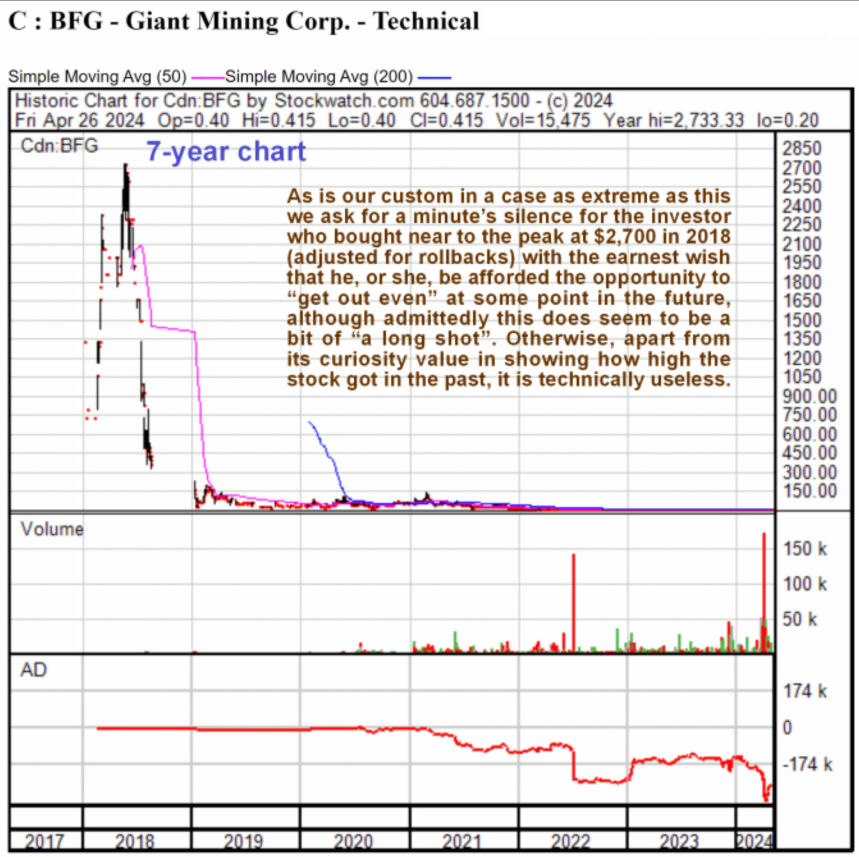

Starting with a 7-year chart, we can see that the stock has suffered a horrendous decline from its 2018 peak, although we should note that it never got to over $2,700 — this price is adjusted for subsequent rollbacks. What this chart makes plain, even taking this into account, is that the stock is now worthless compared to its former glories.

Even when we knock out the wild 2018 peak by going back only to 2020 using a 4-year chart, the decline from the rollback adjusted early 2021 peak at about $142 to the present is still horrendous, with its lofty heights crushing recent action flat on the chart, making it unintelligible.

On the positive side, the upside from this low level is giant, with the big volume buildup just this month. We can start to see on this chart a sign that it may be reversing to the upside.

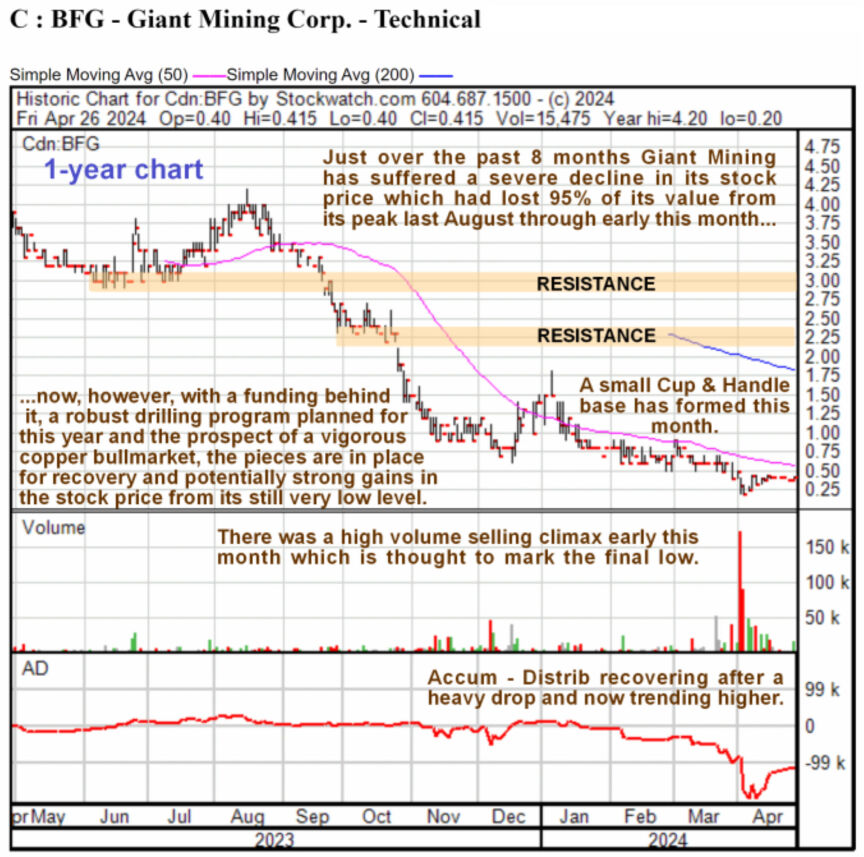

Zooming in again via the 1-year chart, we see that even over the past 10 months we see that Giant Mining lost 95% of its value from its peak last August through early this month but on this chart, we can start to see the positive price / volume action of recent weeks that is a sign of a reversal at long last.

