Zinger Key Points

- Nvidia's market value dropped by $900 billion since June despite ongoing AI investment.

- Big Tech giants like Microsoft and Amazon continue to invest heavily in AI infrastructure.

- Markets are swinging wildly, but for Matt Maley, it's just another opportunity to trade. His clear, simple trade alerts have helped members lock in gains as high as 100% and 450%. Now, you can get his next trade signal—completely free.

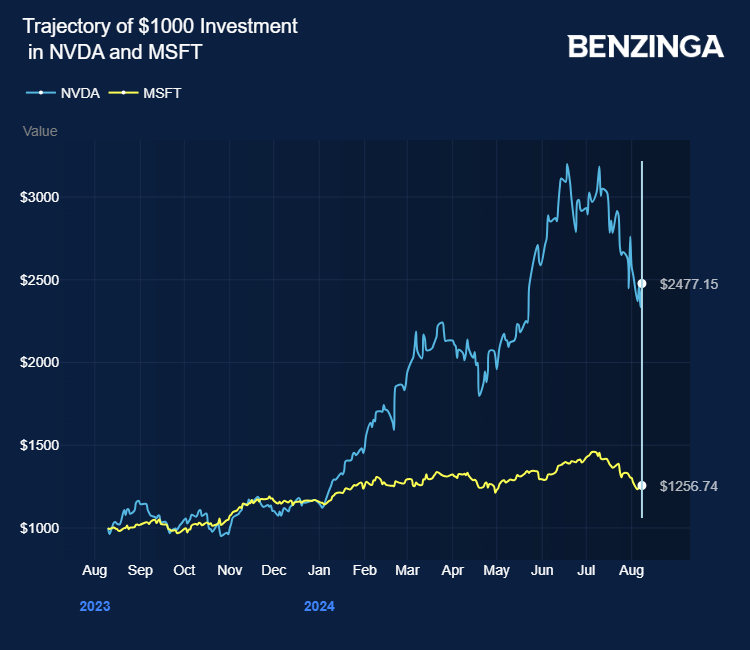

Nvidia Corp NVDA has seen its market value decline by $900 billion since its peak in June 2024, despite the ongoing surge in artificial intelligence (AI) spending.

While this drop might suggest a cooling of the AI boom that propelled Nvidia to its heights, the underlying trends tell a different story.

U.S. Big Tech giants led by Microsoft Corp MSFT, Amazon.com Inc AMZN, Alphabet Inc GOOGL, and Meta Platforms Inc META, which represent over 40% of Nvidia’s revenue, have all committed to continued investment in AI infrastructure, Bloomberg reports. Nvidia stock is trading up on Friday.

Also Read: Nvidia Greenlights Samsung’s Fifth-Gen HBM3E Chips for AI Processors: Report

Super Micro Computer Inc SMCI, a company that manufactures data center servers used in AI applications, recently projected sales could reach up to $30 billion over the next year, surpassing analyst expectations.

Key Nvidia supplier Taiwan Semiconductor Manufacturing Co TSM saw its revenue surge by 45% in July, outpacing the growth rate from the June quarter.

Analysts forecast Taiwan Semiconductor’s third-quarter revenue to rise by 37%, and the strong July performance indicates that TSMC might exceed these projections, Bloomberg reports.

Rhys Williams, chief strategist at Wayve Capital Management LLC, told Bloomberg that companies have yet to reduce their AI spending or report issues with their AI initiatives.

Srini Pajjuri, managing director and senior research analyst at Raymond James, told Bloomberg the uncertainty surrounding the monetization of AI and questioned how long companies can sustain this level of spending without straightforward returns.

Ken Mahoney, president and CEO of Mahoney Asset Management, told Bloomberg that the recent selloff has brought Nvidia’s valuation down to about 30 times forward earnings, potentially making it more attractive to long-term investors.

Nvidia stock has increased by over 135% in the last 12 months despite losing 22% in the last 30 days. Investors can gain exposure to Nvidia through the iShares Core S&P 500 ETF IVV and the Vanguard Total Stock Market ETF VTI.

Price Action: NVDA shares traded higher by 1.29% at $106.32 premarket at last check Friday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo:Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.