Zinger Key Points

- Needham's Bernie McTernan maintains Uber with a Buy and $90 target, citing strong Q2 pricing trends.

- McTernan prefers Uber for its profitable growth, but notes Lyft's improving value with lower prices and shorter wait times.

- Join Chris Capre on Sunday at 1 PM ET to learn the short-term trading strategy built for chaotic, tariff-driven markets—and how to spot fast-moving setups in real time.

Needham analyst Bernie McTernan reiterated Uber Technologies Inc UBER with a Buy and a $90 price target.

McTernan observed strong second-quarter pricing trends, pushing the analyst to increase his bookings estimates for Uber and Lyft towards the high end of guidance. Wait times were mixed, with Uber’s rising and Lyft’s falling, narrowing Uber’s advantage, McTernan noted.

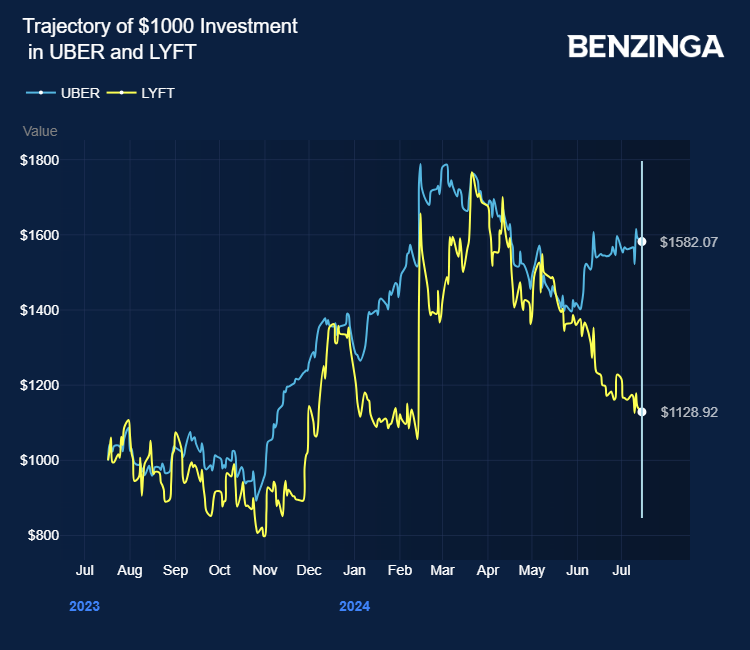

From an investment perspective, McTernan preferred Uber as he noted it as a stronger, profitable growth story. However, Lyft’s value proposition to consumers is improving, with lower pricing and wait times and a valuation that has drifted back towards trough levels, the analyst said. For both, competition fears from Tesla Inc TSLA are slightly lowered, given the robotaxi event’s pushout, McTernan noted.

For Uber, pricing in the second quarter was the highest McTernan observed in his sample. Additionally, on a quarter-on-quarter basis, average pricing was up +400bps compared to +60bps in the second quarter of 2023. As a result of this supportive environment, the analyst moved his quarter-on-quarter mobility bookings growth estimate to +10.5% from +7.5% and relative to +11.7% in the second quarter of 2023, which puts his estimates towards the high end of consolidated bookings guidance.

McTernan projects second-quarter revenue of $10.75 billion (prior $10.58 billion).

McTernan reiterated Lyft Inc LYFT with a Hold. Pricing in the second quarter for Lyft was the highest McTernan observed since the price cuts last year.

Also, average pricing in the second quarter was up +235bps versus -750bps in the year-ago quarter, with the year prior year’s decline reflecting the price cuts. As a result of this supportive pricing environment, the analyst increased his bookings estimate by ~1%, which puts him towards the high end of company guidance. McTernan’s estimates assume +10.3% quarter-on-quarter bookings growth, relative to his prior estimate of +9.7% and +12.9% last year.

McTernan projects second-quarter revenue of $1.41 billion (prior $1.40 billion).

Despite the pricing strength in the second quarter, it ended on the lows, but there tends to be seasonality throughout the quarter, with pricing picking up, especially after Labor Day, McTernan said. As a result, he left his third-quarter bookings estimates unchanged for Uber and Lyft, although it does not assume less quarter-on-quarter growth.

Price Actions: UBER shares traded lower by 0.40% at $72.14 at last check Monday. LYFT is down 1.72% at $12.89.

Photo via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.