Zinger Key Points

- AMD shares fall 2.67% after Morgan Stanley downgrades the stock from Overweight to Equal-Weight, citing high valuations.

- Despite high valuations, the analyst sees AMD gaining market share in client and server CPU markets.

- Get real-time earnings alerts before the market moves and access expert analysis that uncovers hidden opportunities in the post-earnings chaos.

Advanced Micro Devices Inc AMD shares are trading lower after Morgan Stanley analyst Joseph Moore downgraded the stock from Overweight to Equal-Weight.

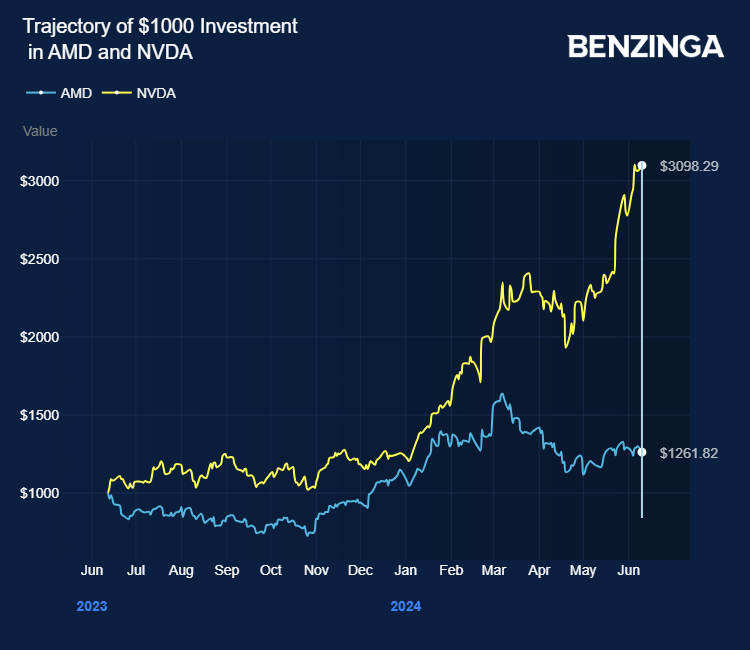

The analyst noted AMD’s high valuations, highlighting the impact of Blackwell’s launch on Nvidia Corp’s NVDA competitors. AMD appears costly compared to other large-cap AI companies like Nvidia and Broadcom Inc AVGO.

Despite this, the analyst believes AMD’s product lineup will continue to gain market share in the client and server CPU markets.

Last week, TF International Securities analyst Ming-Chi Kuo indicated a lack of progress regarding AMD’s plans to tap Samsung Electronics Co to develop 3-nanometer chip processing technology.

The analyst said it would benefit AMD more from investing in Taiwan Semiconductor Manufacturing Co’s TSM 2-nm products. According to the analyst, AMD and Samsung are currently discussing the use of 5-nm technology for AMD’s AI chip MI400 series.

AMD stock gained over 26% in the last 12 months. Investors can gain exposure to the stock via Invesco QQQ Trust, Series 1 QQQ and SPDR S&P 500 SPY.

Price Action: AMD shares traded lower by 3.81% at $161.48 at the last check on Monday.

Photo by cebbi from Pixabay

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.