Zinger Key Points

- Qualcomm reported third-quarter revenue of $9.4 billion and earnings per share of $2.33, both exceeding expectations.

- Analysts had varied responses, with some raising price targets and maintaining positive ratings, while others expressed concerns over growth

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

Qualcomm Inc. QCOM shares are trading lower Thursday, following the release of its fiscal third-quarter earnings.

Earnings Recap: Qualcomm reported third-quarter results with revenues of $9.4 billion, surpassing the consensus estimate of $9.22 billion. The company’s earnings per share (EPS) also beat expectations, coming in at $2.33 versus the anticipated $2.25.

This performance was driven by strong growth in the Auto and IoT segments. However, the guidance for the next quarter highlighted potential headwinds, particularly the earlier-than-expected revoking of the company’s license to sell to Huawei.

Analysts’ Updates:

- Piper Sandler: Analyst Harsh Kumar reiterated an Overweight rating, raising the price target from $185 to $205. Kumar noted the strength from Android and an upcoming ramp with a modem-only customer, despite flat guidance for the Auto segment sequentially.

- JPMorgan: Analyst Samik Chatterjee maintained an Overweight rating but lowered the price target from $235 to $230. Chatterjee highlighted the premium smartphone market and growth in the Autos and IoT businesses as key drivers.

- Cantor Fitzgerald: Analyst C.J. Muse reaffirmed a Neutral rating with a $215 price target, expressing disappointment with the initial guidance for the December quarter and highlighting the impact of Huawei’s export restrictions.

- WestPark Capital: Analyst Kevin Garrigan reiterated a Hold rating, pointing out the strength in the premium-tier smartphone market and the Auto and IoT segments but noting the persistent Huawei headwind.

- Oppenheimer: Analyst Rick Schafer maintained a Perform rating, mentioning mixed results and uncertainties regarding Apple’s future relationship with Qualcomm and the potential impact of AI.

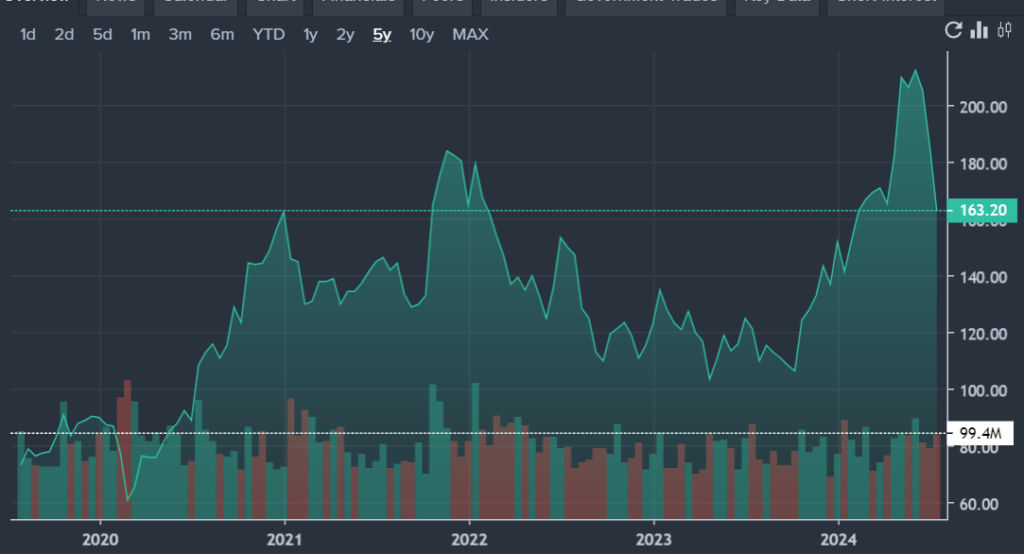

Price Action: Qualcomm’s shares were down by 9.52% to $163.72, according to Benzinga Pro.

Now Read:

Image Credits – Shutterstock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.