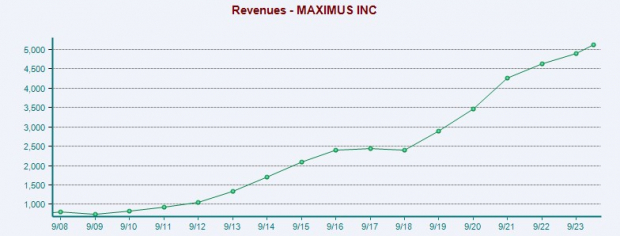

Government health and human services program operator Maximus MMS made its way onto the Zacks Rank #1 (Strong Buy) list last week with its stock starting to check the boxes in terms of value, growth, and momentum.

Landing the Bull of the Day, Maximus belongs to the top-rated Zacks Government Services Industry which is currently in the upper 1 percentile of over 250 Zacks industries. Strong demand and elevated volumes in federal services programs including those tied to Medicaid redetermination have made Maximus stock very compelling with U.S. government agencies already accounting for more than 80% of the company's revenue heading into fiscal 2024.

Foreign government agencies accounted for roughly 14% of Maximus' revenue with a breadth that extends to Australia, Canada, Saudi Arabia, Singapore, and the United Kingdom.

Image Source: Zacks Investment Research

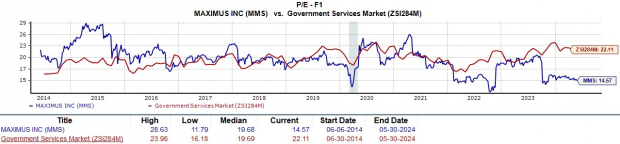

Attractive Valuation

Considering its strong business environment, Maximus' valuation makes the company stand out with MMS trading at the optimum level of less than 2X sales with a P/S ratio of 1X compared to its industry average of 1.3X.

Even better, MMS trades at a 14.5X forward earnings multiple which is a pleasant discount to its peer's average of 22.1X and the S&P 500's 21.9X. Checking an "A" Zacks Styles Scores Grade for Value, Maximus is also attractive in terms of valuation metrics such as Price to Book Value (P/B) and Price to Cash Flow (P/CF).

Image Source: Zacks Investment Research

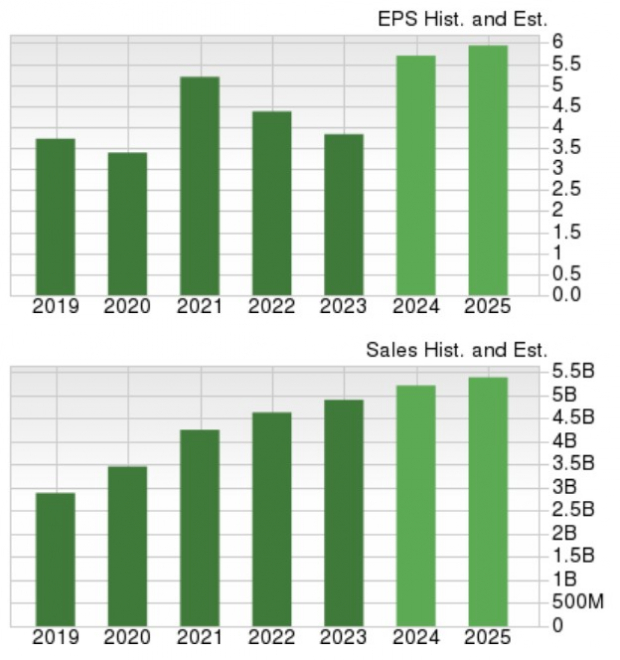

Steady Growth

With an "A" Zacks Style Scores grade for Growth as well, Maximus is now expected to see its bottom line expand by 51% in FY24 to $5.79 per share versus $3.83 a share last year. Plus, FY25 EPS is projected to increase another 4%. On the top line, total sales are projected to be up 7% this year and are expected to rise another 3% in FY25 to $5.39 billion.

Image Source: Zacks Investment Research

Most compelling and indicative of more short-term upside for Maximus stock is that FY24 and FY25 EPS estimates have continued to trend higher in the last 30 days and are nicely up in the last week.

This comes as Maximus impressively exceeded top and bottom line expectations for its fiscal second quarter in early May and raised its EPS guidance for the second time this year.

Image Source: Zacks Investment Research

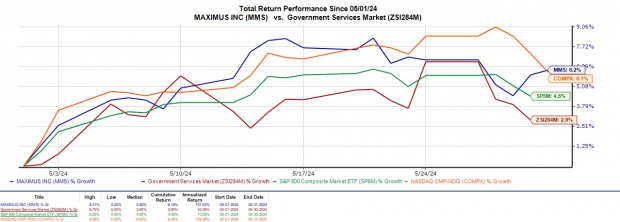

MMS is Gaining Momentum

Correlating with a strengthened outlook and the positive trend of earnings estimate revisions, Maximus lands an "A" Style Scores grade for Momentum with MMS rising +6% over the last month to roughly match the Nasdaq while topping the S&P 500's +4% and the Zacks Government Services Market's +3%.

Image Source: Zacks Investment Research

Bottom Line

Benefiting from a strong business industry, it's hard to overlook the very favorable trading indicators for Maximus stock with MMS commanding an overall "A" VGM Zacks Style Scores Grade for the combination of Value, Growth, and Momentum.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.