Zinger Key Points

- Taiwan's semiconductor industry will lead globally for 8-10 more years, analysts say.

- Analysts urge Taiwan's government to protect research and adapt to changing supply chains.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Analysts on Tuesday said that Taiwan’s Semiconductor Industry should maintain its global lead for at least the next eight to ten years.

They urged the government to ensure the country’s research security and develop a “grand strategy” considering changing supply chains.

Taiwan Semiconductor Manufacturing Co TSM, headquartered in Taiwan, led global foundry revenue in the first quarter. It is a crucial supplier of Nvidia Corp and Apple Inc AAPL.

Also Read: What’s Going On With Taiwan Semi Stock On Tuesday?

TSMC held a 62% market share in the first quarter.

At a forum called “Taiwan in the era of techno-geopolitics” in Taipei hosted by the new think tank Research Institute for Democracy, Society, and Emerging Technology (DSET), veteran analyst Ray Yang said he believes Taiwan’s semiconductor industry will maintain its competitive edge for another eight to 10 years, Focus Taiwan reports.

Ray Yang, consulting director at the Industry, Science and Technology International Strategy Center, stated, “Next year, the industry will utilize 2-nanometer process technology, and I believe Taiwan will continue to dominate until at least the 9-angstrom generation.”

During these partnerships, Yang emphasized the importance of international collaboration and the need to protect Taiwan’s research security.

Meanwhile, Taiwan’s Semiconductor Industry is facing geopolitical pressure linked to the U.S. concerns that most of the IC manufacturing is happening in Asia. However, it should still reach a mutually beneficial compromise with Washington, Taipei Times cited a former TSMC executive.

Konrad Young, a former TSMC R&D director, told at the DSET forum that the semiconductor industry faces risks from US-China trade tensions-driven “geopolitics 2.0.”

According to Young, “geopolitics 2.0” is a contemporary version of what he called “geopolitics 1.0,” which took place in the 1980s when the U.S., feeling threatened by Japan, sought to dismantle its dominance in the semiconductor industry. He noted that the current risk stems from the U.S.’s concerns amid its trade frictions with China, particularly the potential loss of Taiwan’s competitive edge if Taiwanese companies are asked to set up factories in the U.S.

However, Young pointed out that American companies, including top IC firms such as Qualcomm Inc QCOM and Nvidia Corp NVDA, still rely heavily on TSMC for their chip manufacturing needs. This reliance makes it unlikely that the U.S. government would take actions resulting in mutually assured destruction.

Young also called for cooperation with non-US countries such as Europe, Japan, Southeast Asia, and even the Middle East, which have invested in the industry.

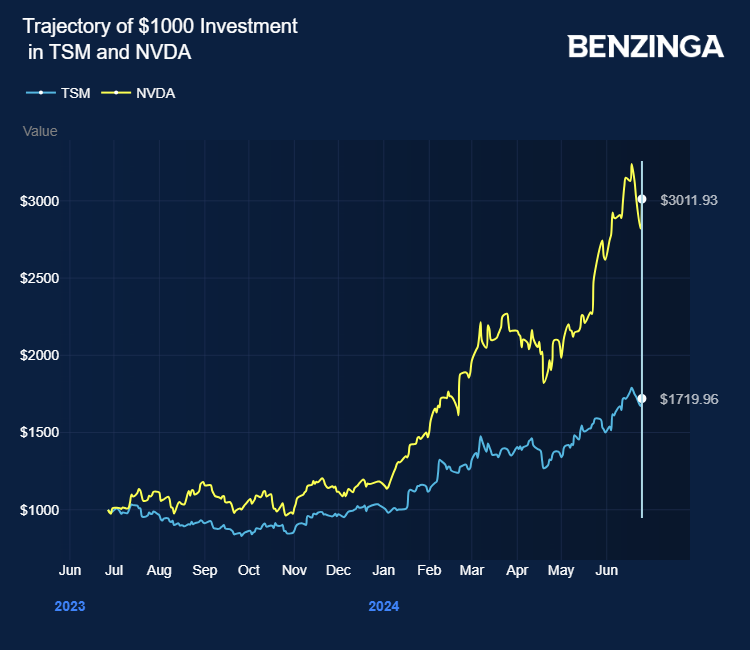

TSMC stock gained over 72% in the last 12 months, buoyed by the artificial intelligence frenzy.

Price Action: At the last check on Wednesday, TSM shares traded higher by 0.21% to $172.96 premarket.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Jack Hong via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.