Source: Clive Maund 05/28/2024

In light of recent restrictions and tariffs surrounding Graphite, Technical Analyst Clive Maund takes a look at Graphano Energy Ltd. to explain why he believes it is an Immediate Strong Buy.

The intensifying debt crisis is expected to lead to a capital flight from all debt instruments and fiat, generally into tangible assets and specifically into commodities such as graphite, all of which are expected to soar.

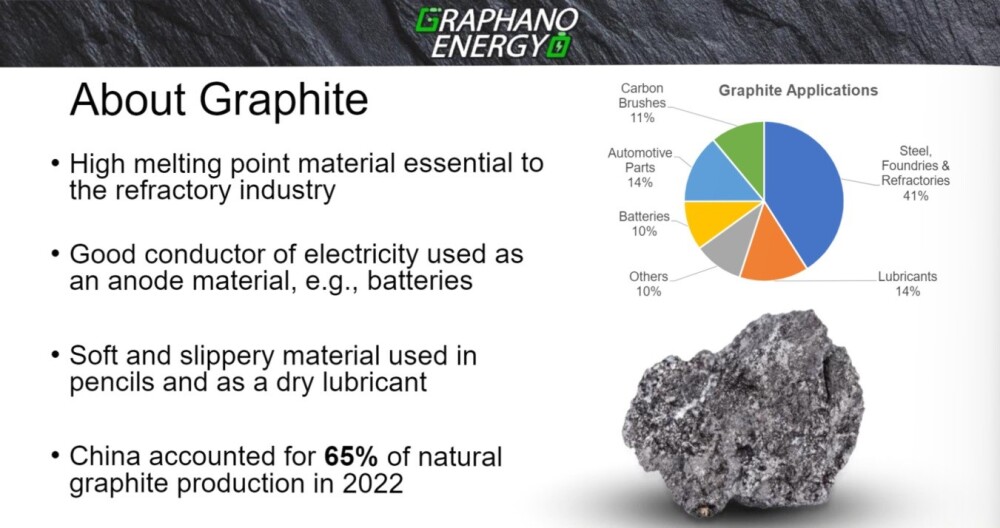

Many people, perhaps not surprisingly, do not know much about the uses to which graphite is put, and the following slide, lifted from Graphano Energy Ltd.'s GELEF investor deck, provides some information on the characteristics of graphite and its uses. According to the United States Geological Survey, China accounted for 77% of natural graphite production in 2023, an increase relative to 2022, but last Fall, China announced restrictions on the export of graphite to the U.S. and other countries, and it was very recently in the news that the U.S. is to slap a 25% tariff on natural graphite imports from China starting in 2026, a development that is going to make the product of North American producers a lot more competitive and attractive.

In related news, the CEO and President of Graphite One Inc. GPHOF, Anthony Huston, was invited by President Biden to a WHITE HOUSE INVESTMENT AND JOB CREATION SESSION, which gives an indication of how seriously the administration is taking the domestic production of this important raw material which is also interesting also because Graphite One was recommended in an article posted about a week before it took off strongly higher.

This being so, we are now believed to be at a favorable point to buy Graphano Energy stock as it is in a position to break out of a large base pattern and is at a very good entry point, as we will see when we review its charts toward the end of this article.

