Zinger Key Points

- Alibaba expands global cloud reach to Mexico, with plans for new data centers in Malaysia, Thailand, and South Korea.

- Alibaba's cloud unit aims for double-digit growth in H2 2024, leveraging AI tools and new partnerships.

- Don't face extreme market conditions unprepared. Get the professional edge with Benzinga Pro's exclusive alerts, news advantage, and volatility tools at 60% off today.

Alibaba Group Holding Limited BABA announced on Thursday that it has expanded its global cloud computing availability. The head of the unit's international arm highlighted the company's AI products as a growth driver.

The Chinese technology giant has extended the availability zone of its cloud computing products to Mexico for the first time.

Over the next three years, it plans to build new data centers in key markets, including Malaysia, Thailand, and South Korea, CNBC cited Selina Yuan, President of Alibaba Cloud's international division, in an interview on Wednesday.

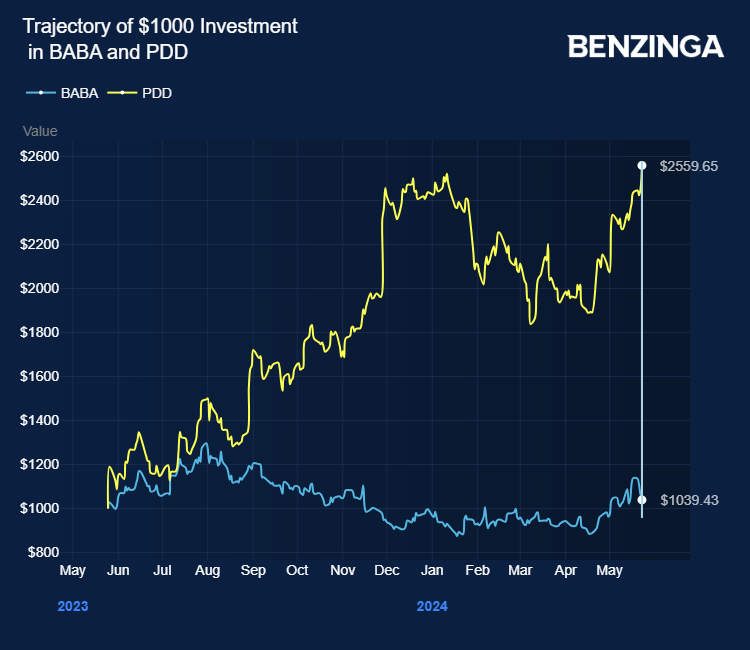

Also Read: Alibaba Rival PDD Has Major Upside with New Market Openings and Rising Adoption: Analysts

According to Synergy Research Group, Amazon.Com Inc AMZN, Microsoft Corp MSFT, and Alphabet Inc GOOG GOOGL-owned Google account for around 67% of the global cloud market share, while Alibaba holds just under 5%, CNBC writes.

In China, Alibaba dominates 39% of the market, according to Canalys.

Alibaba executives indicated during an earnings call that the cloud division will likely return to "double-digit growth" in the second half of the current fiscal year.

On Wednesday, Alibaba expanded its partnership with French luxury house LVMH, which has started using Alibaba's AI tools in China.

In 2023, Alibaba launched its large language model (LLM), Tongyi Qianwen. This month, the company rolled out a more advanced version.

Alibaba has already waged a price war with its contemporaries by cutting the prices of its cloud and artificial intelligence services.

Alibaba looks to raise $4.5 billion via a convertible bond offering to finance its share repurchases.

Meanwhile, Chinese stocks are bearing the brunt of negative speculation of U.S. short sellers.

Alibaba stock has lost 0.5% in the last 12 months as it battles cutthroat competition and a weak economy. Investors can gain exposure to the stock via Global X E-Commerce ETF EBIZ and Matthews International Funds Matthews Pacific Tiger Active ETF ASIA.

Price Action: BABA shares were trading lower by 0.12% at $80.70 premarket at the last check on Friday.

Photo via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.