Zinger Key Points

- Piper Sandler raises its price target on First Solar from $195 to $219 while maintaining an Overweight rating.

- UBS maintains a Buy rating on the stock and boosts its price target from $252 to $270.

- Get Wall Street's Hottest Chart Every Morning

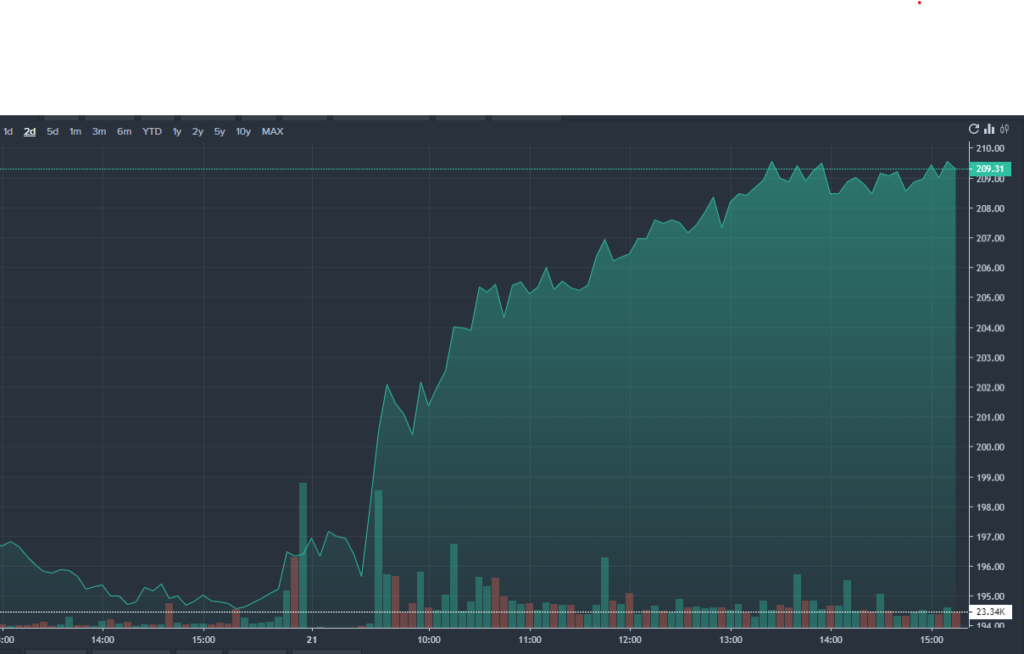

Solar energy solutions provider First Solar, Inc. FSLR saw its shares surge nearly 7% on Tuesday following positive updates from a pair of analysts.

What To Know: Piper Sandler analyst Kashy Harrison maintained an Overweight rating on First Solar and raised the price target from $195 to $219. The higher price target suggests Piper Sandler has increased confidence in First Solar’s growth prospects and ability to capitalize on industry tailwinds.

Similarly, UBS analyst Jon Windham kept a Buy rating on the stock, but boosted his price target even higher — from $252 to $270. The lofty price target reflects the analyst’s bullish view on First Solar’s position within the rapidly expanding solar energy market.

The price target increases seem to highlight optimism surrounding First Solar’s future amid supportive renewable energy policies and accelerating solar adoption globally. Based on the analyst changes from Tuesday, First Solar appears well-positioned to benefit from secular tailwinds.

See Also: What’s Going On With Pineapple Energy (PEGY) Stock?

Is FSLR A Good Stock To Buy?

When deciding whether to buy a stock, there are some key fundamentals investors may want to consider. One of these factors is revenue growth. Buying a stock is essentially a bet that the business will continue to grow and generate profits in the future. First Solar has reported average annual revenue growth of 5.17% over the past five years.

It's also important to pay attention to valuation when deciding whether to buy a stock. First Solar has a forward P/E ratio of 14.84. This means investors are paying $14.84 for each dollar of expected earnings in the future. The average forward P/E ratio of First Solar's peers is 40.07.

Other important metrics to look at include a company's profitability, balance sheet, performance relative to a benchmark index and valuation compared to peers. For in-depth analysis tools and important financial data, check out Benzinga PRO.

FSLR Price Action: First Solar shares were trading higher by 6.71% at the time of writing, according to Benzinga Pro.

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.