Halozyme Therapeutics HALO announced that it has been granted a new patent in the EU that covers the ENHANZE rHuPH20 product, which is produced using the company's proprietary ENHANZE manufacturing methods.

Per the press release, the new patent is included in all of Halozyme's existing and future ENHANZE licenses, meaning that all of its licensees will benefit from this patent. The patent is set to be validated in 37 EU countries, where it will be legally recognized and enforceable, until the expiry date of Mar 6, 2029.

The new patent grant is a significant intellectual property milestone for HALO, ensuring protection and control over its ENHANZE rHuPH20 product across a wide geographical area in the EU until 2029. This enhances the company's competitive edge and provides security for its product and associated technologies.

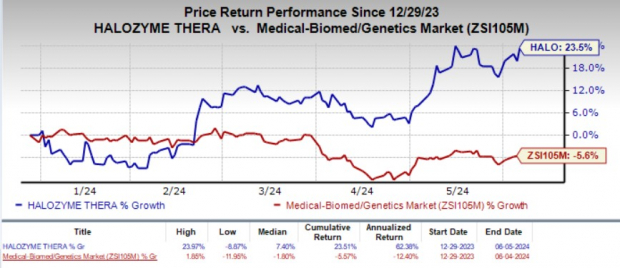

Shares of the company gained 2.3% in the after-market hours on Jun 5 in response to the encouraging news. Year to date, the stock has jumped 23.5% against the industry's 5.6% decline.

Image Source: Zacks Investment Research

ENHANZE is Halozyme's novel drug delivery technology that facilitates the subcutaneous administration of drugs. The company currently licenses this technology to leading pharmaceutical companies, including Roche RHHBY, Takeda TAK, Pfizer PFE, J&J JNJ, AbbVie ABBV, Eli Lilly LLY, Bristol-Myers Squibb BMY, Argenx ARGNF, ViiV Healthcare, Chugai Pharmaceutical CHGCF and Acumen Pharmaceuticals ABOS.

These companies are using this technology for developing SC formulations of their currently marketed drugs. Halozyme earns royalties on sales of seven commercial products by its partners including from J&J for subcutaneous formulation of its multiple myeloma drug, Darzalex (daratumumab).

Based on this new patent grant, management believes that it will be able to maintain the original royalty rate for J&J's Darzalex SC, in the EU through March 2029.

Per the terms of the licensing agreement with JNJ, the new EU patent prevents a reduction in the royalty rate paid by J&J for sales of Darzalex SC to Halozyme in the EU countries where it is validated. This implies that until the patent expires in 2029, HALO will continue to receive the same royalty rate from J&J, providing financial stability and sustained revenues from this partnership.

For other ENHANZE licenses, Halozyme does not expect the new patent to impact the existing royalty arrangements. These licenses already have issued or pending collaboration patents that ensure the current royalty rates will extend beyond the expiration date of the new patent.

Therefore, revenues from these other licenses are already secured and unaffected by the latest patent, maintaining HALO's overall financial expectations and stability from its ENHANZE licensing agreements.

In the first quarter of 2024, the company recorded $120.6 million in royalties, representing an increase of 21% year over year, primarily driven by robust demand for JNJ's Darzalex and Roche's Phesgo. For the full year, Halozyme anticipates its royalty revenues in the range of $500-$525 million.

Zacks Rank and Stocks to Consider

Halozyme currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the drug/biotech industry are ALX Oncology Holdings ALXO and Annovis Bio ANVS, each carrying a Zacks Rank #2 (Buy) at present.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology's 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73. Year to date, shares of ALXO have plunged 40.9%.

ALX Oncology beat estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for Annovis' 2024 loss per share has narrowed from $2.93 to $2.46. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.83 to $1.95. Year to date, shares of ANVS have plunged 64%.

ANVS beat estimates in three of the trailing four quarters and missed once, delivering an average negative surprise of 1.39%.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.