Zinger Key Points

- AMD shares rose 1.21% to $161.92 premarket after TSMC's price hike plans led to a selloff in chip stocks.

- Analysts expressed bullishness in AMD's product pipeline after the Computex event.

- Markets are messy—but the right setups can still deliver triple-digit gains. Join Matt Maley live this Wednesday at 6 PM ET to see how he’s trading it.

Advanced Micro Devices, Inc AMD stock saw some redemption Wednesday after Tuesday’s broader sector selloff amid reports of Taiwan Semiconductor Manufacturing Co’s TSM planning to boost the prices of its chip production services.

Recent reports indicated AMD, which bagged a 33% market share in the server CPU market, is looking to expand its partnership with Samsung Electronics Co to develop 3-nanometer chip processing technology. AMD’s collaboration with Samsung has the potential to help the South Korean chipmaker reduce its market share gap with TSMC.

Despite Nvidia Corp’s NVDA big win with AI, gaming, and cloud computing, analysts flagged AMD’s robust pipeline with upcoming MI325, MI350, MI400, and MI400, adding HBM4 and MI350, improving Inference performance 35x against MI300 after the Computex event in Taiwan.

They also flagged AMD’s 33% Data Center compute share in the first quarter of 2024, up from ~8% in 2020, with Genoa tailwinds and Turin on deck.

AMD, which analysts tout as the second most significant AI beneficiary after Nvidia, is also eying the AI PC market, similar to Intel Corp INTC, where Arm Holdings Plc ARM is a key player.

Also, AMD showcased its MI325X accelerator at the Taiwan event. The company plans to develop AI chips over the next two years.

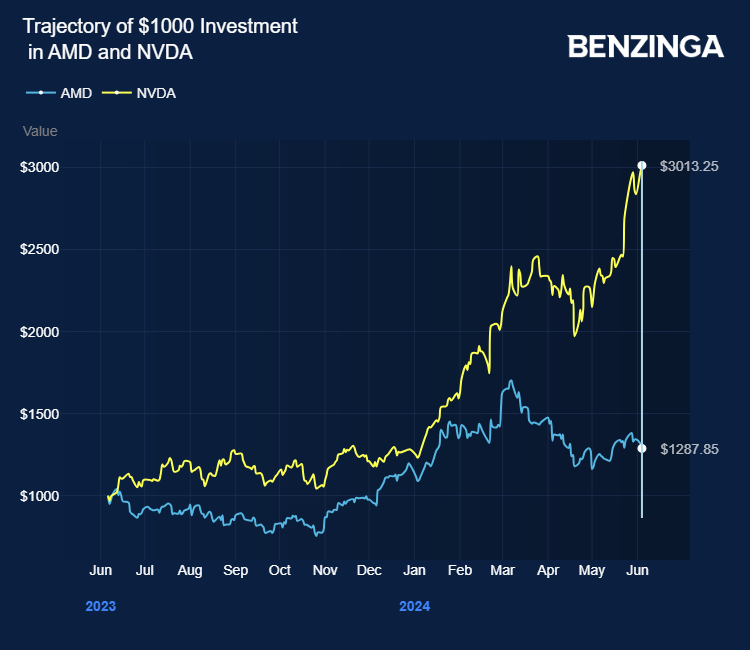

AMD stock gained 36% in the last 12 months. Investors can gain exposure to the stock via Spear Alpha ETF SPRX and Pacer Funds Pacer Data And Digital Revolution ETF TRFK.

Price Action: AMD shares traded higher by 3.30% at $165.27 at the last check Wednesday.

Photo via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.