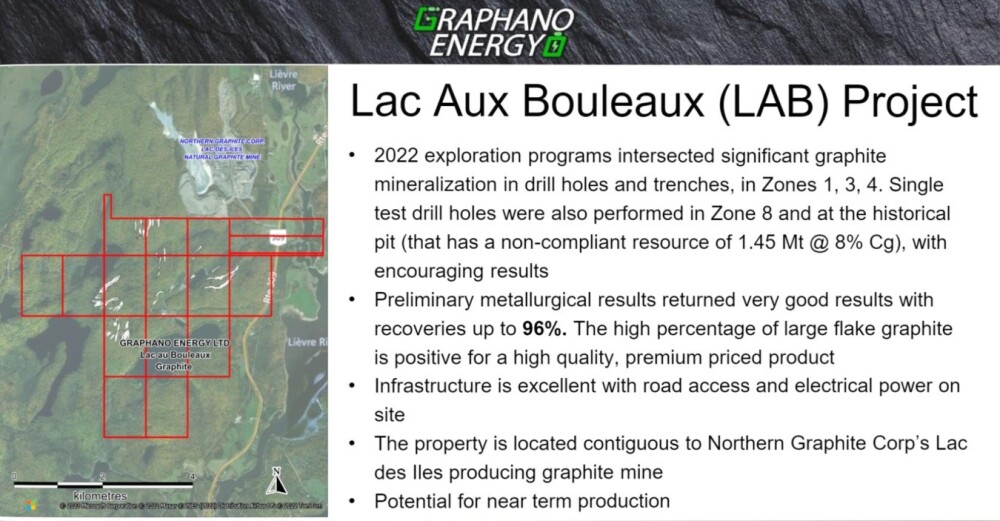

Graphano Energy has three graphite-bearing properties that are quite close to each other in Quebec, with the flagship LAB (Lac Aux Bouleaux) property being adjacent to the only producing graphite mine in North America which is the Lac de Iles mine belonging to Northern Graphite Corp. NGPHF. The past two drilling seasons have produced consistently positive drill results, and the company has staked additional ground.

The extent of the LAB Project is shown on the following slide, and a very interesting and important point to observe is how the LAB ground is contiguous with Northern Graphite's Lac de Iles mine to the north, which, as mentioned above, is the only producing graphite mine in North America, and it is understood that Northern Graphite would gain greatly with the acquisition of Graphano Energy, which will lead to higher mine life and likely significantly lower production costs.

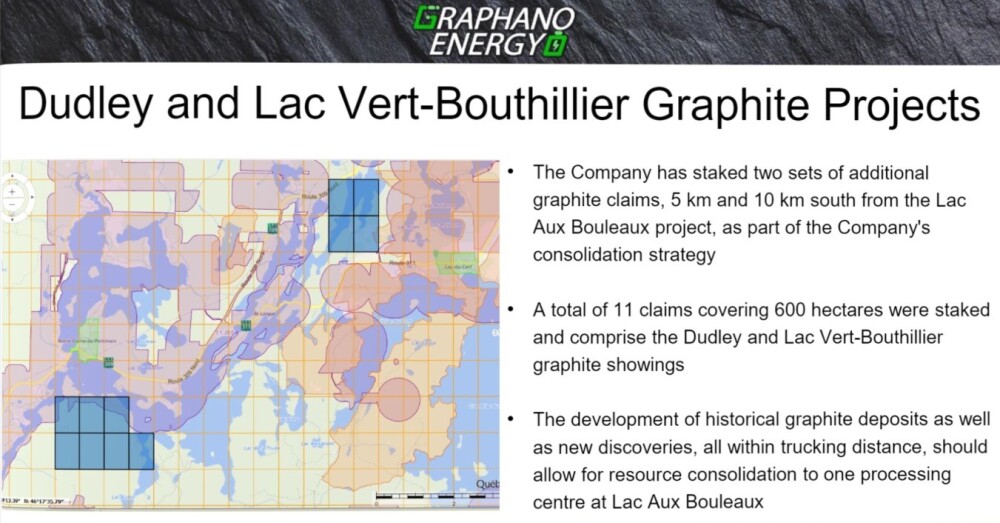

The company's other two graphite projects, which are comprised of two sets of additional claims, the Dudley and Lac Vert-Bouthillier properties, are in the same general area, which means that, once developed, the company will benefit from economies of scale since the ore from all 3 properties can be trucked an acceptable distance to one processing center at Lac Aux Bouleaux, where the Mill building of the historical mine is still present at the site.

The following slide shows the relative positions of the Dudley and Lac Vert-Bouthillier properties and the claims that comprise them.

