Zinger Key Points

- Abbott Laboratories reported second-quarter sales of $10.377 billion, slightly surpassing estimates, with adjusted EPS of $1.14

- he company received FDA approval for the Esprit below-the-knee system, two new glucose monitoring systems, and a CE Mark

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

Shares of Abbott Laboratories ABT are trading lower on Thursday following the company’s second-quarter 2024 financial results.

What’s Going On: Abbott reported second-quarter sales of $10.377 billion, slightly beating the $10.371 billion estimate. EPS came in at $1.14, surpassing analyst estimates of $1.10.

The company also saw a 10.2% increase in sales to $4.73 billion and a 12.1% organic growth rate. This growth included double-digit gains in Diabetes Care, Electrophysiology and Structural Heart sectors.

Despite the growth in medical devices, diagnostics sales were impacted by a year-over-year decline in COVID-19 testing-related sales, which dropped to $102 million from $263 million the previous year. Overall diagnostics sales fell 5.3% to $2.19 billion. Meanwhile, nutrition sales increased 3.5% to $2.15 billion, with a 7.5% organic growth rate.

What Else: In April, Abbott received FDA approval for the Esprit below-the-knee (BTK) system, a breakthrough for peripheral artery disease treatment. In June, the company announced FDA clearance for two new over-the-counter continuous glucose monitoring systems, Lingo and Libre Rio, based on the FreeStyle Libre technology. Additionally, Abbott obtained a CE Mark for its AVEIR dual chamber leadless pacemaker system.

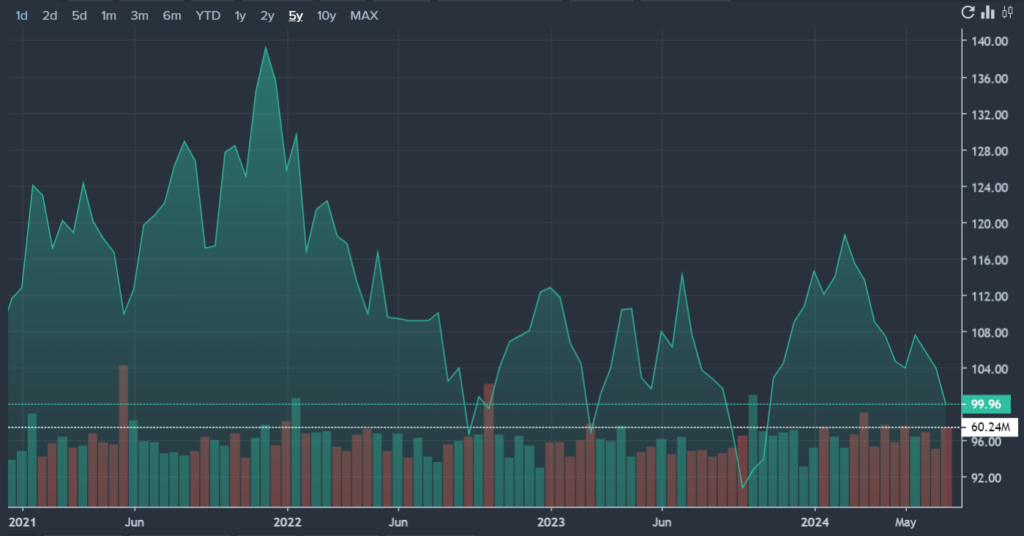

ABT Price Action: Abbott Laboratories shares were down by 4.32% at $100.16 according to Benzinga Pro.

See Also:

Photo by solarseven on Shutterstock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.