The dive to what looks like the final low early this month was on comparatively very heavy volume, and it looks like a "selling climax" the price has since stabilized on improving upside volume that has driven a recovery in the Accumulation line, which is viewed as a fairly convincing sign that the bottom is in. So we will now look at recent action in much more detail on a 3-month chart in an effort to discern exactly what is going on.

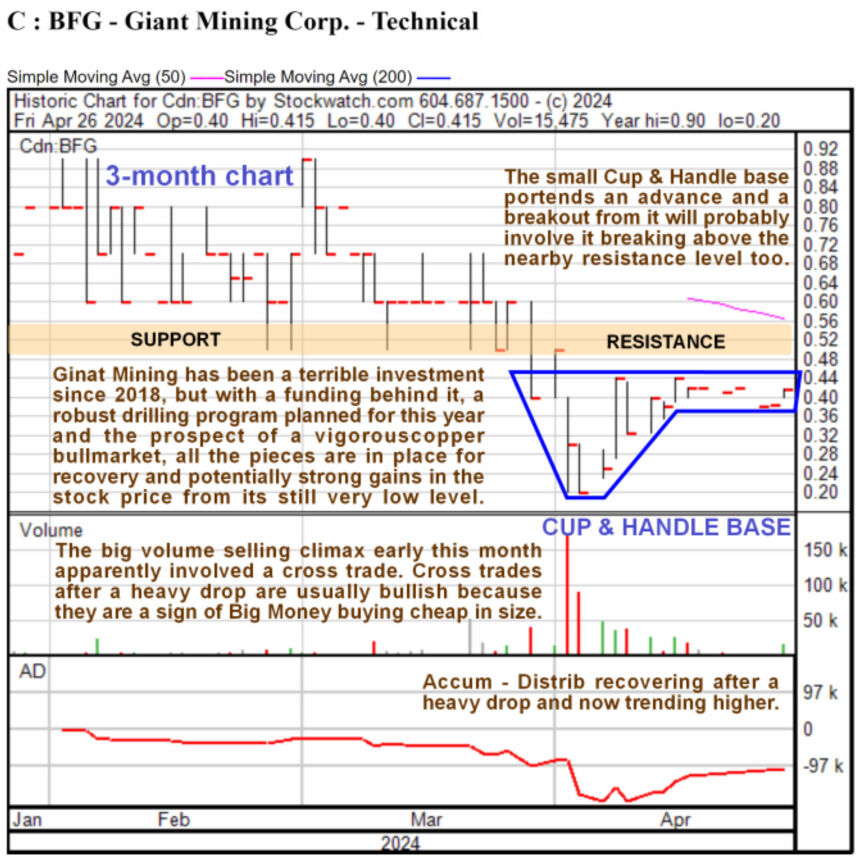

The 3-month chart opens out recent action so that we can readily see what is going on. On it, we can see that the price pattern from late last month is a small Cup and Handle base, even if it more closely resembles one of those small plastic scoops that you use to measure out doses of powdered medicine.

As mentioned above, the dive into the low was on relatively heavy volume that is believed to have been due to a "cross trade" and cross trades in this position are usually due to Smart Money taking advantage of very low prices to establish a big position in a stock on the cheap. The price then rose out of the low on quite a good volume, which then became very light again or non-existent as the price settled into a very narrow range to form the Handle of the pattern. The price is still within this Handle, and the increase in activity when the price rose a little on Friday may mark the start of a breakout from the base pattern.

Giant Mining has three big things going for it now, which are positive circumstances that have all come about in the recent past. One is that it has just closed oversubscribed funding, another is that it is just about to start a significant drilling program that should generate interest in the stock and could turn up positive results, and last but not least, copper has just started a major bull market in the face of a massive impending supply crunch.

The perfect time to show up for a party is right after others have spent hours preparing it, and you turn up just as it's getting started. This is believed to be the situation we find ourselves in right now with Giant Mining.

Giant Mining is therefore rated an Immediate Speculative Buy for all timeframes. It must be classed as speculative because it is a small company whose stock is at a very low price, but that also affords massive leverage if things go well, as they are expected to. Due to the extraordinarily low number of shares in issue (less than 2 million in the float) you are advised not to go spreading this around until you have made any purchases you may want to.

Giant Mining Corp.'s website.

Giant Mining Corp. closed at CA$0.495 on May 3, 2024.

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Giant Mining Corp.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.