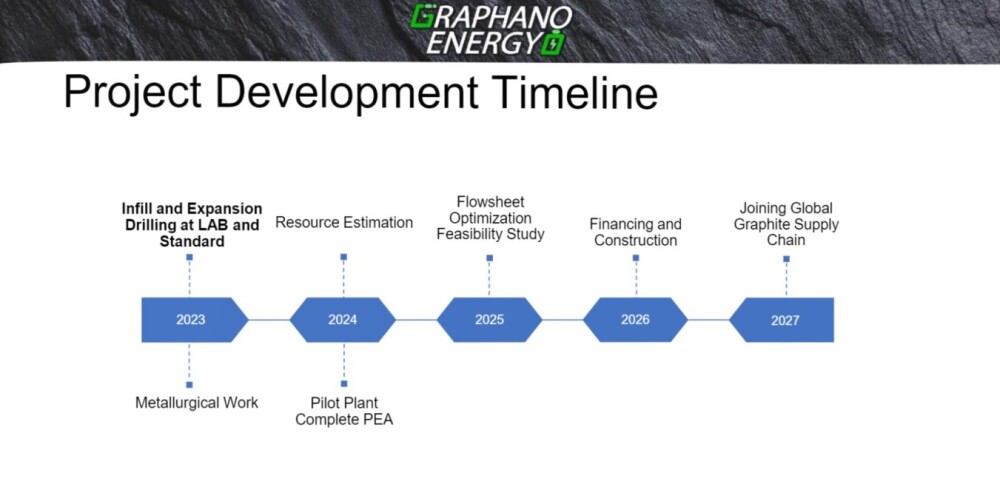

The next slide shows the timeline to production, and while it may initially seem a little offputting that production does not look set to begin until 2027, we can be sure that investors will want to position themselves ahead of this, which means that the stock can be expected to advance long before production starts, especially if the company delineates a compliant resource with passing time as looks likely, and especially given that a major commodities bull market is getting started and now, of course, we have the added catalyst of tariffs and trade wars that will make domestic production of important raw materials all the more important.

Moreover, the mass production of electric vehicles is not expected until after 2027, accounting for only a 7.6% share of the total U.S. vehicle market in 2023.

The number of shares in issue is about 17 million of which 11% are owned by insiders, 4% are owned by management, 3.5% by institutions with the largest (non-insider) shareholder having a 9.8% stake.

Catalysts that are likely to help get the stock moving as the year wears on, in addition to the powerful macro factors mentioned above, are the upcoming prospecting work during the summer season, the reporting of metallurgical results, announcements concerning the new properties that have been staked and the prospect of a new drilling campaign towards the end of the year.

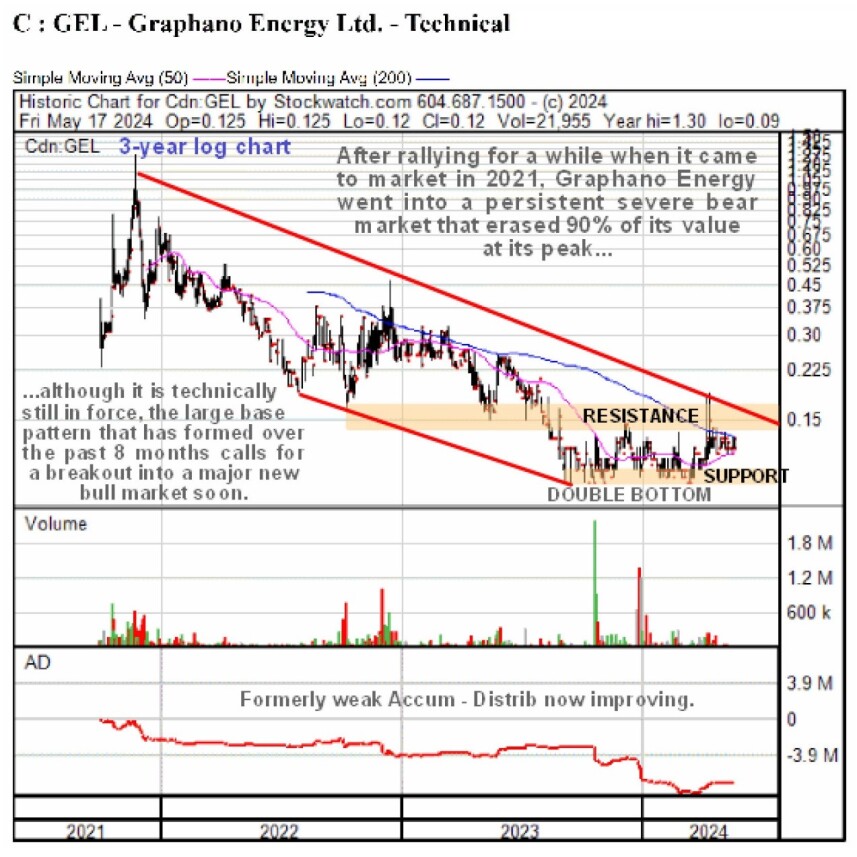

Now we turn to the stock charts for Graphano Energy, which provide clear and strong evidence that it is late in the process of reversing to the upside into a major bull market following a long and severe bear market.

