Zinger Key Points

- Nadella diversifies Microsoft's AI investments globally.

- Nadella hires AI expert Mustafa Suleyman for internal development.

- Markets are swinging wildly, but for Matt Maley, it's just another opportunity to trade. His clear, simple trade alerts have helped members lock in gains as high as 100% and 450%. Now, you can get his next trade signal—completely free.

Satya Nadella, CEO of Microsoft Corp MSFT, bet the company’s future on artificial intelligence by partnering with OpenAI, the creator of ChatGPT.

Recently, Nadella has diversified Microsoft’s AI investments. Nadella has pursued new global partnerships and invested in various AI startups, including a $1.5 billion investment in an Abu Dhabi-based firm in April.

He has also started building an in-house AI team to potentially compete with OpenAI, the Wall Street Journal reports.

To lead this initiative, Nadella recruited Mustafa Suleyman, co-founder of DeepMind and Inflection AI. Suleyman brought his team from Inflection to Microsoft, where they are developing an AI model that is on par with OpenAI’s technology.

The WSJ claims that this internal AI model could replace some of Microsoft’s existing OpenAI-based products.

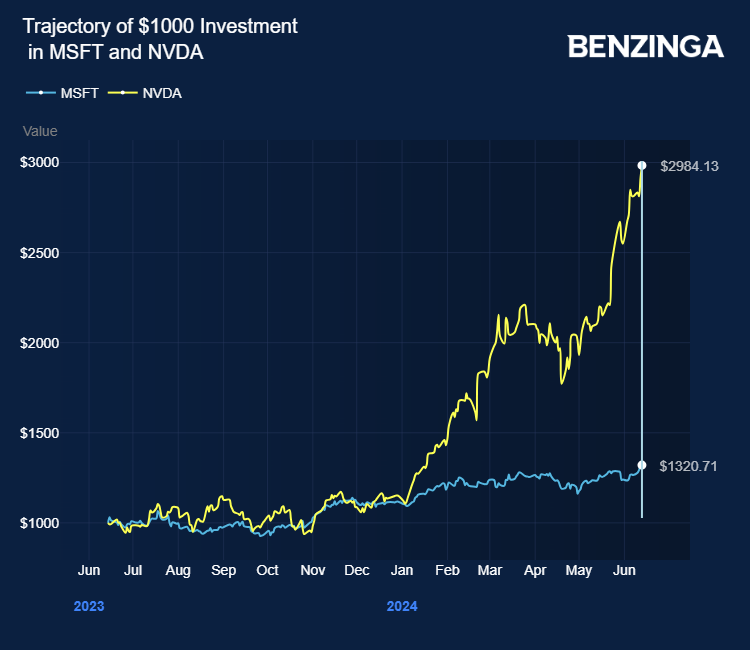

Microsoft remains the top contender among Apple Inc AAPL and Nvidia Corp NVDA in the race to a $4 trillion market capitalization.

Chip companies ranging from Nvidia Corp NVDA, Broadcom Inc AVGO, Advanced Micro Devices, Inc AMD are bearing testimony to the AI frenzy thanks to the Big Tech companies like Microsoft, Apple, Meta Platforms Inc META which is in no mood to fizzle out soon.

Analysts maintained Microsoft as a top candidate for public cloud leadership by 2032, backed by its generative AI moat.

Microsoft stock gained over 32% in the last 12 months. Investors can gain exposure to the stock via Vanguard Total Stock Market ETF VTI and SPDR Select Sector Fund – Technology XLK.

MSFT Stock Prediction For 2024

Microsoft’ revenue growth in FY23 was 6.88%, reflecting the influence of various factors including the macroeconomic environment, demand for its products and services, and its position relative to competitors. This growth is a critical indicator for investors assessing the company’s future prospects.

Some macro factors that could impact the company's performance in the next year include higher interest rates, progress on reeling in inflation and labor market strength. The Fed's benchmark rate is currently at 5.33%, while PPI recently came in at -0.2%, growing 2.2% from last year. The unemployment rate was most recently reported as 4.0%.

An investor should pay attention to economic conditions to decide whether they think the macro environment is positive or negative for Microsoft stock. For real time economic data and breaking market updates, check out Benzinga Pro. Try it for free.

How does this stack up against Microsoft's peers?

Investors may also want to analyze a stock in comparison to companies with similar products or in similar industries. Microsoft operates in the Information Technology sector. The stock has experienced average annual growth of 19.33% compared to the -4.5% average of its peer companies. This is below the broader sector movement of Microsoft.

Price Action: MSFT shares traded higher by 0.49% at $425.35 at the last check on Thursday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.