The Nasdaq 100 closed higher by around 300 points during Monday's session. Investors, meanwhile, focused on some notable insider trades.

When insiders sell shares, it could be a preplanned sale, or could indicate their concern in the company's prospects or that they view the stock as being overpriced. Insider sales should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a selling decision.

Below is a look at a few recent notable insider sales. For more, check out Benzinga’s insider transactions platform.

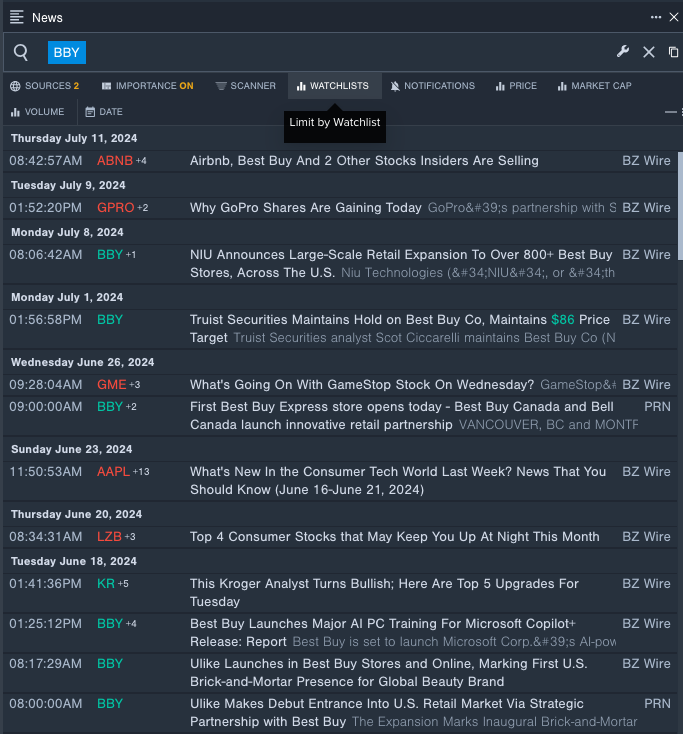

Best Buy

- The Trade: Best Buy Co., Inc. BBY Richard M Schulze sold a total of 1,600,000 shares at an average price of $88.39. The insider received around $141.4 million from selling those shares.

- What's Happening: On July 1, Truist Securities analyst Scot Ciccarelli maintained Best Buy with a Hold and maintained a price target of $86.

- What Best Buy Does: With $43.5 billion in consolidated 2023 sales, Best Buy is the largest pure-play consumer electronics retailer in the US, boasting roughly 8.3% share of the North American market and north of 33% share of offline sales in the region, per our calculations, CTA, and Euromonitor data.

- Benzinga Pro's real-time newsfeed alerted to latest BBY news.

Halliburton

- The Trade: Halliburton Company HAL EVP, Secretary and CLO Van H. Beckwith sold a total of 10,000 shares at an average price of $36.75. The insider received around $367,500 from selling those shares.

- What's Happening: On July 19, Halliburton reported worse-than-expected second-quarter revenue results.

- What Halliburton Does: Halliburton is one of the three largest oilfield service firms in the world, offering superior expertise in a number of business lines, including completion fluids, wireline services, cementing, and countless others.

- Benzinga Pro's charting tool helped identify the trend in HAL stock.

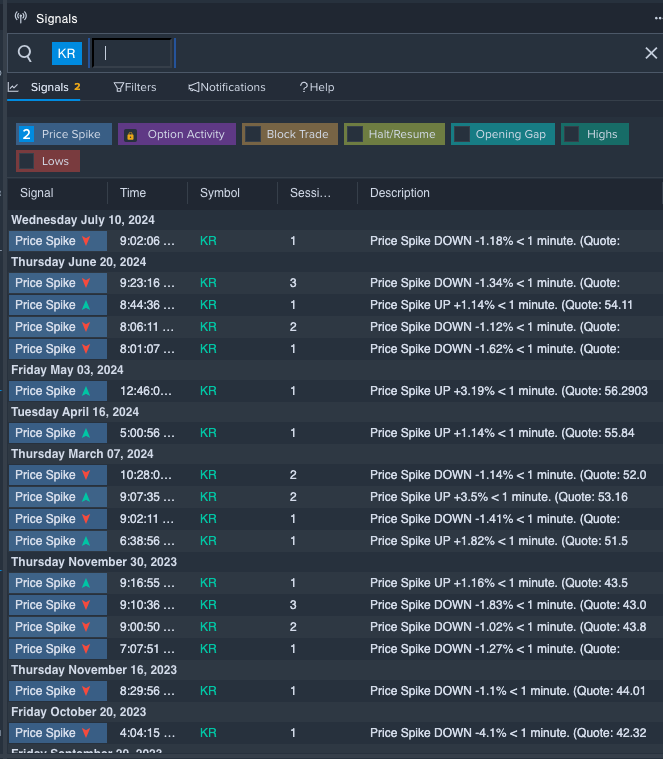

Kroger

- The Trade: The Kroger Co. KR Vice President & Controller Brian W Nichols sold a total of 2,000 shares at an average price of $54.53. The insider received around $109,060 from selling those shares.

- What's Happening: On July 22, Argus Research analyst Chris Graja maintained Kroger with a Buy and raised the price target from $70 to $72.

- What Kroger Does: Kroger is one of the largest grocery retailers in the United States with more than 2,700 stores across a portfolio of over 20 supermarket banners.

- Benzinga Pro's signals feature notified of a potential breakout in KR shares.

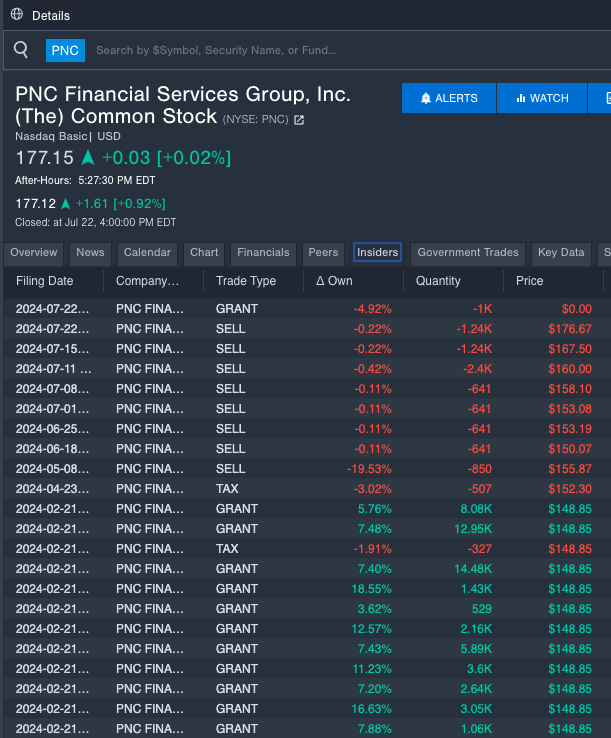

PNC Financial

- The Trade: The PNC Financial Services Group, Inc. PNC CEO William S Demchak sold a total of 1,242 shares at an average price of $176.67. The insider received around $219,424 from selling those shares.

- What's Happening: On July 16, the bank reported a revenue increase of 2% Y/Y to $5.411 billion, slightly missing the consensus of $5.412 billion.

- What PNC Financial Does: PNC Financial Services Group is a diversified financial services company offering retail banking, corporate and institutional banking, asset management, and residential mortgage banking across the United States.

- Insider trades for PNC were monitored using Benzinga Pro..

Check This Out:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.