Zinger Key Points

- Intel prepares for increased AI-capable product demand as businesses lean towards private AI computing environments.

- Intel aims to embed AI in computers, edge computing, and software, anticipating shifts from public clouds to private storage.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Intel Corp INTC is gearing up for increased demand for AI-capable consumer products. It anticipates that businesses will increasingly rely on private environments for AI computing needs.

Intel aims to integrate AI capabilities across various products, from computers to edge computing to software, the Wall Street Journal cited Alexis Crowell, Intel’s VP and CTO for Asia-Pacific and Japan.

Crowell noted that demand for traditional data centers might slow as companies seek a balance between public cloud infrastructure and private data storage for privacy and cost reasons.

This shift aligns with IDC’s prediction that by next year, 75% of enterprise-generated data will be processed outside traditional data centers or the cloud.

Intel, traditionally strong in CPUs for personal computers and servers, faces challenges in the data center market dominated by Nvidia Corp’s NVDA AI chips.

Despite this, Intel’s data center and AI division saw a 5% revenue increase to $3 billion in Q1.

The company plans to bolster its AI chip offerings with the Gaudi 3 chip, which will likely outperform Nvidia’s H100 and generate $500 million in revenue in the latter half of 2024, WSJ writes.

Chip company CEOs, including Intel and Nvidia, have gathered at Taiwan’s Computex event to discuss AI’s prospects.

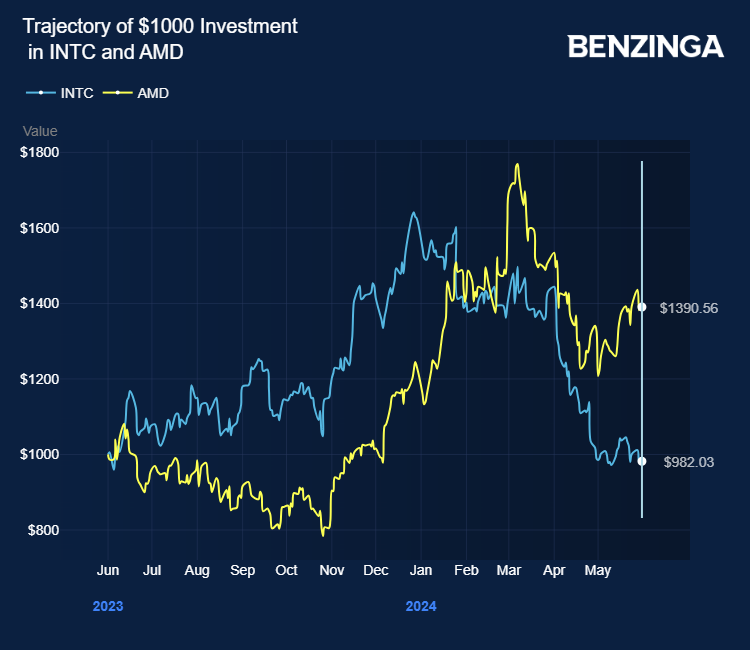

Currently, Intel and Advanced Micro Devices Inc AMD are battling for the AI PC market’s dominance, while Nvidia sealed its numero uno position with its latest quarterly earnings beat.

Intel has earmarked shipping chips for over 100 million AI PCs by 2025, including over 40 million in 2024.

Intel stock lost over 4% in the last 12 months. Investors can gain exposure to the stock via ProShares Nanotechnology ETF TINY

and First Trust S-Network Streaming And Gaming ETF BNGE.

Price Action: INTC shares traded lower by 0.63% at $30.00 at the last check on Friday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.