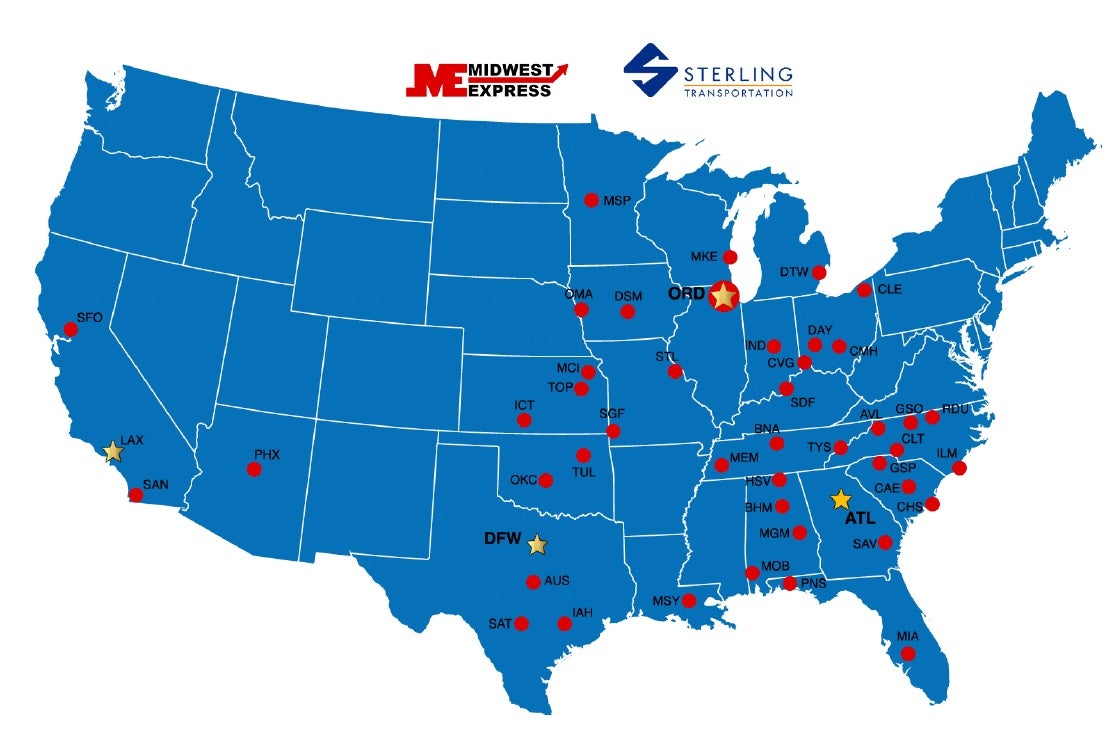

Headquartered near Chicago, Midwest Express is a 41-year-old entity specializing in pickup and delivery and airport-to-airport linehaul transportation in a less-than-truckload configuration. Prior to the partnership, it was a large regional operator covering essential trade lanes in the central U.S. Last year, it expanded into Dallas and Atlanta, connecting expedited LTL service between the Midwest, Southeast and Southwest.

In conjunction with the new agreement, Midwest Express is rebranding to Forwarders Xpress (FX). The new name reflects the company's expanded reach and focus on wholesale customers.

Los Angeles-based Sterling Transportation has been providing linehaul transportation and some local cartage services for three decades. Traditionally, it has served the power lane of Los Angeles to Miami in both directions, but it now has other connection points in Dallas and Houston.

For the most part, the wholesale linehaul space is fragmented among several regional providers, most of which lack the capital to invest in advanced customer-facing technologies. The major national player in the space is Forward Air FWRD.

But Shanna Smith, executive vice president at Midwest Express, says there is an opportunity for other providers that can bring linehaul and local cartage capacity alongside a leading technology to freight forwarders and the airlines.

"We believe that in our relationships across the industry there is a considerable amount of strength in combining what we can do on the service side of things with a core competency of extending the geographic footprint of the airport-to-airport linehaul" Smith told FreightWaves.

The two companies will first maximize assets in current markets, creating more direct routings. The plan is to then fill the gaps in the network — mostly the Northeast and Pacific Northwest — as the year progresses. That will be accomplished through terminal acquisitions and interline partnerships with other providers.

Smith said there is a "significant amount of motivation" on the part of both customers and carriers for expanded capacity options in the wholesale airport-to-airport freight market. She sees an opportunity to capture density in many primary markets, the success of which will ultimately determine the size and depth of the companies' combined geographic footprint over time.

Image - Midwest Express and Sterling Transportation coverage map

Midwest Express and Sterling Transportation are utilizing a hybrid operating model, which includes company drivers and third-party transportation providers. The leadership teams from both companies have decades of experience in the space, with some members previously working at Forward Air.

Providing both the scale and the technology through the shared-capacity agreement is the linchpin to the deal as there are few that can provide both, Smith said. The two companies are heavily focused on the tech side, mutually investing in upgrades. The goal of the tech investment is to create connectivity across the partners, making the experience seamless for the customer.

"This partnership leverages a strategic alignment of entrepreneurial cultures and is focused on building long standing relationships that embrace flexibility in meeting the opportunities of the future" said Lance Small, chief strategy officer at Sterling Transportation.

At first, he thought it would be difficult to create a national footprint with a seamless technology without hiring a large team of developers. However, as the initiative progressed, he said the two companies were able to find "off-the-shelf" technologies that could be easily integrated.

"We know who we're going to be and there is no question about that" Smith said. "We are a wholesale provider of local and over-the-road transportation. We know our customers are airlines, the freight forwarding community and to a certain degree 3PLs and some of the integrators. That's not going to change."

The post Midwest Express, Sterling building national wholesale linehaul network appeared first on FreightWaves.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.