Zinger Key Points

- Nvidia and peer chip stocks rebounded Thursday after a market selloff, driven by upbeat results from Taiwan Semiconductor.

- Taiwan Semiconductor's Q2 revenue soared 40.1% YoY to $20.82B, beating estimates. EPS of $1.48 exceeded expectations.

- Our government trade tracker caught Pelosi’s 169% AI winner. Discover how to track all 535 Congress member stock trades today.

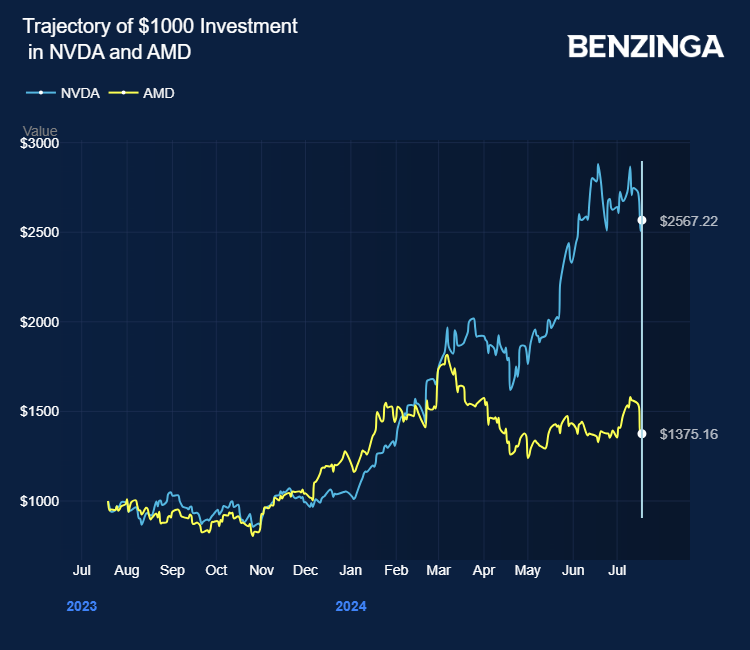

Chip stocks, led by Nvidia Corp NVDA and Advanced Micro Devices, Inc AMD saw redemption in Thursday's premarket session after a broader market selloff Wednesday. The stock gave up the gain in the regular session.

The Biden administration's advanced semiconductor crusade against China and Presidential candidate Donald Trump's remarks against Taiwan Semiconductor Manufacturing Co TSM cost the semiconductor sector over $500 billion in stock market value on Wednesday, Reuters reports.

Chip stocks got a boost from Taiwan Semiconductor's upbeat quarterly results Thursday, thanks to the AI frenzy.

The contract chipmaker reported second-quarter revenue of $20.82 billion, implying a growth of 40.1% year-over-year, quashing the analyst consensus estimate of $20.23 billion.

Sequentially, the revenue grew by 13.6%, backed by strong demand for 3-nanometer and 5-nm technologies.

The high-performance computing and smartphone end markets accounted for 52% and 33% of net revenue, respectively. The company expects supply constraints to ease by 2025 and 2026.

Taiwan Semiconductor expects third-quarter revenue of $22.4 billion—$23.3 billion versus a consensus of $22.7 billion. EPS of $1.48 beat the analyst consensus estimate of $1.41.

Analysts consider Nvidia to be the key AI beneficiary. Nvidia holds 70% to 95% of the market share for artificial intelligence accelerators, as per Mizuho Securities. The chip designer's Nvidia's pricing power has enabled it to reach a 78% gross margin versus AMD's 47%, CNBC reports.

The Big Tech three, namely, Alphabet Inc GOOG GOOGL Google, Microsoft Corp MSFT, and Amazon.Com Inc AMZN plus Oracle Corp ORCL, account for over 40% of Nvidia's revenue.

Price Actions: NVDA shares traded lower by 0.97% to $116.85 at the last check on Thursday. AMD is down 2.84% at $154.86.

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.