Bank OZK's OZK ratings and outlook have been affirmed by Moody's Ratings, a division of Moody's Corporation MCO. This decision underscores the balance between the bank's strong financial metrics and the risks associated with its substantial exposure to commercial real estate (CRE) loans.

The rating agency has affirmed all the ratings and assessments of Bank OZK, including its long-term local currency deposit rating of A3 and short-term local currency deposit rating of Prime-2. Despite the affirmation, the outlook on the bank's long-term deposit and issuer ratings remains negative.

Key Factors Behind Rating Affirmation

The affirmation of these ratings reflects a mix of positive financial performance and significant risk factors. The primary concerns stem from Bank OZK's high concentration in CRE loans, particularly construction loans, amid a challenging interest rate environment.

CRE Loan Exposure: As of Mar 31, 2024, CRE loans represented 455% of Bank OZK's tangible common equity (TCE). Including unfunded commitments, the total CRE exposure is nearly double this amount. This substantial exposure poses a risk, especially as interest rates remain high, adversely impacting asset quality and profitability.

Capital Ratios and Profitability: Despite a significant decline in OZK's TCE to risk-weighted assets (RWA) ratio since 2021, Moody's expects this ratio to improve over the next 12 to 18 months. This improvement will be supported by the company's decision to halt share buybacks for the year.

Per Moody's, Bank OZK's strong nominal leverage, with TCE at 12.4% of tangible assets and robust long-term profitability, with a three-year average return on assets of 2.1%, are seen as mitigating factors against its concentration risks.

Funding and Risk Management: Bank OZK's core deposit funding, with about 81% of deposits insured or collateralized and its low reliance on wholesale borrowing, provides a buffer against funding pressures. Its high-yielding, mostly floating-rate loans, along with a low-duration securities portfolio, have supported strong net interest margins, a key profitability driver.

Outlook and Potential Rating Changes

Moody's negative outlook indicates that an upgrade of Bank OZK's ratings is unlikely in the near term. Nonetheless, the outlook could stabilize if the bank maintains robust profitability and capital ratios without significant deterioration in asset quality.

Conversely, a downgrade could occur if the bank's TCE/RWA ratio falls below 10%, its TCE to tangible assets ratio drops under 11%, underwriting standards weaken, or reliance on more confidence-sensitive funding increases significantly.

Our Viewpoint

Bank OZK's ratings affirmation by Moody's reflects strong financial performance and prudent risk management. However, its significant exposure to CRE loans and the broader interest rate environment continue to pose challenges.

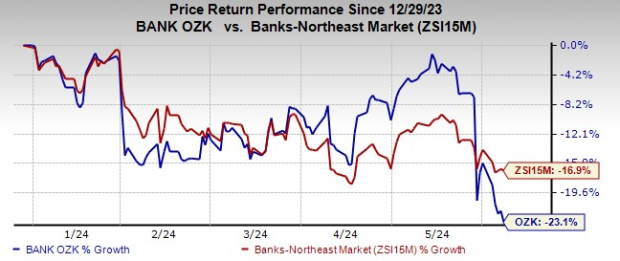

Shares of this Zacks Rank #3 (Hold) company have lost 23.1% this year compared with the industry's decline of 16.9%.

Image Source: Zacks Investment Research

Similar Actions Taken by Moody's on Other Banks

Associated Banc-Corp's ASB outlook has been reaffirmed as stable by Moody's. The rating agency has also reiterated the company's Baa3 standalone baseline credit assessment. Further, the company's issuer rating of Baa3 for long-term senior unsecured notes remained unchanged.

Per Moody's, ASB's ratings affirmation reflected the balance between its credit headwinds due to its significantly concentrated portfolio in CRE loans and the offsetting qualitative and quantitative risk mitigating factors.

Zions Bancorporation's ZION ratings and outlook have been affirmed by Moody's. The reiteration reflects the bank's solid performance and underlying challenges. This affirmation includes the company's standalone Baseline Credit Assessment, Adjusted BCA of baa1 and a long-term issuer rating of Baa2. The ratings affirm the bank's stability despite some ongoing issues.

Further, the outlook for Zions' long-term issuer rating and long-term deposit rating remains stable.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.