Starting with the 3-year log chart, which shows all of the action in the stock since it started trading, we see that after it began trading in the latter part of 2021, it ran up in a brief but strong uptrend, after which it sloped off into a severe bear market that by the time it had run its course in September of last year had dragged the price down as low as 9 cents so the stock had lost well over 90% of its value at its late 2021 peak at about CA$1.28.

The reason for using a log chart in this case is that it "opens out" the base pattern, making it easier to see what is going on, and we also get a fit for the long-term downtrend channel using log. Since hitting bottom last September, the price has clearly been marking out a base pattern, which we will now proceed to look at in more detail on a 1-year log chart.

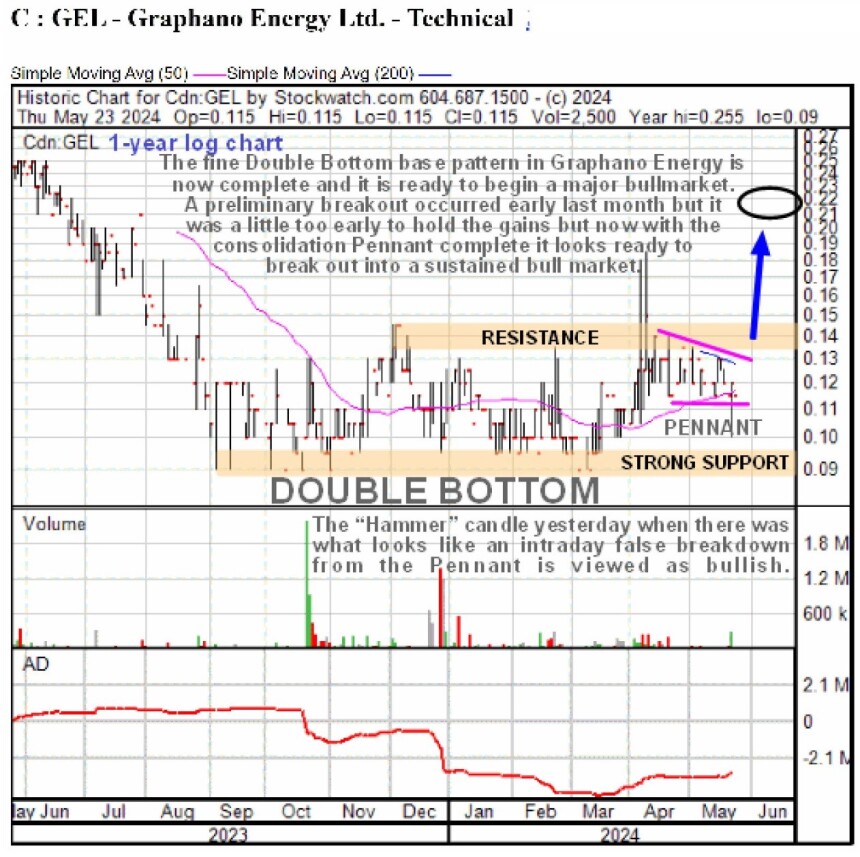

On the 1-year chart, we see that a fine, large Double Bottom base pattern has formed since last September, with its first low(s) having occurred last September and October and it dipping back to form the second low of the pattern in March.

The pattern was complete by late March, which is evidenced by the fact that it tried to break out of it early in April with a couple of sharp upward stabs, but the attempt was premature, so it slipped back into the base pattern again to do a little more work with a clear bull Pennant forming above the rising 50-day moving average in recent weeks that promises a breakout soon that will hold. It looks ready to break out very soon now, so this is viewed as an excellent point at which to buy the stock.

With a breakout into a new bull market looking imminent, Graphano Energy is rated an Immediate Strong Buy. The first target for an advance is the CA$0.22 area.

Graphano Energy Ltd closed at CA$0.11, US$0.087 on May 27, 2024.

Important Disclosures:

- For this article, the company has paid Street Smart US$1,500.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts' Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.