Zinger Key Points

- Trump has a majority 64.9% stake in TMTG thanks to the 114.7 million shares he owns in the company.

- TMTG shares fell 22.26% since July 19, the last trading session before Biden announced his decision to quit the race.

- Get real-time earnings alerts before the market moves and access expert analysis that uncovers hidden opportunities in the post-earnings chaos.

After a lackluster performance in the presidential debate against Republican candidate Donald Trump, President Joe Biden’s poll numbers turned abysmal, forcing him to quit the race. This thrust Vice President Kamala Harris into the spotlight and ever since she took the plunge, she appears to be giving Trump a run for his money in every since.

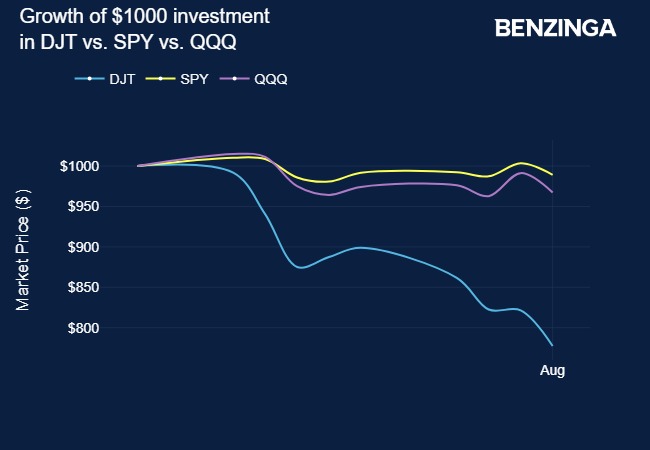

Kamala – The Wealth Shrinker? Biden officially confirmed his decision to stand out on July 21 and since then, shares of Trump-owned Trump Media & Technology Group Corp. DJT have fallen by 22.26% from $34.99 (July 19) to $27.20 (Aug. 1 closing price). Incidentally, the broader market did experience a swoon during the period, as tech stocks, which have been leading the market rally since the start of 2023, came under pressure amid rotation out of these stocks and into SMID-caps. This rotation was set in motion by rising expectations that the Federal Reserve would soon begin reversing the rate hikes,

However, TMTG underperformed even in the underperforming tech space and the broader market during this period.

Source: Benzinga

As of Thursday’s close, TMTG’s market cap is at $5.166 billion.

Source: Y Charts

Trump has a majority 64.9% stake in TMTG thanks to the 114.7 million shares he owns in the company, according to filings by the company. He and other insiders cannot sell their stake in TMTG until September due to a lockup period and unless the board decides to waive or pull forward the timing of the lock-up expiration.

The former president’s wealth tumbled from $4 billion as of July 19 to $3.1 billion by Aug. 1, CNN reported, citing data from Bloomberg.

See Also: Best Communication Services Stocks

Why It’s Important: TMTG went public by merging with SPAC Digital World Acquisition Corp. on March 26. The stock closed the debut session at $57.99, rising to a post-IPO high of $79.38 in the very same session. TMTG's public debut swelled Trump's net worth by $4.1 billion, Forbes reported.

Since then the stock has seen considerable volatility amid developments surrounding Trump's legal travails and his election prospects.

Aside from Trump's woes, the company's fundamentals have not evinced enthusiasm among analysts, with most crying foul over the company's staggering valuation and dismissing it as unsustainable. The Truth Social platform owned by TMTG has failed to find much traction as it operates in a niche area as opposed to bigger publicly-listed social media rivals.

The average number of monthly visits to the platform for the one year from April 2023 to May 2024 fell 39% relative to the previous one-year period, data from digital intelligence platform Similarweb showed, reported CNBC.

In the political arena, Trump is facing a real test as Harris’ standing against him suggests either a very close race or a very slight edge for the ex-president, going by the results of most opinion polls.

TMTG fell 2.99% to $26.66 in premarket trading on Friday, according to Benzinga Pro data.

Did You Know?

- Congress Is Making Huge Investments. Get Tips On What They Bought And Sold Ahead Of The 2024 Election With Our Easy-to-Use Tool

Image via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.