Zinger Key Points

- Taiwan Semiconductor shares hit a record high, Thursday, as per Taiwan Stock Exchange data.

- Investors expect Taiwan Semi to benefit from strong AI and HPC chip demand.

- Our government trade tracker caught Pelosi’s 169% AI winner. Discover how to track all 535 Congress member stock trades today.

Taiwan Semiconductor Manufacturing Co TSM saw its shares rise to a record on Thursday in the Taiwan Stock Exchange. The rally boosted Taiwan Semiconductor’s market capitalization to over $946 billion in the U.S. stock exchange as of Friday.

Investors are optimistic that Taiwan Semiconductor will benefit from robust demand for artificial intelligence (AI) and high-performance computing (HPC) chips, the Taiwan Times reports.

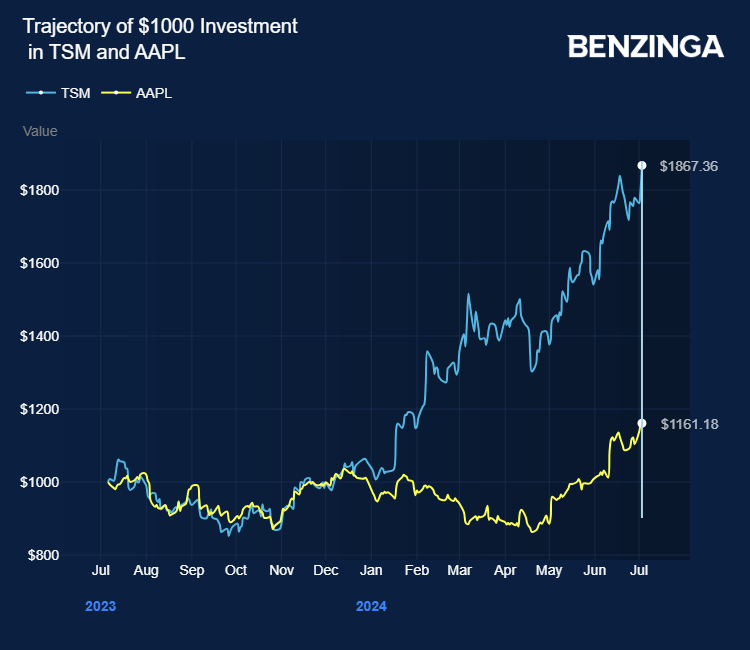

Taiwan Semiconductor has surged 69.48% this year, solidifying its position as the most valuable stock on the local exchange and the world’s 10th-largest company by market capitalization.

Analysts anticipate a positive earnings report from Taiwan Semiconductor, which is expected to drive its share price further.

As a primary advanced-chip supplier for U.S. Big Tech companies, Taiwan Semiconductor is expected to guide over 10% quarterly revenue growth in its upcoming earnings conference on July 18.

Several analysts are bullish on the prospects of Taiwan Semiconductor. UBS has raised its full-year capital expenditure estimates for Taiwan Semiconductor to $32 billion for this year and $37 billion for next year, citing demand for demand for 2nm and 3nm technologies.

UBS analyst Lin Lijun expressed optimism over Taiwan Semiconductor’s position as the primary CoWoS supplier in 2025.

Taiwan Semiconductor revenue is expected to grow by a low to mid-20 percent year-on-year, with the second half of the year outperforming the first.

Wall Street brokerages increased their price targets for Taiwan Semiconductor in June, citing expected earnings growth from AI demand and projected price hikes in 2025. Goldman Sachs forecasts increased prices for 3- and 5nm chip manufacturing.

Taiwan Semiconductor stock gained 81% in the last 12 months in the U.S. stock exchange. Investors can gain exposure to the semiconductor sector via VanEck Semiconductor ETF SMH and iShares Semiconductor ETF SOXX.

Price Action: TSM shares traded higher by 1.00% to $184.31 at the last check Friday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Jack Hong via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.